Mirza Baig / Profile

- Information

|

10+ years

experience

|

0

products

|

0

demo versions

|

|

0

jobs

|

0

signals

|

0

subscribers

|

::: You must expect to be stung by bees when in search of honey :::

::: He who is not courageous enough to take risks will accomplish nothing in life :::

::: He who is not courageous enough to take risks will accomplish nothing in life :::

Friends

301

Requests

Outgoing

Mirza Baig

Sergey Golubev

AUDUSD Technical Strategy: Pending Long Clear candlestick reversal patterns absent on the daily chart Harami on the four hour timeframe awaiting confirmation AUD/USD is awaiting guidance near the 0.9320 mark with candlestick reversal signals lacking on the daily chart...

Mirza Baig

Muhammad Syamil Bin Abdullah

5 skills every trader must have

Many people believe that trading cannot be taught. They say that the best traders in the world are born with an innate gift that allows them to trade the markets with ease. Others, however, think trading can be taught, and this was famously put to the test by Richard Dennis and his Turtle Traders.

Whatever your personal opinion, successful traders do require certain skills and here are a few:

1. Discipline to trade to follow the plan

One of the key skills a trader must have is the discipline to follow the plan. When things are going wrong and the markets are not playing as expected, it’s tempted to abandon the plan and trade by gut instinct but this is a mistake. In fact, it’s times like those when the trading plan becomes even more crucial.

2. Intense work ethic

Some people get into the markets for the money alone and it is these people who normally do not last very long. Surviving in the markets means having the work ethic to do your homework on the markets, to analyse future opportunities and to go over all of your previous trades looking for ways to improve. In the end, it’s no surprise that those who do well in the markets are those that stick at it for long hours every day of every week.

3. Recognising when you’re wrong

Being able to recognise when you’re wrong is what sets winning and losing traders apart. If the price action is telling you that your trade is wrong, you need to have the strength to throw in the towel and close the position out for a loss – before it gets even worse. All traders make losing trades so traders who can’t recognise when they are wrong stand to lose much more hanging on.

4. Pulling the trigger

To succeed in trading requires finding profitable opportunities the moment they appear so it is necessary for a winning trader not only to find the trades but to act on them without delay. Following technical indicators and watching price action can lead to good trade signals but if pulling the trigger on a trade is a problem, it will always be difficult to make money. Because, profitable trading opportunities rarely exist for very long in the forex markets.

5. Patience

Patience is required in large amounts in order to be a successful trader. You must be patient to wait for the perfect opportunity to trade, then you must be patient enough to watch that trade as it loses money. Finally, you must be patient enough to go through the many years of hard work which it takes to become good at trading.

Many people believe that trading cannot be taught. They say that the best traders in the world are born with an innate gift that allows them to trade the markets with ease. Others, however, think trading can be taught, and this was famously put to the test by Richard Dennis and his Turtle Traders.

Whatever your personal opinion, successful traders do require certain skills and here are a few:

1. Discipline to trade to follow the plan

One of the key skills a trader must have is the discipline to follow the plan. When things are going wrong and the markets are not playing as expected, it’s tempted to abandon the plan and trade by gut instinct but this is a mistake. In fact, it’s times like those when the trading plan becomes even more crucial.

2. Intense work ethic

Some people get into the markets for the money alone and it is these people who normally do not last very long. Surviving in the markets means having the work ethic to do your homework on the markets, to analyse future opportunities and to go over all of your previous trades looking for ways to improve. In the end, it’s no surprise that those who do well in the markets are those that stick at it for long hours every day of every week.

3. Recognising when you’re wrong

Being able to recognise when you’re wrong is what sets winning and losing traders apart. If the price action is telling you that your trade is wrong, you need to have the strength to throw in the towel and close the position out for a loss – before it gets even worse. All traders make losing trades so traders who can’t recognise when they are wrong stand to lose much more hanging on.

4. Pulling the trigger

To succeed in trading requires finding profitable opportunities the moment they appear so it is necessary for a winning trader not only to find the trades but to act on them without delay. Following technical indicators and watching price action can lead to good trade signals but if pulling the trigger on a trade is a problem, it will always be difficult to make money. Because, profitable trading opportunities rarely exist for very long in the forex markets.

