Today's focus is on the ECB policy interest rates and President Lagarde's press conference.

The atmosphere seems to be getting more active in the market. The catalyst is a series of positive statements from senior Bank of Japan officials. Following Governor Kuroda, Deputy Governor Nakatani today indicated that "the certainty of achieving the Bank of Japan's price target continues to gradually increase." Regarding wage trends, he mentioned that "if we wait for all the data from small and medium-sized enterprises, it will probably be after autumn," suggesting the possibility of a green light depending on the situation of the spring wage negotiations in March.

Bank of Japan Governor Kuroda has been repeating the basic recognition of "considering a revision of the large-scale easing when the price target is foreseeable," but there are also hints of expectation, stating that "there will be no impediment to necessary policies due to considerations for finance" and "the certainty of achieving the price target continues to gradually increase."

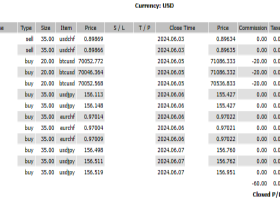

USD/JPY has broken below the 150 yen level and is trading around 149 yen, 148 yen, erasing the large figures.

In the overseas market later, the results of the ECB Governing Council will be announced. The market consensus is formed that the main three interest rates will be kept unchanged. This time, the staff projections on inflation and growth will be announced. It is expected to reflect the recent trend of inflation slowing down. With a large number of members, information from hawks and doves may intersect, but the inflation outlook is likely to be one guideline. Following President Lagarde's press conference, it will be interesting to see how the market's expectations for rate cuts change.

If the differences in direction with the Bank of Japan become clear, there may also be increased selling of the euro and buying of the yen.

The economic indicators to be announced in the overseas market later include ECB policy interest rates (March), US trade balance (January), US non-farm labor productivity index (final value) (Q4), US initial jobless claims (02/25 - 03/02), Canada housing construction permits (January), Canada international merchandise trade (January), etc.

In terms of speaking events, ECB President Lagarde will hold a press conference, Fed Chairman Powell will testify before the Senate Banking Committee, and Cleveland Fed President Mester will give a speech or interview on economic outlook.

Overall, it seems to be a day with many highlights.

Today's focus is on the ECB policy interest rates and President Lagarde's press conference. If there is significant movement in the EUR here, we plan to follow it.