Gold Forecast: Stability Creates Instability.

Hyman Philip Minsky (1919 –1996) saw the money related framework as a delicate substance that continually expected to swing between two extremes. He composed "A principal normal for our economy is that the money related framework swings in the middle of vigor and delicacy and these swings are an indispensable piece of the procedure that produces business cycles."

He saw the money related framework like a pendulum moving from steadiness to delicacy, trailed by emergency … and afterward back to soundness took after by development. This is additionally a marvel of the normal world and also human brain science itself. Nature once in a while stops rather days swing to night, summers to winters and domains rise and fall.

A steady fall in the expense of obligation has made a misguided feeling of solidness to the money related and political frameworks of numerous nations around the globe. It has additionally given a feeling of steadiness to the post war eras as they have viewed their unmerited riches keep on ascending to the point in any air pocket where the recipients of the blast turn into the casualties of any danger re evaluating occasion.

Since the mid 1980's stocks, and all the more as of late securities and land have been on a tear, as the interest for credit expanded so intrigue rates fell, it got to be gainful to reliably get to purchase as the interest for obligation expanded moneylenders fell over themselves to give into these advantages blasts they had served to make.

Another issue is that these obligation air pockets make a misallocation of capital far from beneficial ventures like organizations that may make fares and occupation and towards rising resource costs which just advantage the benefit holders themselves. This makes a feeling of riches and security in a few segments of society however leaves the entire of society more awful off over the long haul as these air pockets, subject to the laws of nature need to swing from intemperate positive thinking to unnecessary cynicism.

The issue is as premium rates almost zero loaning and getting turns out to be more minimal, more cash should be obtained to pursue a lower yielding resource. Time in a benefit bubble gradually dissolves the yield of the advantage, as pay streams increment more gradually than buy costs. Sooner or later this mispricing of danger is normally finished by an increment of defaulting advances some place in the financial chain, from the supplier of credit to the supplier of products.

At the point when taking a gander at the long haul pattern of interest rates it's without a doubt unthinkable not to consider Minsky's money related framework swinging in the middle of strength and delicacy. On the off chance that we consider money related markets being the result of human trepidation and avarice we can acknowledge that as a characteristic sensation they are liable to the rhythms of the common world and the propensity of human instinct to swing from idealism to negativity.

Confidence in resources that create a yield has never been higher, whilst confidence in physical items with utility like products has never been more regrettable. Resources obliging a yield rely on the works or inventiveness of others to pay the rent, profit or coupon; they are basically a type of IOU, they are a benefit the length of the pay stream remains.

Resources like things have an utility to man that has been acknowledged for centuries. From metals to hydrocarbons our current economy is driven by our capacity to misuse these advantages for our advantage. Be that as it may, right now we seem to have an alarmingly expiring interest for physical products, this is likely a tell that the air pocket economy is popping, the misallocation of capital for a considerable length of time has seen a gigantic development in negligible organizations that just exist in this false solidness, any stoppage gets their reasonability to address.

This mispricing wonder we are seeing at this time may well be sowing the seeds for the defaults we would hope to see as the obligation air pocket blasts. In any case, gigantic air pockets have enormous victory beat, the pendulum will swing from our present status of delicacy towards the strength that happens once defaults have been acknowledged, yet in advance don't be astonished to see much more compelling mispricing. https://www.mql5.com/en/signals/120434

