Technical audit of the weekend (1): EUR/USD Fails Crucial Resistant Breakout

20 September 2015, 19:53

0

229

This article I is partitioned into two sections, given that the review this time (particularly EUR/USD) is to some degree more long and point by point specialized side that additionally incorporates dialog about the worth size of the intraday action may be valuable for every one of us.

EUR/USD

High unpredictability post the FOMC demonstrated by sets that proceeds until the end cost at the weekend. On the off chance that you take after the Specialized Audit article the earlier Weekend, I noted immediately reminded that domain 1.1435/65 used to be an in number safe hard infiltrated in May and June. Inability to breakout above key resistance may be at danger of a fleeting pullback furthermore be confirmation that the business sector is as yet putting away memory against the level S/R that is hard to separate which can welcome buyers interest/merchants are equipping to take a position in level S/R.

In major, which can be the reason vendors are get ready in the scope of key-resistance is the verbalization ECB who say they open the likelihood to widen the extension and extent of QE until one year from now as a result of the low swelling rate still hadn't moved from stagnant position, so there is a risk that they will settle on the matter at the following ECB meeting. The other reason is the announcement of Janet Yellen (after the FOMC clarification) that still opens the likelihood to raise rates toward the end of this current year, in spite of the fact that it will depend to a great extent on the data economy (work business sector and expansion markers) in maybe a couple months ahead.

Subsequently the inquiry that may be crossed in our brains is, the manner by which to identify the likelihood of amendment on the pair EUR/USD specialized premise after the Euro did post FOMC rally?Actually not very troublesome, in the event that we are attempting to think all the more clear and not excessively focused with shocks of value unpredictability that is so obviously noticeable on a period compass of not exactly H1.

The primary is, from mapping on the Day by day graph we discover that 1.1435 or 65 never got to be safe solid in May and June, so inability to get through this discriminating safe remedial would be dangerous in the short term, or even the continuation of the bearish in the medium term.

Furthermore, we ought not overlook the fundamental guideline in the transient to medium scaleor intraday, that cost will dependably move in three stages, to be specific: upside/disadvantage solidification/sideways/continuation/adjustment reversal.

Third, esteem value activity or movement is a thing that may in reality should be comprehended by any vendor. I never become weary of saying (at any rate on my nearest companions who likewise falls in the forex world) that we ought to pay consideration on this. Esteem action is notmerely a fire plan, additionally about the value activity against Open Day by day and intraday Bolster/scale Safe, and also value activity against supporting markers( Ichimoku Kinko Hyo).

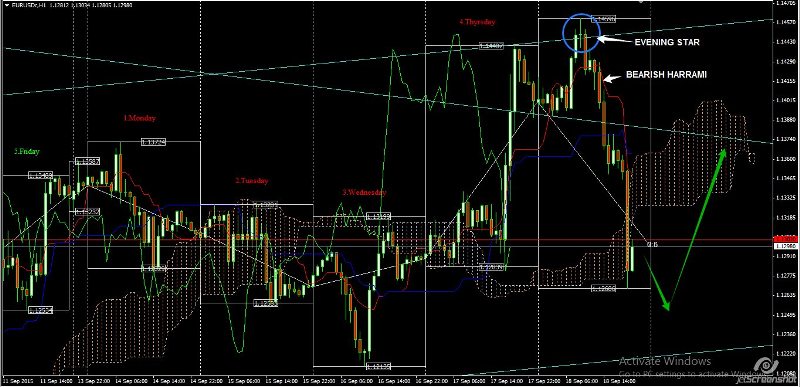

Open Day by day Friday costs yesterday were in level 1.1434 (Open value Day by day this there may be slight contrasts in some illustrative), and fire case Night Star then framed are in the value reach Open Day by day. It was the first alerted that we ought to keep away from or exit from a position of procurement. At that point, inundating the effective H1 bearish leap forward intraday bolster (1.1389) is the following affirmation, that the restorative development is in progress.

Moreover, in the event that you are a client of Ichimoku marker (which is discretionary given that not all merchants utilizing it), light a bearish harami who got through in the base of the Tenkan-sen is a flag that considerable, that the restorative development will be stood up to with the level parity Kijun-sen who yesterday moving level in the scope of 1.1376 as dynamic intraday bolster (now an element safe).

For more points of interest, let us take a gander at the accompanying picture underneath which additionally portray how Iput some passage positions taking into account esteem movement H1 (post FOMC):

On a chart of time designation of H1 above, we see the likelihood of a further declinein need affirmation break under 1.1213 (Low September sixteenth). Tweezer Top scaleDaily which is near the critical 1.1435 safe or 65 bolstered this bearish situation however specialized perspective on a Day by day diagram still shows positive inclination (over the Ichimoku Cloud Daily).https://www.mql5.com/en/signals/111434#!tab=history