Join our fan page

- Views:

- 8345

- Rating:

- Published:

- 2018.04.23 10:54

- Updated:

- 2018.04.23 10:54

-

Need a robot or indicator based on this code? Order it on Freelance Go to Freelance

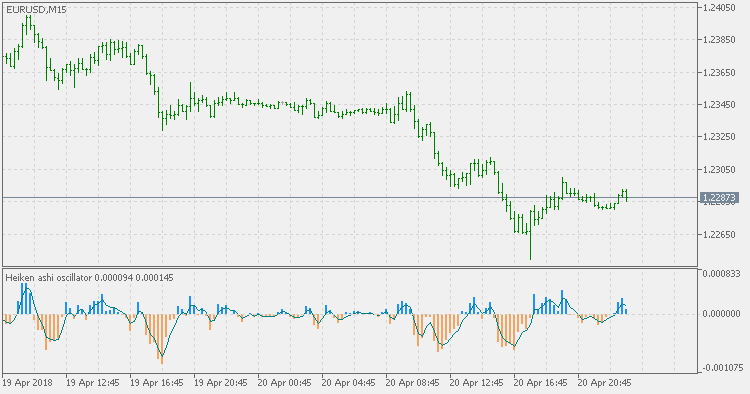

This is one of indicators that falls into the price oscillators family.

Instead of using "pure price" this indicator uses Heiken Ashi values to determine the trend as well as the "strength" of the trend. Additional signal line is added for two purposes:

- To use it as any regular signal line is used: for crosses with the oscillator values.

- Since the oscillator values tend to be "nervous" (very fast changes), it does not hurt to have a smoothed values that, regardless to the natural lag when smoothing the values, is filtering out some false signals.

Stochastic volatility

Stochastic volatility

This is not a directional indicator. This means that even it is stochastic it does not show the direction of the market, but shows the direction-amount-size of volatility. The assumption that seems sound enough and after which this indicator is made is that in the times of extremely low volatility it is a good time to enter the market, since the change in volatility is imminent. Those times are marked by dark gray dots on this indicator. For direction of entry, you should use some other trend showing indicator(s).

EMA Levels MTF

EMA Levels MTF

EMA Levels multi timeframe version.

Heiken Ashi Smoothed Oscillator

Heiken Ashi Smoothed Oscillator

Instead of using the "regular" Heiken Ashi for oscillator calculations, this version is using the smoothed Heiken Ashi. That makes the number of false signals fall dramatically, and, when pre-smoothing is applied to Heiken Ashi, the lag is in acceptable bounds.

Weekly Fibo Levels

Weekly Fibo Levels

Calculation is based on current week open and previous week range.