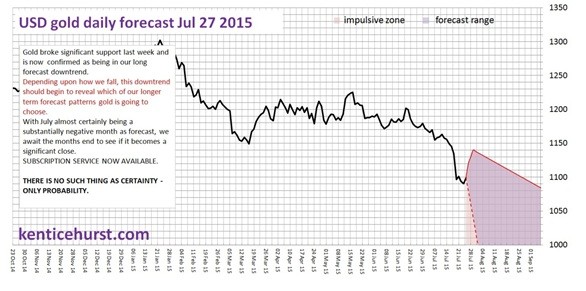

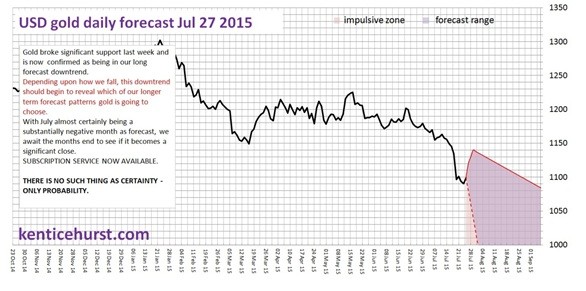

So we are presently well inside of our long gauge downtrend. Having broken to five year lows, we are watching to perceive how we fall over the advancing weeks… and how seriously we end the month. We stay bearish in the short-term, yet wouldn't be amazed at a ricochet over the impending days.

Hyman Philip Minsky (1919 –1996) saw the money related framework as a delicate substance that continually expected to swing between two extremes. He composed "A principal normal for our economy is that the money related framework swings in the middle of vigor and delicacy and these swings are an indispensable piece of the procedure that produces business cycles."

He saw the money related framework like a pendulum moving from steadiness to delicacy, trailed by emergency … and afterward back to soundness took after by development. This is additionally a marvel of the normal world and also human brain science itself. Nature once in a while stops rather days swing to night, summers to winters and domains rise and fall.

The outline underneath from the St Louis Fed is the yield on ten year Treasury Notes extending back sixty years.

A steady fall in the expense of obligation has made a misguided feeling of solidness to the money related and political frameworks of numerous nations around the globe. It has additionally given a feeling of steadiness to the post war eras as they have viewed their unmerited riches keep on ascending to the point in any air pocket where the recipients of the blast turn into the casualties of any danger re evaluating occasion.

Since the mid 1980's stocks, and all the more as of late securities and land have been on a tear, as the interest for credit expanded so intrigue rates fell, it got to be gainful to reliably get to purchase as the interest for obligation expanded moneylenders fell over themselves to give into these advantages blasts they had served to make.

Another issue is that these obligation air pockets make a misallocation of capital far from beneficial ventures like organizations that may make fares and occupation and towards rising resource costs which just advantage the benefit holders themselves. This makes a feeling of riches and security in a few segments of society however leaves the entire of society more awful off over the long haul as these air pockets, subject to the laws of nature need to swing from intemperate positive thinking to unnecessary cynicism.

The issue is as premium rates almost zero loaning and getting turns out to be more minimal, more cash should be obtained to pursue a lower yielding resource. Time in a benefit bubble gradually dissolves the yield of the advantage, as pay streams increment more gradually than buy costs. Sooner or later this mispricing of danger is normally finished by an increment of defaulting advances some place in the financial chain, from the supplier of credit to the supplier of products.

At the point when taking a gander at the long haul pattern of interest rates it's without a doubt unthinkable not to consider Minsky's money related framework swinging in the middle of strength and delicacy. On the off chance that we consider money related markets being the result of human trepidation and avarice we can acknowledge that as a characteristic sensation they are liable to the rhythms of the common world and the propensity of human instinct to swing from idealism to negativity.

Confidence in resources that create a yield has never been higher, whilst confidence in physical items with utility like products has never been more regrettable. Resources obliging a yield rely on the works or inventiveness of others to pay the rent, profit or coupon; they are basically a type of IOU, they are a benefit the length of the pay stream remains.

Resources like things have an utility to man that has been acknowledged for centuries. From metals to hydrocarbons our current economy is driven by our capacity to misuse these advantages for our advantage. Be that as it may, right now we seem to have an alarmingly expiring interest for physical products, this is likely a tell that the air pocket economy is popping, the misallocation of capital for a considerable length of time has seen a gigantic development in negligible organizations that just exist in this false solidness, any stoppage gets their reasonability to address.

This mispricing wonder we are seeing at this time may well be sowing the seeds for the defaults we would hope to see as the obligation air pocket blasts. In any case, gigantic air pockets have enormous victory beat, the pendulum will swing from our present status of delicacy towards the strength that happens once defaults have been acknowledged, yet in advance don't be astonished to see much more compelling mispricing. https://www.mql5.com/en/signals/120434