After the UK voted out, there is room for the downside on EUR/USD. Some see 1.05 and some see parity. What about the pound, the protagonist? Here are two more opinions from Deutsche Bank and Credit Agricole:

Here is their view, courtesy of eFXnews:

Brexit Wins: GBP/USD Towards 1.15; USD/JPY Below 100 – Deutsche Bank

Over the coming days, we see 1.30 and 0.85 as a realistic level for GBP/USD and EUR/GBP to clear respectively, with risks skewed to the downside. While the initial gap lower has been largely driven by market positioning and liquidity, however, the medium term implications of Brexit on sterling have yet to be felt. The UK’s record current account deficit means the currency is the in the worst possible position for the severe slowdown in capital inflows that will result from uncertainty generated by the result today. This will be exacerbated by further Bank of England easing, as forecast by our UK chief economist, and a sharp slowdown in growth. We see GBP/USD at 1.15 by year end.

We felt that the upward momentum in the JPY would remain strong for at least the coming months regardless of the referendum results due to the sluggishness in the US economy and receding expectations of a Fed rate hike. The markets were already nervous as to whether the USD/JPY would halt at 100, and the Brexit vote will put additional upward pressure on the JPY against the GBP and EUR as well. Unless the US economy soon improves to a point where multiple Fed rate hikes can be justified, the USD/JPY could shift its range to the level below 100.

USD: A Familiar ‘Smile’ Pattern – Credit Agricole

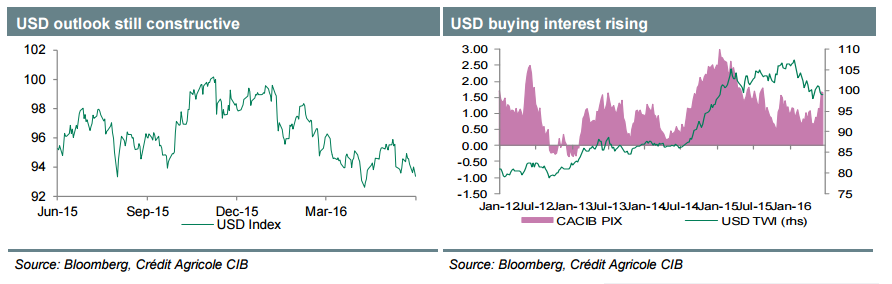

This year’s USD dynamic in our view resemble a familiar ‘smile’ pattern whereby the dollar strengthened on the initial dip in risk appetite early in the year, weakened as the Fed turned more dovish and should start strengthening again as the economy picks up and tightening expectations are rebuilt.

In her semi-annual testimony Chair Yellen pointed to a “sharp” increase in consumer spending, which should be confirmed by a solid May personal income and spending report next week. Meanwhile, the broader labour market indicators have been supportive of the Fed’s view that the very soft May payrolls report was somewhat of an aberration and our economists still expect two rate hikes to be delivered in H2.

However, with a Brexit having materialised and as global growth expectations may turn more muted on the back of it, it appears more unlikely that the Fed will consider higher rates anytime soon. This does not need to dampen the outlook for the USD, which anew benefits from rising safe haven appeal in an environment of EU driven risk aversion.

We remain long USD versus AUD and CAD via options. In an environment of unstable risk sentiment and a stronger USD, the commodity bloc is likely to suffer more considerably.