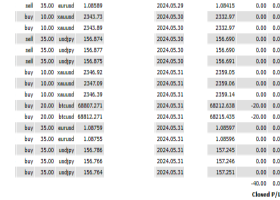

USD/JPY: Strong Buy - Focus Currency and Technical Analysis (15-minute Chart) April 5, 2024

USD/JPY: Strong Buy - Ranging Trend

The USD/JPY pair is showing relatively active downward movement as traders close some of their long dollar positions ahead of the release of the March US labor market report. The yen is being supported by cautiously optimistic statistics from Japan.

In the current 15-minute technical analysis, the downward trend continues, but there is strong buying interest in the dollar. Support is noted around 151.00, where buying orders are present. On the other hand, resistance is anticipated around 152.00, where there are significant sell orders.

EUR/USD: Strong Sell - Ranging Trend

The EUR/USD pair has retreated from its local high on March 21st and is testing the breakdown at 1.0825. Market participants are awaiting the release of the March statistics on the US labor market today. An increase in non-farm payrolls is expected to slow from 275,000 to 200,000, with the unemployment rate expected to remain unchanged at 3.9%.

GBP/USD: Strong Sell - Ranging Trend

The GBP/USD pair is testing the breakdown at 1.2625, and the release of the US labor market report may prompt a reassessment of the timing of the transition to easing monetary policy in June. UK business activity statistics have failed to meet expert expectations.

NZD/USD: Strong Sell - Ranging Trend

The NZD/USD pair is undergoing a correction after a three-day rally ahead of the release of the March US labor market report. Analysts expect a slowdown in the increase in non-farm payrolls and a slight monthly increase in average hourly earnings, but a decrease on an annual basis.

XAU/USD: Buy - Correction from Highs

The XAU/USD pair is showing a correction from near record highs and testing the support level at 2280.00. Investors are focusing on the March US labor market report, which may clarify the Federal Reserve's plans for expected interest rate cuts in June.