Community EA - FACTS and FAQ

It trades exclusively USDCHF and CADCHF and it trades only Long Positions and below we'll explain why.

1. High interest rates attract investors

The USD

provides the highest interest rate in the market with around 1.75%

2. Low interest rates force investors to search for alternatives with a

better outcome

The CHF provides the lowest interest rate. Indeed it's negative with -0.75%

Based on these facts the USD is much more attractive for investors than the CHF.

This

results in a clear uptrend for the corresponding trading pair USDCHF.

And we expect this continues for the next couple of years!

Update in version 2.1: The CAD provides also a high interest rate of 1.75%.

That's

why we can use the identical strategy for trading the CADCHF as well.

The diversification between USDCHF and CADCHF reduces your risk and provides significantly increased earnings potential at the same time!

Benefits of this strategy:

1. The strategy is constantly profitable as long as the CHF interest rate is much lower than the USD

interest rate

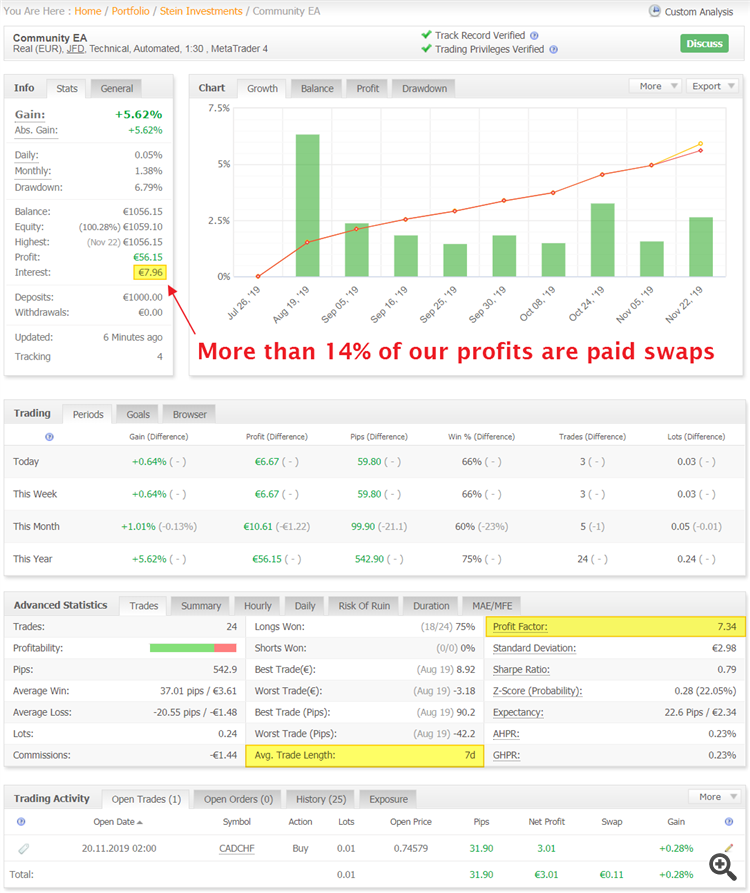

2. Every single trade earns an additional passive income due to the positive swap

paid on long positions at USDCHF and CADCHF

3. 100% stress free trading due to our focus on trading H1 and the calm character of trading the CHF in general

Live Account -> https://www.mql5.com/en/signals/612100

Frequently asked questions

1. There is an update available - can I update when there are currently trades open?

A. Yes, of course. Just update your copy of the Community EA, restart your terminal and you're done.

2. Do you vary the risk up and down while using the EA?

A. I run the Community EA on autopilot with the balanced risk profile and I'll add a second trading symbol that is available with the updated

version 2.1 for my customers as well.

Short term interpretations of the market may lead to emotional and financial traps and that's why I focused myself on the interest

rates ignoring all short term economical statistics.

From my point of view, and proven by the test results of the strategy, this is the most stable way to achieve constant profits in this

Forex trading business.

3. Why it don't work for example on GBPTRY (only short trades) ? - there is much higher difference in the interest rate comparing to USDCHF

A. I'm focused on the pairs with the highest liquidity and stability. Trading the TRY is extremely risky due to political reasons and that's what I and my customers usually like to avoid.

