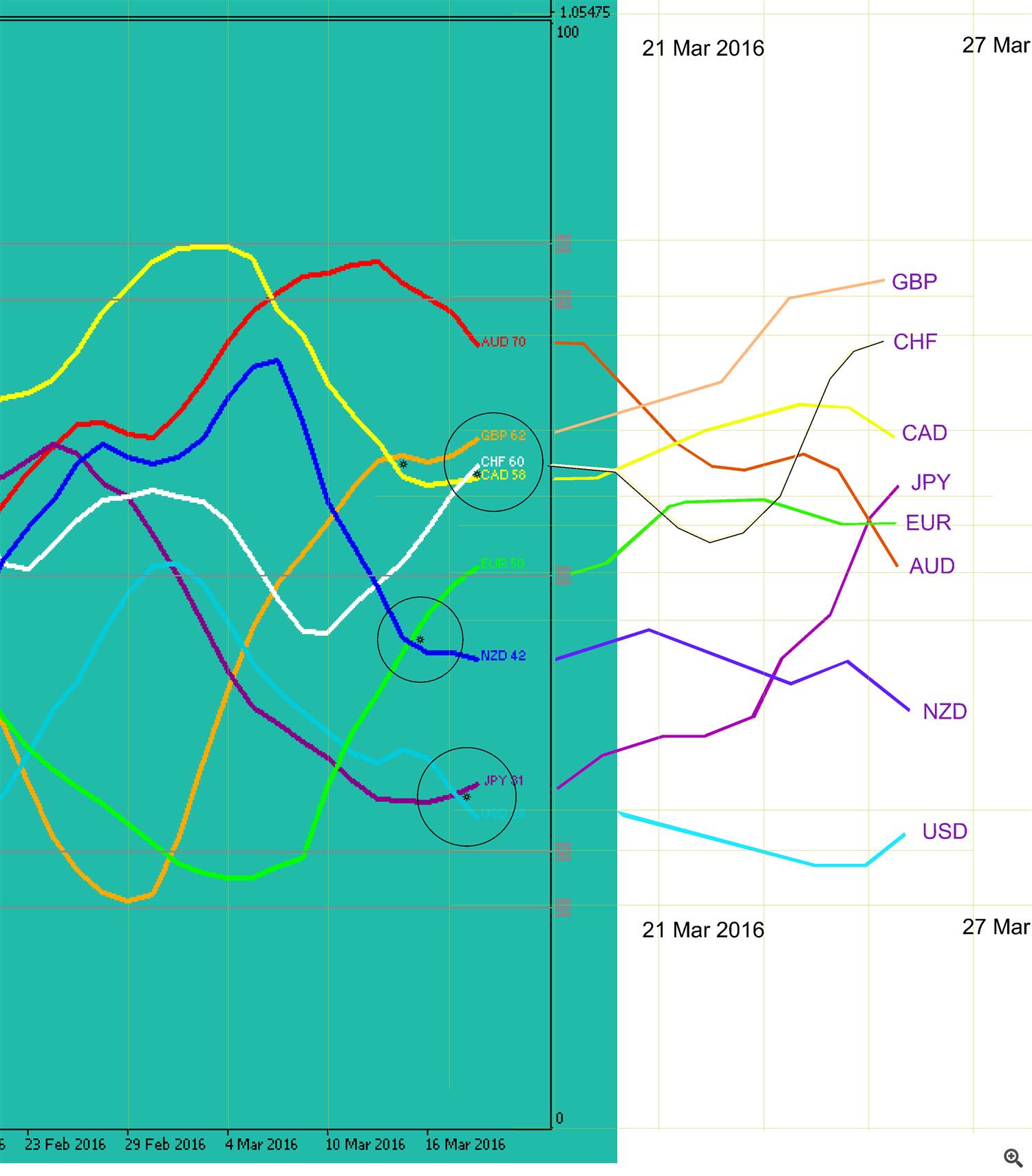

Forecast of movement currency indexes next week 21.03 -27.03.2016.

19 March 2016, 11:29

2

123

Forecast of movement currency indexes next week 21.03 -27.03.2016.

1. AUD. Aussie AUD to close on Friday - the leader of the eight currencies.

AUD 70 Index.

Week AUD lost ground with the index of 78 to 70,

but despite this - the future of former champion today is that the most powerful.

Overhanging the edge of a parabola toward the south, recorded on a chart indicator D1 forces - clearly indicates that the Australian force will continue to weaken:

kangaroos continue to drop down from the north - toward the equator.

