.......

P.S. I may be mistaking buttons on a regular basis.

BUY and SELL? Ah, so that's why the loci ..... so maybe something to work on the memory to remember it better ?

This, by the way, is one more reason to use locks (I'll consider it the main one), apart from psychological one when trading hands .... I will add it to my collection of ....

Maybe it's color blindness + ignorance of English, that's why it clicks everywhere it goes.

It must be spring in the north, the grass is growing. Better than the old one.

Martin + loki is a doubly scary subject. You, will be "beaten" and most likely "kicked". The problem with martingale is large series of losing trades. Applying locks is only one way to deal with them, but there are other ways. Besides, no one is stopping you from increasing lots in a reasonable way.

The most correct way is to have a trading strategy and knowledge of arithmetic. And the problems of one and the other are in the lack of the above.... And why beat someone? And even kicking ??????

The child is still in school and can tell Daddy what to do with arithmetic, but the rest is really problematic. Maybe it's just crooked sharpened hands, incorrectly trained neuronet between the ears, and who knows what else.

To Vinin

Mnu is a couple of three months away from the dacha season, spring is summer, but as usual I'll be at work again. If you trust your eyes, ears and humor, I'm not the only one with seasonal aggravation. Neighbours have gone to quasars with quarks.

To All

I am not a katana, and I am not going to bot. Just a way to soften the martin. Compare two series, building up the volume of positions in case of a losing series

classical martin 1 2 4 8 16 32 64 128 256 512

the suggested way 1 3 4 6 8 12 16 24 32 48

Eliminate locks - fixing losses when opposing positions are opened. This reduces the volume of trades. Zero counter margin requirement is eliminated. Profits/losses and entry/exit points remain in place.

We look at the result... and all that is left is martin in its classic form.

The child is still in school and can tell Daddy what to do with arithmetic, but the rest is a real problem. Maybe it's just crooked sharpened hands, incorrectly trained neuronet between the ears, and who knows what else.

To Vinin

Mnu is a couple of three months away from the dacha season, spring is summer, but as usual I'll be at work again. If you trust your eyes, ears and humor, I'm not the only one who has had a seasonal exacerbation. Neighbours have gone to quasars with quarks.

To All

I am not a katana, and I am not going to bot. Just a way to soften the martin. Compare two series, building up the volume of positions in case of a losing series

classical martin 1 2 4 8 16 32 64 128 256 512

suggested way 1 3 4 6 8 12 16 24 32 48

The problem with martingale is large series of losing trades. The use of lots is only one way of dealing with them, but there are other ways. Besides, no one is stopping you from increasing lots in a sensible way.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

The main thing is not to spit, it's a bad idea in a vacuum of ideas.

Much has been written about Martin, and its main drawback - increase of the position volume in exponential progression in case of bad outcomes.

However with respect to our rams, the increasing of the position volume can be significantly reduced if we move away a favorable outcome, increasing TR SL for an aggregate position in the case of unfavorable outcome (what a tautology) I will not consider here, there is another significant disadvantage - TR is so distant from the current moment that we can never expect it in this life.

The second way is to shift the level of opening the opposite position in case of an unfavourable outcome.

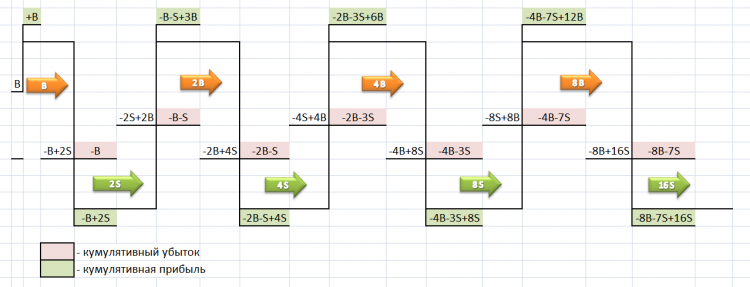

Suppose initially Btsu is opened, see picture. If the price goes down to some level, we open a Sell position with a tripled lot, respectively, there is a level where the aggregate position can be closed at a profit.

Simultaneously with the short position opening a buy order is placed at (Buy+Sell)/2 with 4 times bigger lot than the initial one. If the price moves unfavourably and a buy order triggers, a sell order is placed at once at the level of the initial sell order with the lot six times bigger, etc. for the unfavourable price movement until the price reaches the level when all orders can be closed at profit. This way we manage to avoid geometric growth of the position volume. In this example, the last lot is 26 instead of almost 200 in the classic example.

If the broker does not require a margin deposit for an oppositely opened position, the margin in the above example would only be needed to support 18 lots for a sell position.

P.s. I may be mistaking buttons on a regular basis.