4. I see that it uses kind of grid - please tell me more about grid rules

A. This grid is used as a cost averaging system and recovery option with a maximum of 6 trades of the same size in case the market turns

against us.

With this option, we are much quicker back in profits than without it. I recommend using the visual mode of the strategy tester

to see how it operates and if you are comfortable with it.

5. Is it possible to use SL ? If yes - did you test it ?

A. No, I didn't and it does not make any sense at all because we earn a passive income due to the positive swap even if the trade faces a draw

down.

So I'm absolutely fine with keeping "losing" positions open because they earn money as well.

6. Can you explain the parameter "no trades below % equity" of the Community EA?

A. If there is no position open equity and balance is equal, so the equity is 100% of the balance. So the EA is able to open new trades if the

entry conditions are met.

In case the sum of these open positions cause a draw down of 20% or more the equity is below 80% of the balance (100%-20%=80%) and

the EA will not add any new positions.

Once the price turns back in our favor and the draw down shrinks below 20% the EA can add new positions if the entry conditions

are met.

So, if you don't want any new trades if the draw down exceeds 10% you have to set 90.0 in the corresponding section of the Community EA.

NOTE: This parameter is only used it one trades with a fixed lot size.

Since version 2.2 of the Community EA this equity protection barrier is part of the risk profile and will be set by the EA

automatically.

The limit for the dynamic risk profile to the above mentioned 20%, the balanced profile will use 15% and the conservative

setup gets a limit of 10%.

7.What would happen in the event that the interest rates are reversed?

A. If the interest rate situation reverses we have two options

1. We trade other pairs that provide a big difference in the interest rates of the underlying currencies like we already do with the CADCHF.

2. We trade the same pair in the opposite direction. The identical strategy works already for other majors like EURUSD in the opposite direction with sell trades but the current Brexit situation is unpredictable and that's why I didn't release the EURUSD as trading pair for the Community EA.

