Join our fan page

- Published by:

- Vladimir

- Views:

- 16461

- Rating:

- Published:

- Updated:

-

Need a robot or indicator based on this code? Order it on Freelance Go to Freelance

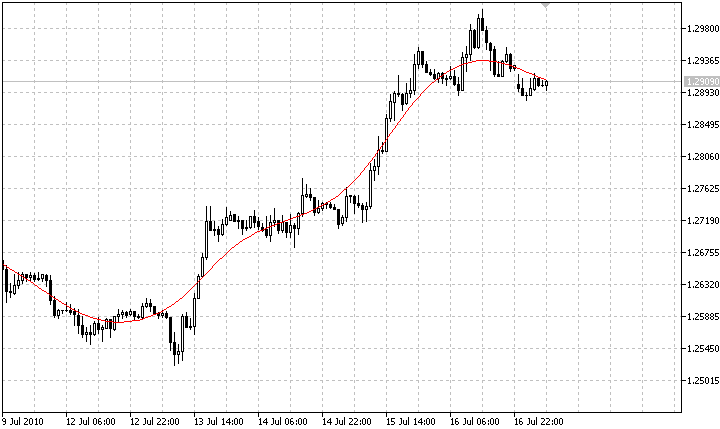

The Hodrick-Prescott filter is used in macroeconomics, especially in real business cycle theory to separate the cyclical component of a time series from raw data. It has a zero lag. There is a common disadvantage of such zero lag filters - the recent values are recalculated.

I have tried to apply this filter for the different purposes: for price channels, to use it as the trend changes indicator, etc, but I have found that it hasn't any significant advantages compared with EMA, LWMA or AMA.

Also I have found that values of the prices, smoothed by this filter are close to the principal component of the Principal Component Analysis (PCA). It seems that there is a mathematical relashionship between the Hodrick-Prescott filter and PCA. It might be useful, so I publish it here. I don't use it, but it would be great if you propose its possible applications.

Translated from Russian by MetaQuotes Ltd.

Original code: https://www.mql5.com/ru/code/143

The Moving Average Indicator, based on the Quasi-Digital Filter

The Moving Average Indicator, based on the Quasi-Digital Filter

The Moving Average indicator, based on the Quasi-Digital Filter. The MACD indicator as example of its use is presented.

iS7N_TREND.mq5

iS7N_TREND.mq5

Now it's two-color (or two-mode) trend indicator, the number of calculated bars can be specified.

An Expert Advisor, based on the "Puria method" Forex Strategy

An Expert Advisor, based on the "Puria method" Forex Strategy

An Expert Advisor, based on the "Puria method" Forex Strategy.

iHeikenAshiSm

iHeikenAshiSm

The Heiken Ashi indicator with smoothing.