Join our fan page

- Views:

- 9863

- Rating:

- Published:

- 2012.09.17 09:57

- Updated:

- 2023.03.29 13:44

-

Need a robot or indicator based on this code? Order it on Freelance Go to Freelance

Real author:

John Q. Aimsson

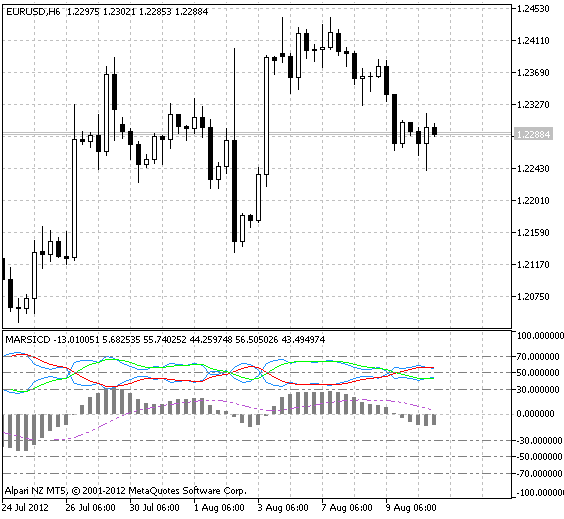

Trend indicator based on two RSI oscillators. In most cases the periods of the oscillators can vary. The final indicator strongly resembles ADX and MACD technical indicators combined on one chart. The indicator should be interpreted in the same way as the two mentioned ones.

This indicator was first implemented in MQL4 and published in Code Base 07.06.2012 (in Russian).

The indicator uses SmoothAlgorithms.mqh library classes (must be copied to the terminal_data_folder\MQL5\Include). The use of the classes was thoroughly described in the article "Averaging Price Series for Intermediate Calculations Without Using Additional Buffers".

Input parameters:

//+----------------------------------------------+ //| Indicator input parameters | //+----------------------------------------------+ input Smooth_Method MAMethod=MODE_LWMA; //Smoothing method input uint ARSI_PERIOD=14; //RSI A period input uint RRSI_PERIOD=14; //RSI R period input uint AMA_PERIOD=5; //Signal A period input uint RMA_PERIOD=5; //Signal R period input uint sMAD_PERIOD=21; //Signal period for the histogram input uint MPhase=15; //Smoothing parameter

MARSICD

Translated from Russian by MetaQuotes Ltd.

Original code: https://www.mql5.com/ru/code/968

MA_NRTR

MA_NRTR

Simple trend indicator in the form of NRTR

The Height of the Period

The Height of the Period

The indicator calculates the difference between the period maximum and minimum. The period is specified in the indicator parameters.

ATRNorm

ATRNorm

ATRNorm is the normalized version of АTR. Tick volume, standard divergence and other parameters can also be used instead of АТR. The indicator represents logical development of the script. ATRNorm has been created to detect flat areas.

MACD Elder Impulse Max

MACD Elder Impulse Max

MACD histogram with bars coloring according to Elder Impulse System.