Ray Steve / Profile

Friends

35

Requests

Outgoing

Ray Steve

Rule Changes: SEC and FINRA Looking to Slow High-Speed Traders?

22 December 2014, 09:11

High-frequency trading is the latest craze hitting the market. Popularized by Michael Lewis’s Flash Boys, high-frequency or high-speed trading involves the use of sophisticated technological tools and computer algorithms to rapidly trade securities...

Share on social networks · 4

316

Ray Steve

Apple announced that App Store has added China UnionPay as a payment option for customers. UnionPay is the most popular payment card in China and will provide App Store customers with a simple and more convenient way to purchase their favorite apps...

Share on social networks · 2

221

Ray Steve

Trade Mindfully: Achieve Your Optimum Trading Performance with Mindfulness and "Cutting Edge" Psychology by Gary Dayton Overcome psychological obstacles to increase trading success Successful traders need to be well-versed and skilled in a wide range of business and economic areas...

Share on social networks · 2

265

Ray Steve

Twitter reported slowing user growth setting up that stock to open down 13% the following day. Tuesday Facebook told investors that its costs will rise between 50% and 70% next year — shares opened down 6.6% Wednesday...

Share on social networks · 1

205

Ray Steve

Shares of Facebook have outperformed all other social media stocks

1 November 2014, 06:11

Facebook (FB) is positioned for a jump after earnings this quarter. The set up looks so good, it may be too perfect...

Share on social networks · 11

244

Ray Steve

There are 4 main types of moving averages: Simple moving average Exponential moving average Smoothed moving average Linear weighted moving average...

Share on social networks · 2

393

1

Ray Steve

Future interest rate expectations take precedence over the headline rate If a country has a high interest rate, but no further increases are expected, the currency can still fall...

Share on social networks · 1

141

Ray Steve

There are 17 stocks that have made the “ninth month” one to remember – in a good way

4 September 2014, 12:11

Seeing that there are actually ways to make money in September is an important realization for investors who adhere to the adage, “Sell in May and go away.” September lands during the time of the year some investors start getting fearful of big corrections — or worse...

Share on social networks · 1

168

Ray Steve

DEFINITION OF TREND An uptrend consists of higher highs and higher lows...

Share on social networks · 1

218

Ray Steve

How to Protect Your Photos (Nude or Otherwise) From Hackers on iCloud

2 September 2014, 18:11

Jennifer Lawrence, Kate Upton and Ariana Grande are among the high-profile celebrities who apparently fell victim to a massive alleged iCloud hack late Sunday night, when someone exposed collections of nude photos that they had purportedly saved on their Apple devices...

Share on social networks · 2

281

1

Ray Steve

Since entering the financial markets in 1969, Martin J. Pring has become a leader in the global investor community. He is the chairman of a conservative money management firm, Pring Turner Capital...

Share on social networks · 1

918

Ray Steve

The IMF’s latest international gold reserves data, updated yesterday, shows that in July, Russia raised its official gold reserves to 35.5 million ounces (1,104 tonnes...

Share on social networks · 1

275

Ray Steve

India's economy grew faster-than-expected in the three months to June and at the strongest pace in two years, preliminary figures from the Central Statistics Office revealed Friday. Gross domestic product grew 5.7 percent in the April to June quarter, which exceeded economists' forecast for 5...

Share on social networks · 1

245

Ray Steve

After many years of trading, you’ll be hard pressed to find an indicator as simple or effective as moving averages. Moving averages take a fixed set of data and give you an average price. If the average is moving higher, price is in an uptrend on at least one or possibly multiple time-frames...

Share on social networks · 1

600

Ray Steve

One of the most popular currency trading strategies in recent history, the carry trade has been successfully used by traders for years. With recent market conditions, this very popular strategy is beginning to look like a losing proposition...

