China's shrinking forex reserves drive investor concerns

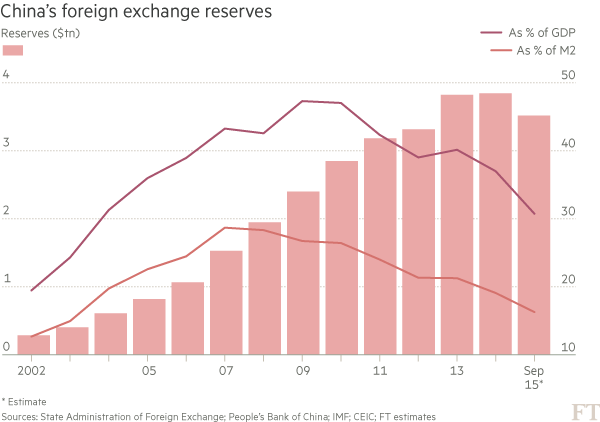

Capital is leaving China at a record pace and the country's central bank is drawing down reserves to buoy the renminbi after its recent grinding fall. Investors are now asking how long China’s shrinking foreign currency reserves — down to $3.5tn from a peak of $4tn in June 2014 — can hold out.

Uncertainty over how China counts its reserves and how much is at hand to deploy at short notice has boosted these concerns.

Amid worries about economic slowdown and rising bad debt in the banking system, market players have viewed China’s massive forex outflow — the world’s largest — as the ultimate guarantor of financial stability, says the Financial Times.

The possibility that reserves could be swiftly exhausted raises doubts about Beijing's ability to fight crisis. It also caps the regulator’s capacities to continue foreign exchange intervention, which may have cost as much as $200bn in August alone.

Société Générale recently pointed out $1tn was the absolute maximum the PBoC can sell.

The composition of China’s reserves is a state secret and the figures remain blurred. The reserves are managed by the sedate State Administration of Foreign Exchange (SAFE), which usually put its money in U.S. government bonds.

However, the low returns that SAFE earned led Beijing to launch a sovereign wealth fund, China Investment Corp, in 2007 to seek riskier and less liquid investments. Recently, competition between the two made SAFE tackle other investments such as British office buildings and Italian banks. Meanwhile, CIC’s investments do not appear in official reserve data, and it is unclear if SAFE’s CIC-style forays do.

China’s offshore intervention is another mystery. The central bank has traditionally limited its currency interventions to the domestic market, but not so long ago it has obtained offshore renminbi in an attempt to narrow the spread between the onshore and offshore rates. Strategists suspect SAFE may count offshore renminbi, known as CNH, as “foreign” reserves — in effect making its reserves look considerbaly bigger than they are.

China seeks IMF endorsement for the yuan as a reserve currency, and this requires more transparency. Beijing has signed up to an IMF standard that requires it to unveil more information about its reserves — including how much is held as financial securities against less liquid assets.

China economist at UBS Tao Wang estimates that China holds $1.4tn

in U.S. Treasury securities + $800bn in those of other states,

mostly in Europe, the U.K. and Japan — well below the official number of

$3.5tn. But she still believes worries over the liquidity of China’s

reserves are exaggerated.

The IMF recommends for such economy as China's, with fixed exchange rates and capital controls, that the central bank keep foreign currency reserves worth 30 per cent of short-term debt, 10 per cent of exports and 5-10 per cent of M2 money.

According to these criteria, the country needs between $1.6tn and $2.6tn in reserves, says Mansoor Mohi-uddin, senior market strategist at Royal Bank of Scotland in Hong Kong. That comes in line with Société Générale's view that the country can spend about $1tn more defending the currency before reserves would plunge below safe levels.

Analysts believe Beijing will eventually have to allow further renminbi depreciation, due to the limited nature of China's forex reserves.

The PBoC had to interfere to calm the market’s jittery mood after August's devaluation. But once the

risk of uncontrolled depreciation has moved away, the regulators are expected

to step back.