APAC Currency Corner – Brexit fallout

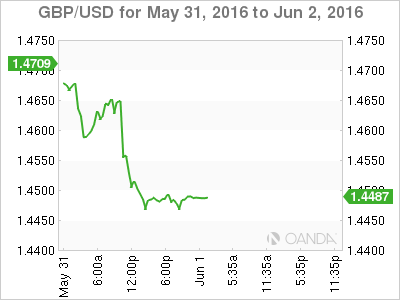

During the past twelve months, investors have built a towering wall of worry around themselves as they brood about everything from a global economic slowdown to collapsing oil prices. Now we have a possible Brexit on the horizon. Yesterday’s latest online ICM Brexit poll (47% Leave vs. 44% Remain) reignited concerns over a potential UK exit from the EU and had shaken those equally towering foundations. The FTSE 100 and the British Pound suffered severe losses overnight leaving global investors sitting on a razor’s edge.

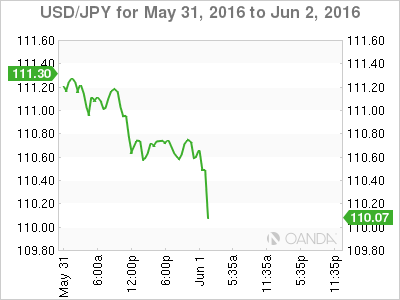

USDJPY – crucial non-farm payrolls looming

The Brexit poll fallout was felt in US equity markets, which saw the S&P soften below the 2100 mark. USDJPY was quick to follow touching 110.53 as a renewed bout of risk aversion gripped the markets. Also weighing on USDJPY was the latest US consumer confidence survey, which fell from 94.7 to 92.6 in May versus 96.1 expected. Interbank players were quick to buy the initial 110.50-60 dip, but the support level has come under renewed pressure this morning as the Nikkei opens 0.8 % lower. Despite the early pressure, we should expect USDJPY to remain firm on dips ahead of Friday’s non-farm payroll. Keep in mind, this is the final NFP before the June FOMC and takes on added importance given the Fed’s recent posturing suggesting a summer rate hike is on the cards. This is the final NFP before the June FOMC and takes on added importance given the Fed’s recent posturing, suggesting a summer rate hike is in the cards.

All eyes will be focused on Japanese PM Abe, who will hold a press conference at 5 PM (SG time) today. He is expected to formally announce a delay to the sales tax hike until Oct 2019.

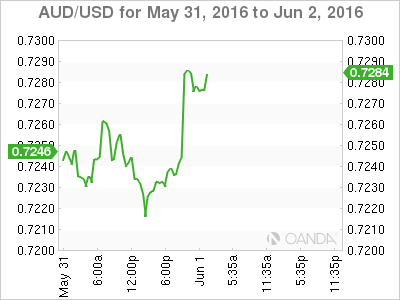

AUDUSD – Aussie rockets after GDP boost

Stronger than expected Q1 exports has seen local traders pare back RBA rate cut expectations. With building permits beating market expectations (+3% vs. -3% MoM, 0.7% vs. -6.7% YoY) this has benefited the Aussie dollar. The AUD accelerated higher to the 0.7260 level, as traders appear less confident the RBA will make back-to-back interest rate cuts. However, with market participants ready and willing to re-initiate Aussie short positions the gains were short-lived. The pair is back trading in and around the 0.7225-30 level ahead of the critical China PMI’s and the all-important Australia GDP data.

Australian GDP came in at a roaring 1.1% versus 0.8 % expected. The Aussie has rocketed higher nearing the 0.7300 level as this convincing result should remove any notion that the RBA will initiate back-to-back interest rate cuts in June.

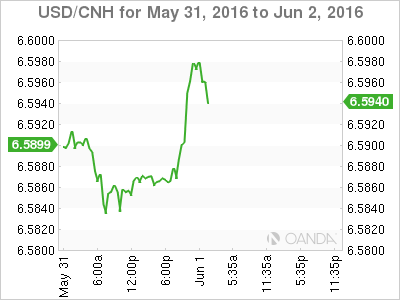

CNH – MSCI inclusion

Yesterday’s big rally in domestic equities was on the back of increased speculation that Chinese mainland A shares may be included by MSCI in its global index next month. On the currency from the markets, despite strong inter-day buying, the USDCNH continues to meet significance resistance at 6.59. However, the song remains the same: slower growth for longer should keep the Yuan trading off it is back foot as Chinese Manufacturing PMI continue to straddle the 50-point breakeven levels. It’s worth noting the currency implications from the Shanghai–HK stock related flow into HK which will likely increase on the back of the MSCI inclusion.

Today’s PBOC Yuan midpoint came in at 6.5889 vs. 6.5790. This is the weakest fixing since early 2011. Yesterday’s 6.59 resistance levels will likely come under immediate pressure as a result.