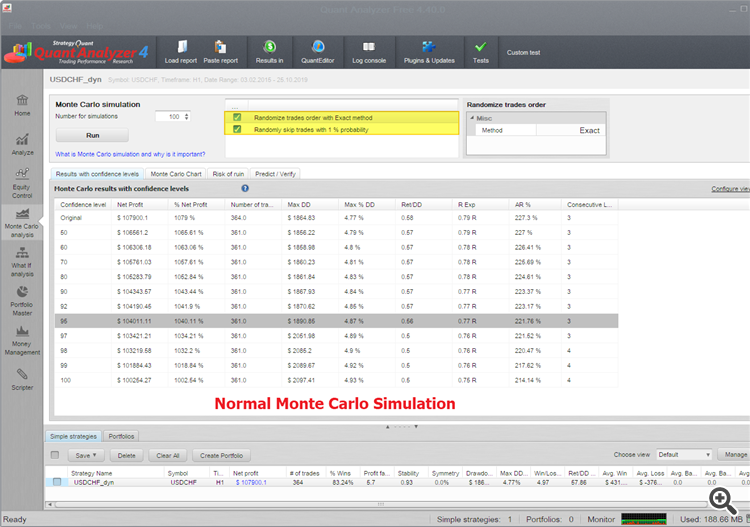

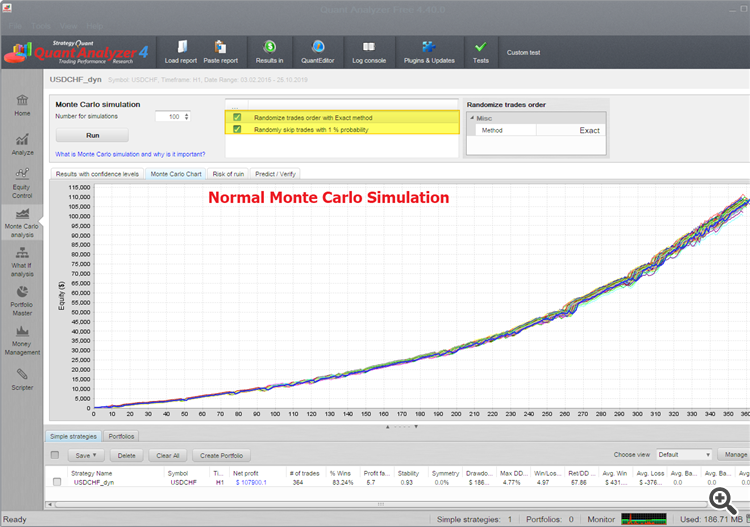

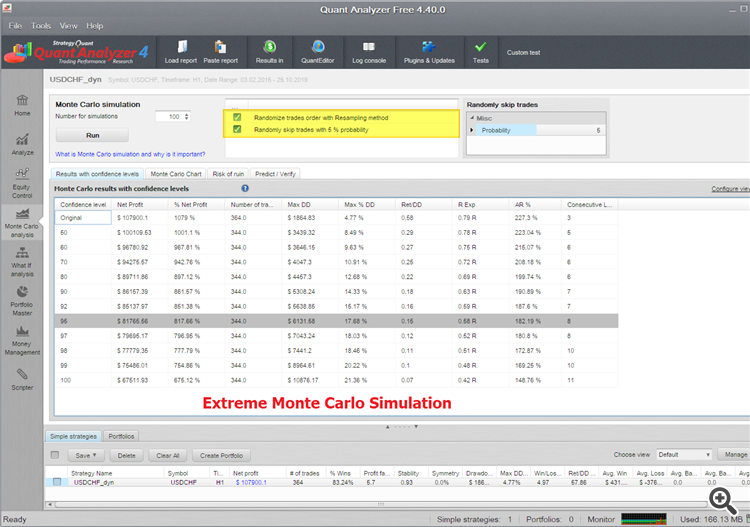

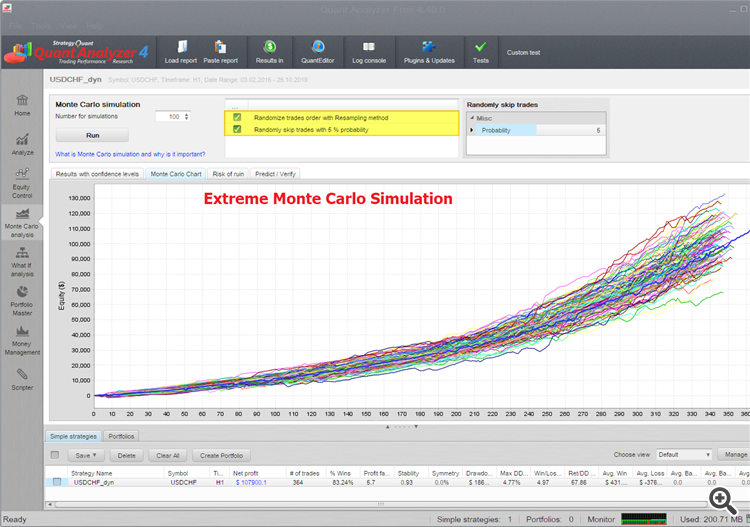

8. Did you run a Monte Carlo Simulation to prove the robustness of your strategy?

A. Yes, I did and here are the results.

9. Could you please tell more about the predefined risk profiles

A. The risk profiles adjust the lot size according to your equity and limit the risk to the downside.

Dynamic Mode = EA trades with 0.01 lot per 500$ balance and opens no new trades if the floating draw down exceeds 20%

Balanced Mode = EA trades with

0.01 lot per 1000$ balance and opens no new trades if the floating draw down exceeds 15%

Conservative Mode = EA trades with 0.01 lot per 1500$ balance and opens no new trades if the floating draw down exceeds 10%

10. Can you explain the restrained performance of the EA's signal account?

A: On the signal account, the EA runs with a balanced risk profile and achieved 7% so far which satisfies conservative clients that look

for low draw downs and consistent profits.

With the beginning of the new year, we'll set up a new live trading account with a dynamic risk setup to demonstrate the full

potential of the Community EA.

In the meantime, I recommend running your own tests in dynamic mode to see what's possible with this smart algorithm.

to be continued...

You want to go back to the product page? -> click here