Promising to be the short of the Australian.

2. GBP- ranked second. The index of GBP 62. For the week the pound rose from 57 to 62.

Surrender Mr. Pound is going, the trend remains bullish.

The old gentleman will be the leader of the Group of Eight GBP next week.

Last week the Pound broke the Canadian and now he has to fight against AUD ..

Therefore long GBPAUD buy, GBPCAD buy

3. CHF - Swiss fifth, moved to third place. Index franc CHF 60.

On the way north, Franc CHF - beat New Zealander and a Canadian NZD CAD.

Therefore short NZDCHF sell, CADCHF sell.

I would like to add that the CHF is in the wake of the GBP, and these two currencies jointly pull together from the podium Aussie AUD.

But still, the franc CHF weaker pound GBP,

and then will be gradually built up a large bag of liquidity.

Therefore AUDCHF sell, GBPCHF buy.

4. CAD. Canadian in fourth place. CAD 58 index.

Canadian falls for the second week. The motion vector is now Canadian sets the correlation of its guide -American Dollar USD, which falls.

Promising to be the sale of CAD, but only after the correction.

Therefore USDCAD buy.

5. EUR. Euro in fifth place. The euro is now a fair price and is located on the equator. EUR 50 Index.

Last week, the single currency has increased and struck a New Zealander,

the next target for the euro - a Canadian CAD.

Here the struggle to be serious, CAD takes the defense,

and not the fact that the euro will start up further north -on top.

It is likely that in this range H4 and will hang a couple EURCAD,

so there will be variations in the two parties to trade.

But still likely scenario multi-way combination,

after the market maker has finished twist thimbles

- The result will be EUR hike to the top of the north. Euro Shopping -perspektivny.

Therefore long EURCAD buy, EURUSD buy, EURNZD buy, EURAUD buy.

6. NZD. New Zealand Maori falls NZD. Its index of 42.

Here at the beginning of the week may be a correction, well then, on a hike to the bottom, to the bottom. Two Pacific Fleet AUD NZD falling, but the Japanese began to fall and finished amplifies,

because there will NZDJPY sell the fight.

7. JPY. JPY The Japanese outsider in a place moved to 7th place. Japanese index JPY 32.

Japanese only began turning toward the north, and, therefore, promising his purchase.

JPY The Japanese currency in power won the falling dollar USD.

Next week, the Japanese continue to be touched on.

Therefore short USDJPY sell, NZDJPY sell, CADJPY sell, AUDJPY sell.

8. USD. The US dollar USD- is the outsider of the week. USD 28 Index.

dollar fall cycle is not over, it is very likely next week

hike to the bottom.

Here I would like to add that all the traditions of the genre - USD reversal will not occur before the time

when povytrushivayut liquidity bags clabyh market participants,

those who got up early to buy.

That is only after that moment - Dolar solemnly make a turn towards the north.

Next week, promising to be the sale of the dollar.

Therefore USDJPY sell, EURUSD buy, USDCHF sell, GBPUSD buy.

The four currencies that effort:

GBP, CHF, EUR, JPY.

The four currencies, which will weaken:

USD, NZD, CAD, AUD.

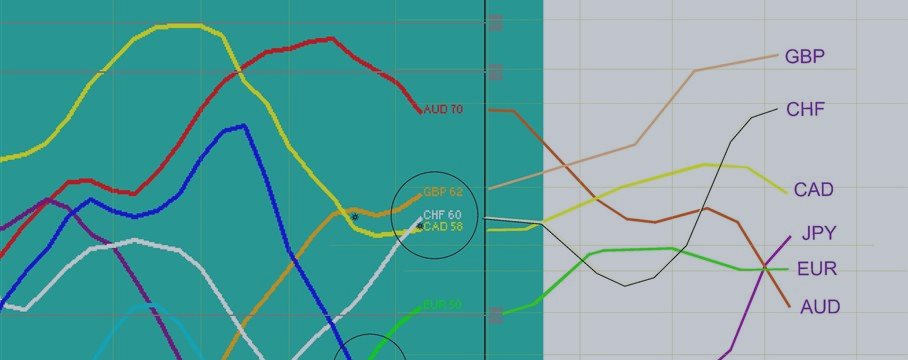

Trading Plan next week, presented as a motion graphics currency indexes,

Where to get the data of the actual position of the index,

and carried out the construction of long-term movement of parabolas for the next week.

Files:

index28_21032016.jpg

2143 kb