Unveiling Trend Strength:

A Forex Trader’s Toolkit

The allure of forex trading lies in capitalizing on trends. But not all trends are created equal. A strong, sustained trend offers far more potential for profit than a sluggish, meandering one. This is where trend strength indicators come in – powerful tools that help you gauge the momentum behind a price movement and identify the most promising trading opportunities.

These technical analysis tools act as your compass, helping you gauge the intensity behind a price movement. Let’s delve into some popular trend strength indicators and how they can empower your trading decisions:

1. Moving Average Convergence Divergence (MACD):

The MACD is a multi-faceted indicator that provides insights into both trend direction and strength. It comprises two moving averages (MAs) – a fast-moving average (EMA) and a slow-moving average (EMA). The distance between these lines, the MACD line, reflects trend momentum. A widening distance indicates a strengthening trend, while a narrowing distance suggests a trend losing steam. Additionally, divergences between the MACD line and a signal line (another EMA) can offer early signals of potential trend reversals.

2. Average Directional Index (ADX):

Unlike the MACD, the ADX focuses solely on trend strength, disregarding direction. It consists of three lines: the ADX line, the +DI (positive directional indicator), and the -DI (negative directional indicator). A rising ADX line above a certain threshold (typically 25) signifies a strong trend, regardless of up or down. The +DI and -DI lines, meanwhile, depict the strength of bulls and bears respectively, helping you identify which side is dominating the trend.

3. Relative Strength Index (RSI):

While not exclusively a trend strength indicator, the RSI can provide valuable clues. Primarily an oscillator that measures price momentum, the RSI ranges from 0 to 100. Readings above 70 suggest overbought conditions, potentially indicating a weakening uptrend. Conversely, readings below 30 suggest oversold conditions, which could signal a potential reversal in a downtrend. By identifying these potential turning points, you can position yourself for trend continuations or anticipate potential reversals.

4. Bollinger Bands:

Bollinger Bands® are a volatility indicator that can also offer insights into trend strength. These bands widen and contract based on price volatility. In a strong trend, price action tends to stay confined within the bands, with limited forays outside. Conversely, during periods of weakening trends, price action may break out of the bands more frequently, suggesting increased volatility and a potential trend shift.

5. Price Action:

Don’t underestimate the power of pure price movement! Observing higher highs and higher lows in an uptrend or lower lows and lower highs in a downtrend is a simple yet effective way to gauge trend strength. Sharp price swings and sustained breakouts from established support/resistance levels further solidify a strong trend.

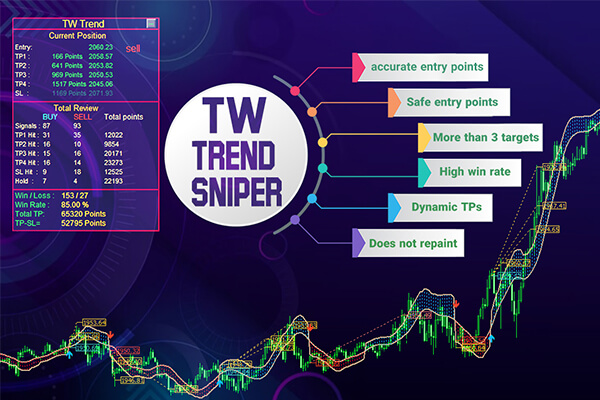

6.Mixed trend method:

Introducing the “TW trend sniper” Indicator, a powerful indicator that is used to identify the main trends by using the “Trade Wizards” exclusive indicator formula along with the use of price action, the detection of currency trading sessions, Fibonacci and detection functions and artificial intelligence noise removal methods with high accuracy.

Remember:

no single indicator is a foolproof way to gauge trend strength. The best approach is to use a combination of indicators alongside price action analysis for a more holistic understanding of the market. Here are some additional tips:

- Consider the timeframe: Trend strength indicators can be applied to different timeframes (short-term, long-term). Choose a timeframe that aligns with your trading strategy.

- Don’t rely solely on indicators: Always factor in fundamental analysis and economic news events to get a complete picture.

- Backtest your strategies: Before deploying these indicators with real capital, test them on historical data to see how they would have performed.

By incorporating trend strength indicators into your forex trading toolbox, you’ll be better equipped to identify powerful trends, improve your entry and exit timing, and ultimately, maximize your profit potential.

Happy trading

may the pips be ever in your favor!