5. Patience

Patience is required in large amounts in order to be a successful trader. You must be patient to wait for the perfect opportunity to trade, then you must be patient enough to watch that trade as it loses money. Finally, you must be patient enough to go through the many years of hard work which it takes to become good at trading.

Mirza Baig

mazen nafee

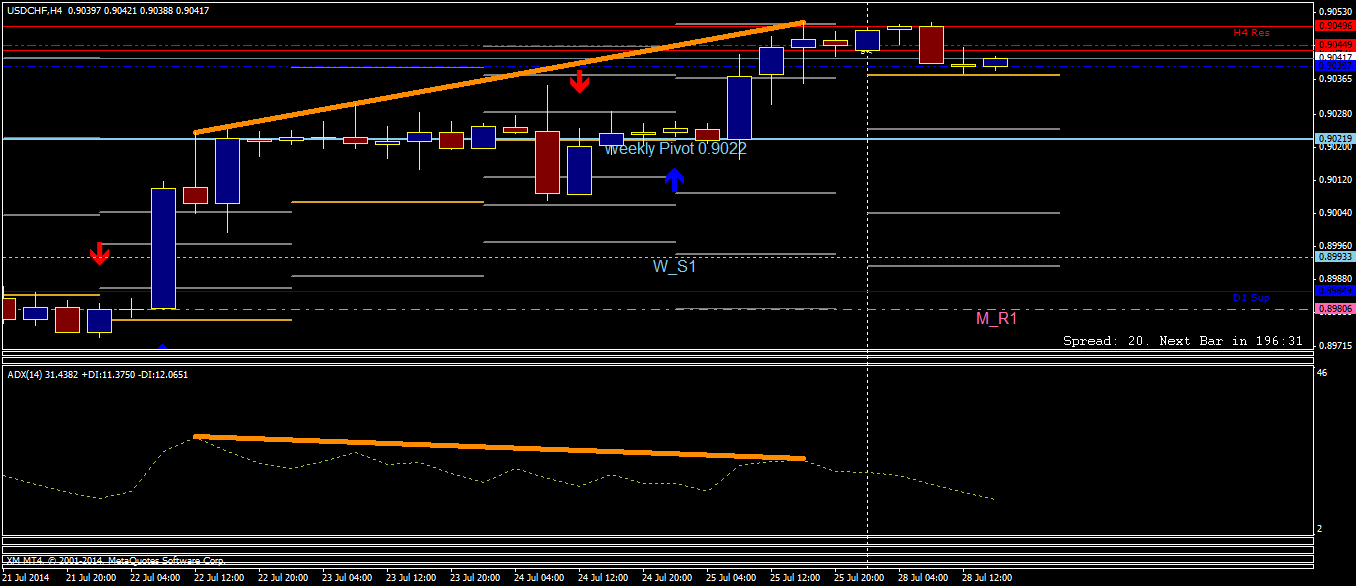

