Join our fan page

- Views:

- 9509

- Rating:

- Published:

- 2012.01.20 11:21

- Updated:

- 2016.11.22 07:32

-

Need a robot or indicator based on this code? Order it on Freelance Go to Freelance

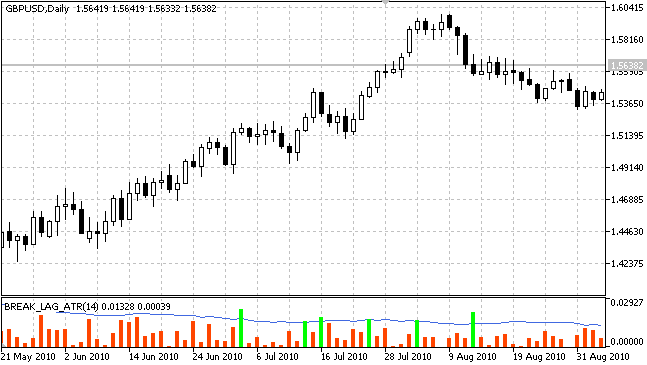

A bit enhanced volatility indicator (ATR) for a specified period.

A breakout is deemed to be genuine, if the body of a formed bar exceeds average true range (ATR). ABS (Close-Open) candlesticks body size is displayed as a histogram. Histogram green columns show volatility breakout as a histogram and can serve as signals for market entry/exit/position reversal or position volume increasing.

Translated from Russian by MetaQuotes Ltd.

Original code: https://www.mql5.com/ru/code/703

Heiken_Ashi_Smoothed_HTF_Signal

Heiken_Ashi_Smoothed_HTF_Signal

Heiken_Ashi_Smoothed_HTF_Signal displays trend direction as a sequence of graphical objects, the trend is determined by Heiken_Ashi_Smoothed indicator.

IncFramaOnArray

IncFramaOnArray

The CFramaOnArray class is intended for calulcation of Fractal Adaptive Moving Average (FRAMA) on indicator buffers.

VQ bars

VQ bars

Trend indicator that sets color dots on a price chart according to a trend direction.

DinapoliTargets

DinapoliTargets

The indicator draws a grid of possible future levels of price.