Dollar Weakening After Yesterday's US CPI: Focus on Today's US Indicators for Confirmation

Market Commentary:

Following yesterday's US CPI release, the USD is trending lower. Despite significant volatility immediately after the CPI announcement, which resulted in the closing of many USD short positions, the current trend favors USD weakness. Presently, the only open position is a long on BTC/USD.

Market Update:

- USD/JPY: Fell from the 156-yen range to the 154-yen range yesterday, and has further declined to the 153-yen range in today's Tokyo market.

- EUR/USD: Rose from around 1.0830 to near 1.0869 following the CPI release.

Upcoming Economic Indicators:

- US Housing Starts (April)

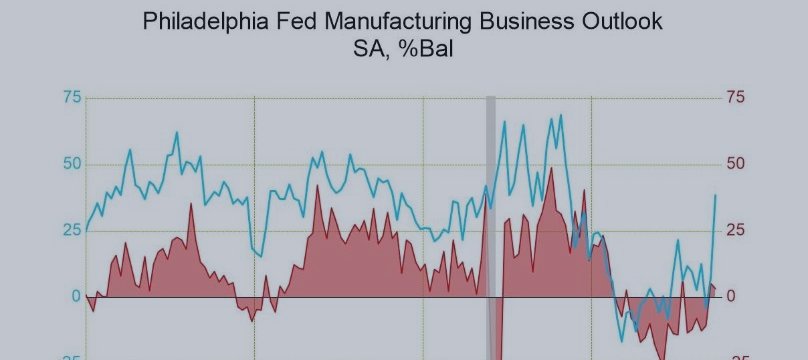

- Philadelphia Fed Manufacturing Index (May)

- US Import Price Index (April)

- US Export Price Index (April)

- US Initial Jobless Claims (05/05 - 05/11)

- US Industrial Production Index (April)

Market reactions to these indicators, especially jobless claims and industrial production, will be closely watched. If these indicators point towards a calming US economy, further USD depreciation is expected.

Upcoming Speaking Events:

- ECB Vice President De Guindos: Press conference after financial stability report release.

- ECB Officials: Including Panetta, de Cos, Centeno, Nagel, and Villeroy de Galhau, will be participating in various speaking events.

- BOE Member Green: Speech on the labor market.

- US Fed Officials: Including Vice Chair Barr, Richmond Fed President Barkin, Philadelphia Fed President Harker, Cleveland Fed President Mester, and Atlanta Fed President Bostic, will give speeches later in the NY session.

At this point, the consensus is for the ECB to start rate cuts in June, the BOE to consider rate cuts around August, and the US Fed to potentially start rate cuts in September following the recent CPI results. Observing the speeches by central bank officials will be crucial to gauge any changes in market expectations.