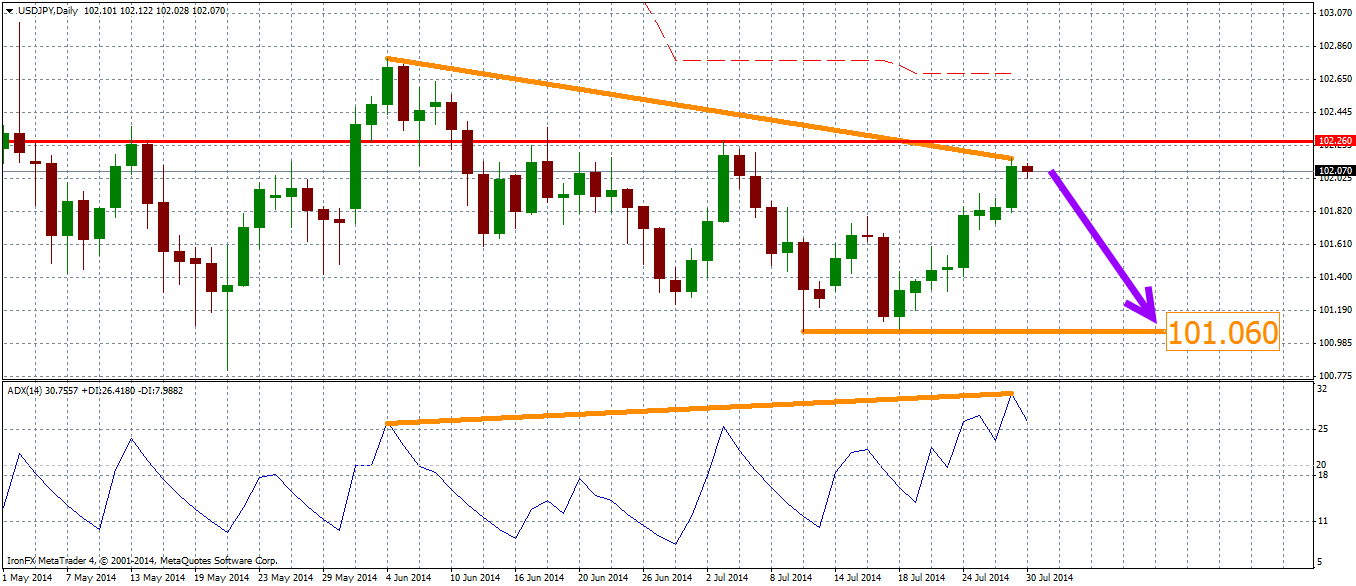

Comment to topic USDJPY Analysis

Daily Chart Bearish Divergence (DMI+) My preference: Short positions Below 102.26 with targets @ 101.60

Mirza Baig

mazen nafee

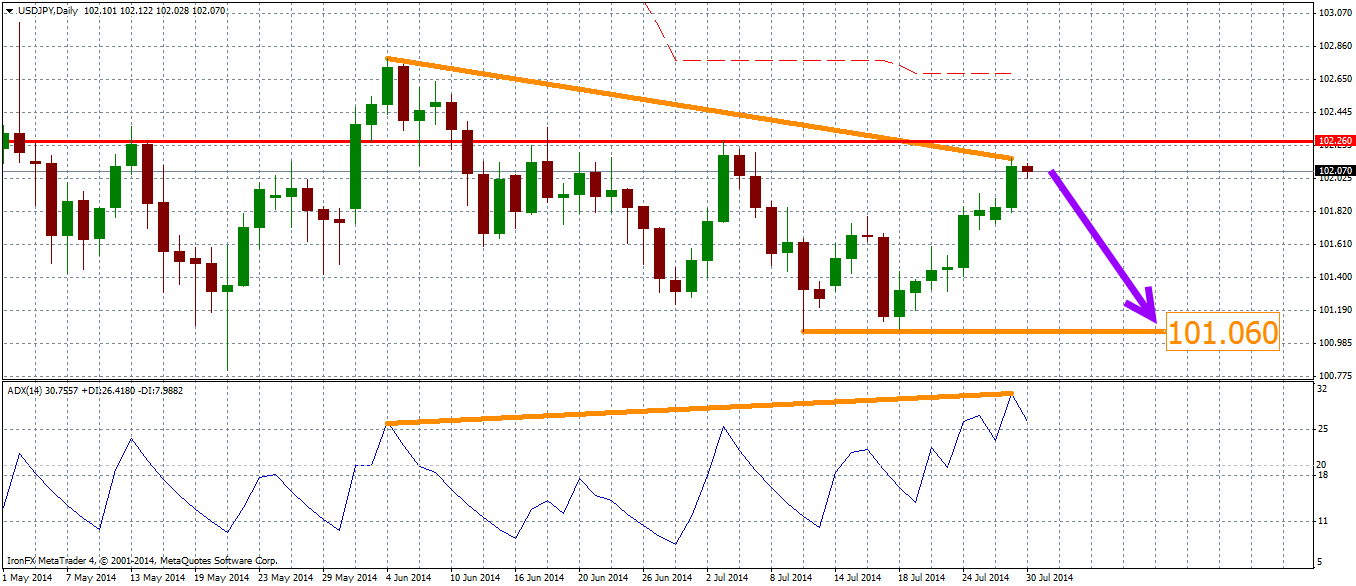

Comment to topic USDJPY Analysis

Hourly Chart Bearish Divergence (DMI+) My preference: Short positions Below 102.26 with targets @ 101.708

: