USD/CHF: Dollar continues to grow in the European session

Trading recommendations

Buy in the market. Stop-Loss 0.9980. Targets

1.0030, 1.0090, 1.1000, 1.0200

Sell Stop 0.9980. Stop-Loss 1.0010. Targets

0.9950, 0.9910, 0.9850, 0.9820, 0.9790

Overview

and dynamics

Despite the dollar's correction in the Asian

session, it continued to grow in the early European session. However, the

dollar seems to suspend its large-scale growth in the foreign exchange market

after the election of the US president Donald Trump. Resetting of US government

bonds temporarily stopped. The situation on the US debt market stabilizes.

The yield on US 10-year bonds on Monday reached

2.3%, its highest level since 30 December on expectations of growth of budget

expenditures at Trump administration.

According to the presented Tuesday to the US

Commerce Department, retail sales in October, adjusted for seasonal variations

rose by 0.8%. Retail sales in September, according to revised data, rose by 1%,

not 0.6% as previously reported. In the last two months retail sales

demonstrate better growth dynamics, at least two years.

Import prices rose 0.5% in October compared with

the previous month, according to the US Department of Labor (vs. + 0.3%).

Import prices show, so the growth in seven of the last eight months, which is a

sign of the strengthening of inflation. This is a strong argument in favor of

raising interest rates in the United States at a meeting of the Federal Reserve

in December.

Now the attention of market participants will

gradually switch to the Fed meeting, scheduled for December 13-14, and where it

will be decided whether the interest rate increase in the United States.

According to the quotations of futures on a bet the Fed, investors assess the

probability of a December tightening of monetary policy in about 85% -90%.

By the beginning of the European session, the pair

USD / CHF is trading near the 1.0020 mark, 20 points above the psychologically

important 1.0000 level.

In September, the Swiss National Bank left rates

on deposits at the level of 0.75%. The range for the 3-month LIBOR interest

rate also remained unchanged (-0.25% - -1.25%). In the accompanying statement,

the SNB said that the "negative interest rate and the statement about the

readiness of the central bank to intervene in the currency market aimed at

reducing the attractiveness of the Swiss franc, which should ease the pressure

on him," in the direction of increasing its rate. The next meeting of the

SNB on its monetary policy will be on December 15 immediately after the two-day

Fed meeting on 13-14 December.

Today at 13:00 (GMT + 3) will be published index

of economic expectations ZEW in Switzerland in November that assesses the

business climate, the employment situation in the market and other elements of

the state of the economy. High scores are considered to be positive for the

CHF, and vice versa.

At 17:15 published economic indicators have on the

United States (industrial production, capacity utilization for October). Strong

data will give an additional dollar upward momentum, and vice versa.

Technical

analysis

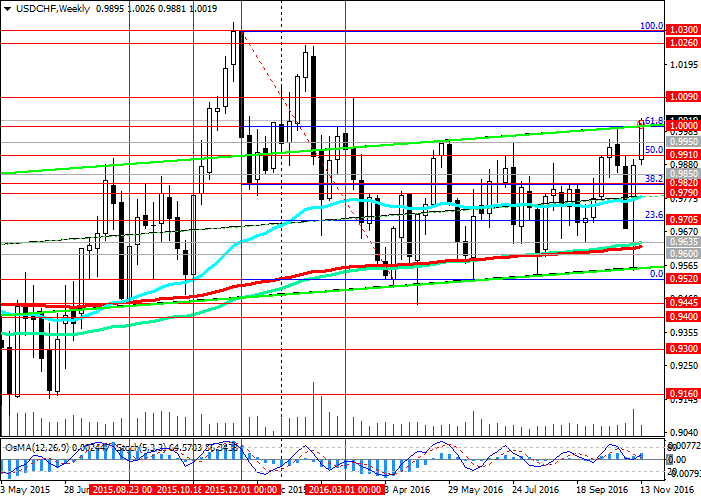

The general strengthening of the dollar in the

foreign exchange market, comes amid US sales of government bonds after the

victory of Donald Trump, little seems to have stopped. USD / CHF has reached a strong

resistance level of 1.0000 (Fibonacci level of 61.8% to the last wave of the

global decline in December 2015 and at the level of 1.0300). This level is also

a strong psychological level, as well as top of the line range, which is

located between the levels of 0.9520 (Fibonacci level of 0%), and 1.0000. A

mark of 1.0000 and the upper line goes newly formed downtrend channel on the

daily chart and the top line of the rising channel on the weekly chart.

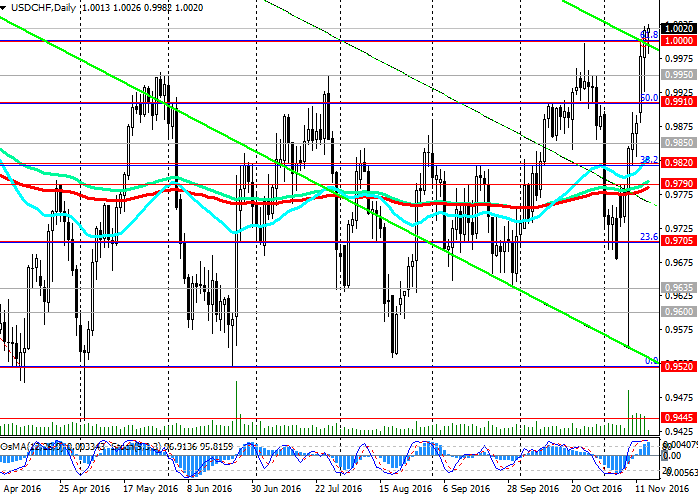

From a technical point of view, the positive dynamics

of the pair USD / CHF is maintained in the medium term. But in the short

time-frame (4-hour) were the signals to open short positions in the framework

of a short-term downward correction yet. Indicators OsMA and Stochastic on the

4-hour chart have moved to the side of the sellers.

In case of breaking the support level of 1.0000

decline in USD / CHF pair could continue to support levels 0.9950, 0.9910

(50.0% Fibonacci level and EMA144 on the 1-hour chart).

With the development of a downward movement may

reduce the pair USD / CHF support levels 0.9820 (38.2% Fibonacci level), 0.9790

(balance EMA200 line EMA144 on the daily chart).

Nevertheless, the fundamental background creates

the preconditions for the further strengthening of the dollar and, accordingly,

the growth of the pair USD / CHF.

Indicators OsMA and Stochastic on the daily,

weekly, monthly schedules are on the side of buyers. The next goal – is 1.0090

(highs of March 2016). Further the objectives of growth can become levels

1.0260 (highs in February 2016 on the eve of the SNB decision

"decouple" from the euro franc), 1.0300 (highs in 2015).

Further dynamics of the dollar and the pair USD /

CHF will be directly related to economic policy Trump and Fed actions in

respect of the interest rate in the United States.

Support levels: 1.0000, 0.9950, 0.9910,

0.9850, 0.9820, 0.9790

Resistance

levels: 1.0030, 1.0090, 1.1000, 1.0200

Author signals - https://www.mql5.com/en/signals/author/edayprofit

*)presented material expresses the personal views of the author and is not a direct guide to conduct trading operations.