Review of trades of the Owl Smart Levels strategy for the week from June 26 to 30, 2023

Today I present you an overview of trades made using the Owl strategy - smart levels for the EURUSD, GBPUSD and AUDUSD currency pairs for the week from June 26 to 30, 2023. The trading history of this week was one of the shortest - only three trades were opened on two currency pairs. However the week was quite profitable for three trades. So, below is the traditional report on trades.

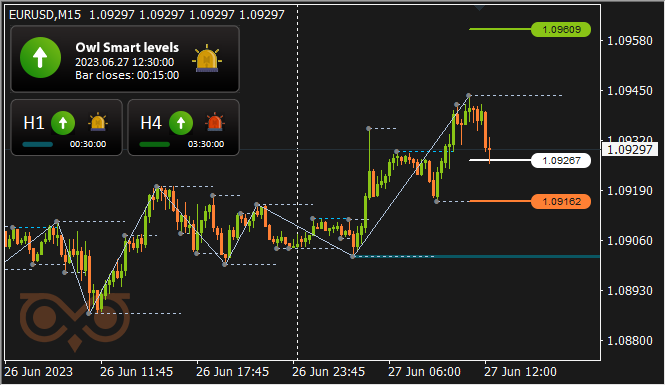

For convenience and timely receipt of signals I use the Owl Smart Levels Indicator. The main trading timeframe is M15, while the H1 and H4 timeframes are used to confirm the trend direction of the higher timeframe.

EURUSD review

The market was in a dead zone on Monday and didn't give a chance to the indicator to give a signal. The first signal to open a trade for buying on EURUSD was given by the Owl Smart Levels indicator on Tuesday in the middle of the day.

Fig. 1. EURUSD BUY 0.14, OpenPrice = 1.09267, StopLoss = 1.09162, TakeProfit = 1.09609, Profit = $48.86.

A few hours later the trade closed on the plus side and brought in a fairly common amount of profit of $48.

On Wednesday there was also a dead zone all day long and the next trade at this asset was opened on Friday.

Fig. 2. EURUSD SELL 0.21, OpenPrice = 1.08684, StopLoss = 1.08755, TakeProfit = 1.08452, Profit = $49.01.

The second trade turned out to be profitable just like the first one, closed at TakeProfit.

GBPUSD review

The market spent most of Monday and Tuesday in the dead zone. Despite the fact that on the other days when there was no dead zone it was possible to trade, the Owl Smart Levels indicator did not find any opportunities to make profitable trades.

AUDUSD review

The market spent Tuesday in the dead zone, and Owl Smart Levels suggested to open a trade for selling on Wednesday morning.

Fig. 3. AUDUSD BUY 0.20, OpenPrice = 0.66428, StopLoss = 0.66486, TakeProfit = 0.66238, Profit = -$15.

Unfortunately, the trade was closed by StopLoss literally on the next candle, and this was that rare case when the indicator did not have time to warn about the necessity of closing the trade in manual mode. The direction of the price, in general, has not changed, but as a result of "trampling in place" in this volatile area, the indicator simply did not have time to react in such a short time and a small distance, and then the market went down.

Thursday, the second half of the day the market spent in the dead zone, and on Friday there were no signals for opening trades.

Last week only three trades were opened. Two trades have brought good profit each and one was much less profitable.

Results:

So, the climax of June was a weekly profit of $157 in the middle of the month, after which the profit went down. Let's expect the growth of a new wave of profitability in August and approaching the level of $200 per week with a deposit of $1000.

We will see how the trading will look like and how the market will behave, as well as what trades will be offered to us to open Owl Smart Levels on Monday, during the upcoming trading week.

See other reviews of the Owl Smart Levels strategy:

- From June 19 to 23, 2023, Total: +6%

- From June 12 to 16, 2023, Total: +15.8%

- From June 5 to 9, 2023, Total: +7.5%

- Archive of reviews >>

I'm Sergei Ermolov, follow me and don't miss more useful tools for profitable trading on the Forex market.