As reported today by the Federal Office of Statistics of Switzerland, the CPI of Switzerland in September increased by 0.2% and 0.7% in annual terms (forecast was + 0.6% and + 0.5% in August). The consumer price index measures the average change in prices for all goods and a service purchased by households for personal consumption, and is a key indicator of inflation. The Swiss National Bank adheres to the policy of extra soft monetary policy and traditionally declares about the overvaluation of the Swiss franc and its high exchange rate.

The Swiss franc has reacted with a decline in the publication of data, including against the dollar, which remains the leader in the foreign exchange market, pending the publication on Friday of key data on the labor market in the US for September.

Some economists believe that a significant increase in jobs would justify another increase in interest rates by the Federal Reserve System before the end of this year. If NFP grows by less than 100,000, the dollar may fall sharply.

Also, investors are interested in whom US President Donald Trump recommends to the position of the head of the Federal Reserve after the term of office of the current chairman of the Federal Reserve, Janet Yellen expires in February.

The candidatures of the current Fed governor Jerome Powell and former manager Kevin Warsh are being considered. Unlike Powell, Warsh is an ardent critic of the Fed and an opponent of the quantitative easing program. Kevin Warsh is known as an opponent of super-soft monetary policy, while Jerome Powell is a supporter of Yellen.

The change in the leadership of the US central bank can significantly affect the prospects for monetary policy. Tighter monetary policy usually provides support to the dollar, making US assets more attractive to investors seeking to profitability.

Also today, volatility in the foreign exchange market could rise sharply from 11:30 (GMT), when information is published from the ECB's September meeting on monetary policy. The information contained in the protocols can shed light on the prospects of the QE program in the Eurozone.

At 13:10, 13:15, 14:00 (GMT), speeches of FRS management members Jerome Powell, John Williams and Patrick Harker are scheduled. It is likely that they will also speak in favor of another increase in the interest rate in the US before the end of the year, which the dollar will support.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support and resistance levels

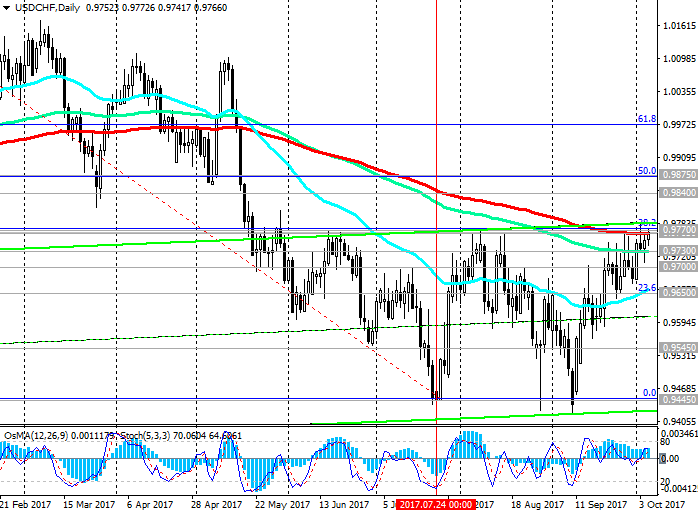

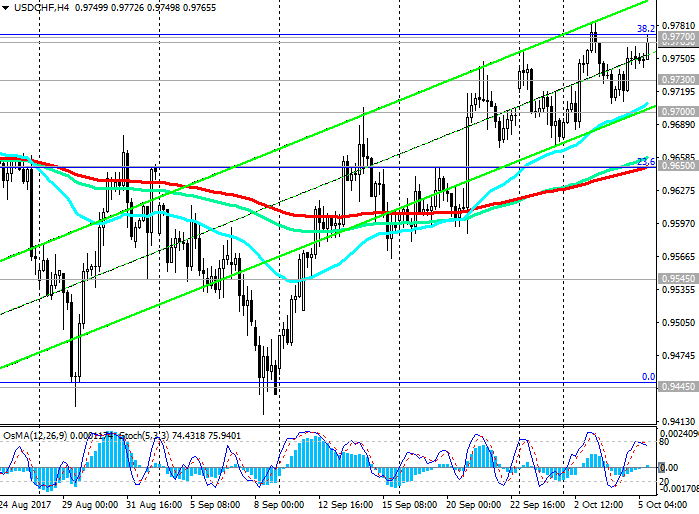

At the beginning of the European session, the pair USD / CHF is trading near the key resistance levels 0.9765 (EMA200 on the daily chart), 0.9770 (the Fibonacci retracement level of 38.2% of the upward correction to the last global decline wave since December 2016 and from the level of 1.0300).

Concerns about geopolitical tensions have declined, and the dollar has received support from the Fed, which confirmed its intention to raise the rate in December, and from positive US macro data coming in recently.

Indicators OsMA and Stochastics on the 4-hour, daily, weekly charts went to the side of buyers.

Breakdown of resistance levels 0.9765, 0.9770 will provoke further growth of USD / CHF with targets at the levels of 0.9840, 0.9875 (Fibonacci level of 50%).

The alternative scenario involves breakdown of support levels 0.9730 (EMA144 on the daily chart), 0.9700 (EMA200 on the weekly chart) and further decline with targets at support levels 0.9650 (Fibonacci level 23.6% and EMA200 on 4-hour chart), 0.9300 (lower limit downlink on the weekly chart).

So far, long positions are preferable.

Support levels: 0.9730, 0.9700, 0.9650, 0.9635, 0.9600, 0.9545, 0.9500, 0.9445, 0.9400, 0.9300

Resistance levels: 0.9765, 0.9770, 0.9800, 0.9840, 0.9875

Trading Scenarios

Buy Stop 0.9780. Stop-Loss 0.9740. Take-Profit 0.9800, 0.9840, 0.9875

Sell Stop 0.9740. Stop-Loss 0.9780. Take-Profit 0.9700, 0.9670, 0.9650, 0.9635, 0.9600, 0.9545, 0.9500, 0.9445, 0.9400, 0.9300

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com