Join our fan page

- Views:

- 4392

- Rating:

- Published:

- 2016.04.14 09:39

- Updated:

- 2016.11.22 07:32

-

Need a robot or indicator based on this code? Order it on Freelance Go to Freelance

Real author:

Witold Wozniak

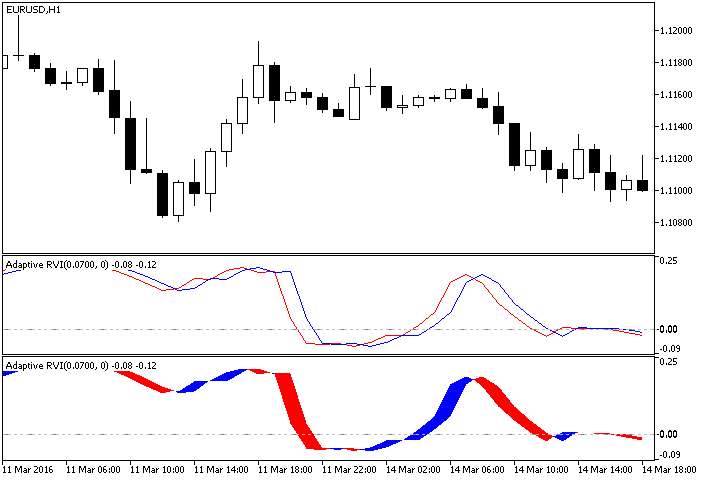

AdaptiveRVI is the Relative Vigor Index oscillator that adapts to the constantly changing marker cycles of a real financial asset.

Conventional oscillators require constant adjustment of the averaging period for the current market conditions. In this indicator, the period id adjusted automatically. This is done through the use of the additional CyclePeriod indicator, which calculates the indicator averaging period for the current market state.

The indicator has been developed based on the article "Using The Fisher Transform" by John Ehlers that was published in November 2002 in the Technical Analysis Of Stock & Commodities magazine.

The indicator uses the CyclePeriod indicator for operation. Add the compiled file of CyclePeriod to the \MQL5\Indicators folder of the client terminal.

Fig.1. The AdaptiveRVI and AdaptiveRVICloud indicators

Translated from Russian by MetaQuotes Ltd.

Original code: https://www.mql5.com/ru/code/15167

Exp_Laguerre

Exp_Laguerre

A trading system based on the signals of the ColorLaguerre indicator.

JMA_StDev_HTF

JMA_StDev_HTF

The JMA_StDev indicator with the timeframe selection option available in input parameters.

RVI

RVI

The Relative Vigor Index oscillator developed based on the article "Using The Fisher Transform" by John Ehlers that was published in November 2002 in the Technical Analysis Of Stock & Commodities magazine.

XMA_BBx7_Cloud_Digit_Grid

XMA_BBx7_Cloud_Digit_Grid

Three Bollinger Bands channels based on one moving average, drawn as a colored cloud, with the display of the last values as price labels and the possibility to round Bollinger levels up to a required number of digits, and a price grid with these rounded values.