Join our fan page

- Views:

- 6730

- Rating:

- Published:

- 2019.02.07 08:47

-

Need a robot or indicator based on this code? Order it on Freelance Go to Freelance

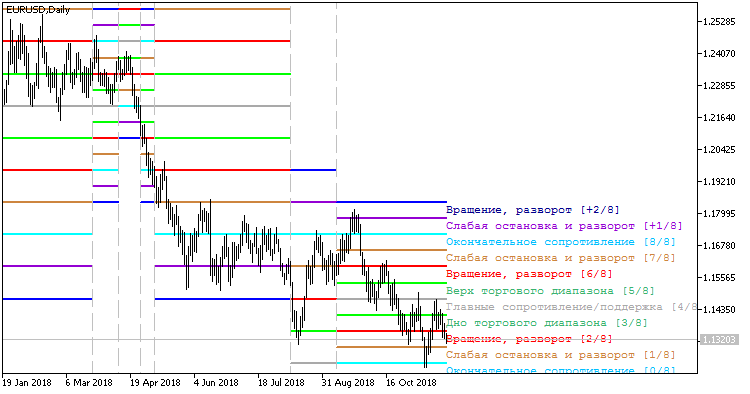

Indicator of Murrey levels in indicator buffers with the added visual text information on those levels, calculating the levels on a timeframe specified in the inputs.

//+----------------------------------------------+ //| INDICATOR INPUT PARAMETERS | //+----------------------------------------------+ input ENUM_TIMEFRAMES Timeframe=PERIOD_D1; //Indicator timeframe for calculating the levels input int CalculationPeriod=64; //P calculation period input int StepBack=0; input int FontSize=8; //font size input type_font FontType=Font7; //font type input string LableSirname="Murrey_Math_Lv"; //First part of the graphical objects names

The indicator uses the class of library GetFontName.mqh (to be copied to the terminal_data_folder\MQL5\Include).

For the indicator to operate, indicator Murrey_Math_Lv.ex5 should be in the terminal_directory\MQL5\Indicators folder .

Fig. 1. Indicator MurreyMathFixPeriod_Lv

Translated from Russian by MetaQuotes Ltd.

Original code: https://www.mql5.com/ru/code/23403

Murrey_Math_Lv

Murrey_Math_Lv

Indicator of Murrey levels in indicator buffers with the added visual text information on those levels

FitFul 13

FitFul 13

The EA focuses on the OHLC of timeframe W1

iCCI iRSI

iCCI iRSI

A trading system based on two custom indicators: CCI Color Levels and RSI Custom Smoothing.

Heiken_Ashi_Smoothed_Volatility_Volume_HTF

Heiken_Ashi_Smoothed_Volatility_Volume_HTF

Indicator Heiken_Ashi_Smoothed_Volatility_Volume with the timeframe selection option in its input parameters