Join our fan page

- Views:

- 32438

- Rating:

- Published:

- Updated:

-

Need a robot or indicator based on this code? Order it on Freelance Go to Freelance

The indicator is rewritten from MQL4, the author Alejandro Galindo, published by Scriptor, link to the source - https://www.mql5.com/en/code/7343.

How it works

The indicator draws the Pivot levels, the Pivot sublevels and the Camarilla levels.

Levels can be displayed by indicator buffers (by the whole history) and/or only current levels by horizontal lines.

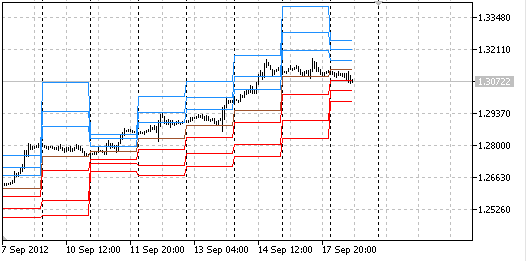

Drawing levels using the indicator buffers.

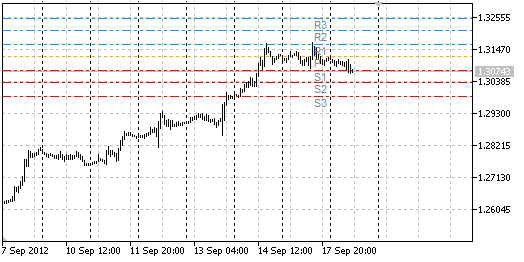

Drawing levels using the horizontal lines.

Parameters

- DayStartHour - Hour of day start.

- DayStartMinute - Minutes of day start.

- PivotsBuffers - Draw the Pivot levels using the indicator buffers.

- MidpivotsBuffers - Draw the Pivot sublevels using the indicator buffers.

- CamarillaBuffers - Draw the Camarilla levels using the indicator buffers.

- PivotsLines - Draw the current Pivot levels using the horizontal lines.

- MidpivotsLines - Draw the current Pivot sublevels using the horizontal lines.

- CamarillaLines - Draw the current Camarilla levels using the horizontal lines.

- ClrPivot - Color of the Pivot horizontal line.

- ClrS - Color of S1, S2, S3 horizontal lines.

- ClrR - Color of R1, R2, R3 horizontal lines.

- ClrM - Color of M0, M1, M2, M3, M4, M5 horizontal lines.

- ClrCamarilla - Color of the Camarilla horizontal lines.

- ClrTxt - Color of texts with horizontal lines names.

- AttachSundToMond - Attach Sunday bars to Monday.

Translated from Russian by MetaQuotes Ltd.

Original code: https://www.mql5.com/ru/code/1114

MultiJFatlSignal

MultiJFatlSignal

The MultiJFatlSignal indicator shows the information about active trends using the JFatl four indicators value from different Time Frame

Displaying Several CChartObject Objects in a Single Window

Displaying Several CChartObject Objects in a Single Window

This script displays several subcharts in a single chart window according to the number of currency pairs in Market Watch menu.

Terminator_v2.0

Terminator_v2.0

Intitial position is opened according to signals of the indicator.(there are six variants). If position becomes unprofitable, its volume is increased

Exp_BinaryWave

Exp_BinaryWave

The Trading system based on signal entry taken from the BinaryWave integral oscillator.