Key Events Today: US CPI and Retail Sales, No Clear Direction from Yesterday's US PPI

15 5月 2024, 11:40

0

14

Yesterday, the US Producer Price Index (PPI) exceeded expectations, but the previous figure was revised downward. The initial rise in the dollar quickly reversed, resulting in volatile price movements without a clear direction.

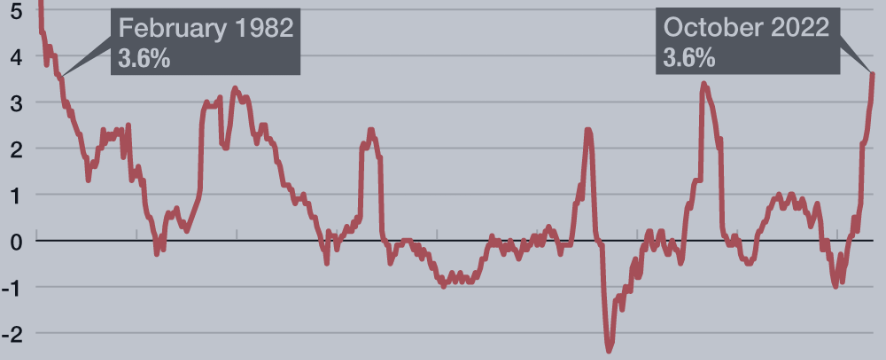

Today, the more closely watched US Consumer Price Index (CPI) will be released. Market forecasts predict a slight slowdown to +3.4% year-on-year from the previous +3.5%, and core CPI is expected to slow to +3.6% from the previous +3.8%. The market will likely react to the deviation between the actual results and the forecasts, similar to yesterday. Attention will also be paid to revisions of previous values.

At the same time, US retail sales and the NY Fed Manufacturing Index will be released. If the directions of these three major indices align, market reactions may be amplified. The key announcements, including the CPI, will be made.

Other economic indicators to be released in the overseas market later include the US MBA Mortgage Applications Index (05/04 - 05/10), US Business Inventories (March), US NAHB Housing Market Index (May), TIC Net Long-Term Transactions (March), Canada Housing Starts (April), and Canada Manufacturing Sales (March).

Regarding speaking events, after a series of ECB-related events with Müller (Governor of the Central Bank of Estonia), Villeroy de Galhau (Governor of the Central Bank of France), and Makhlouf (Governor of the Central Bank of Ireland), Fed Vice Chair Barr will attend a hearing on financial supervision. Former Fed Chair Bernanke will present a report on the Bank of England's economic forecast review. Later in the NY session, speeches by Kashkari (President of the Minneapolis Fed) and Bowman (Federal Reserve Governor) are scheduled.

Additionally, the US Weekly Petroleum Status Report will be released. In terms of US corporate earnings, Cisco Systems will be in focus.

Today, the plan is to follow the clear direction of the US dollar after the US Consumer Price Index (CPI) and retail sales are released.