Share on social networks · 1

615

Ray Steve

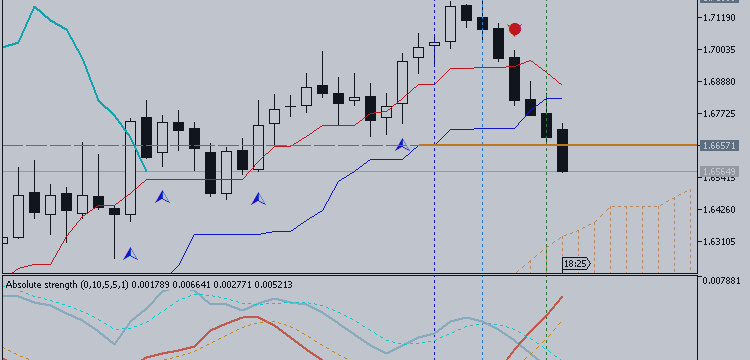

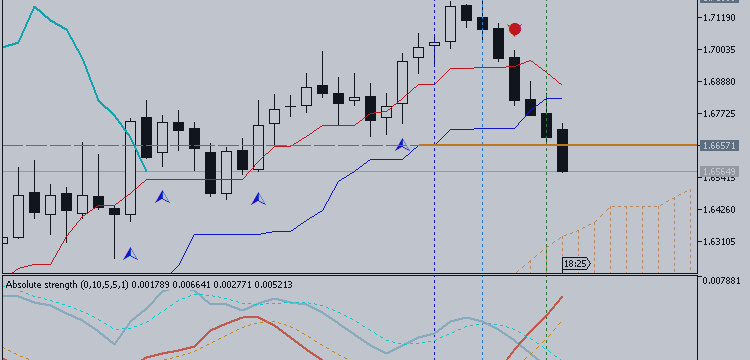

“Of note is a weekly outside reversal and weekly RSI rolling over from above 70 this week. Prior instances of RSI rolling over (2004, 2006, and 2007) from above 70 indicated tops of at least several months.” GBPUSD has traded back to the year open (1.6565). 1.6565 to the March low (1...

Share on social networks · 1

234

Ray Steve

Martin is definitely the most unusual trader. It's not so much his background. Though he did get to work for a while for Sir James Goldsmith, the billionaire corporate raider who was feared in corporate boardrooms on both sides of the Atlantic during the eighties...

Share on social networks · 1

464

Ray Steve

EURGBP Technical Strategy: Flat Support: 0.7973, 0.7954, 0.7935 Resistance:0.8007, 0.8031, 0.8050 The Euro began edging higher against the British Pound as expected after prices produced in a bullish Morning Star candlestick pattern. A pullback now sees prices testing support at 0...

Share on social networks · 1

174

Ray Steve

What can we learn from Warren Buffett, or Warren chooses cash over bonds

21 August 2014, 17:17

Berkshire Hathaway (NYSE:BRK.A) (NYSE:BRK.B) is sitting on $50 billion which is a lot of cash to say the least. That money pile could buy a lot of businesses. He could go out and purchase a few really good companies, outright. But he's not buying much of anything...

Share on social networks · 1

304

Ray Steve

manijeh alizadi ghahveh

Gold extends losing streak on strong dollar

Gold extended losses to a fifth session on Thursday, dropping to a two-week low after the U.S. dollar strengthened on indications from the U.S. Federal Reserve that it could raise interest rates sooner than expected.

A surprisingly strong recovery in the U.S. job market could lead the Fed to raise interest rates earlier than it had been anticipating, minutes from the Fed's July meeting showed, although most officials wanted further evidence before changing their view.

Spot gold hit a two-week low of $1,284.80 an ounce and traded down 0.5 percent on the day at $1,285.81 at 0324 GMT. U.S. gold was down about $8 at $1,287.

"Gold is under pressure because of the stronger dollar," said one precious metals trader. "More data today should test gold's support and it is very likely that gold will go to $1,280 and below."

Read MoreThe other commodity that's leaping on the Ukraine war

Gold failed to move up despite a dip in Asian shares, which came under pressure as a disappointing Chinese manufacturing survey stoked concern about the regional giant.

The U.S. dollar traded at 11-month highs against a basket of major currencies because of the slightly hawkish tone in the U.S. central bank's minutes.

Thursday's data on U.S. weekly jobless claims and euro zone and U.S. manufacturing data should be the next triggers for gold, and markets are also waiting for Fed chair Janet Yellen's comments at the Jackson Hole central bankers' gathering on Friday.

Investors fear that strong data could prompt the Fed to increase rates soon. Higher interest rates would dull the appeal of non-interest-bearing assets such as gold.

Read MoreUkraine's Poroshenko to attend crisis talks with Putin

Meanwhile, SPDR Gold Trust, the world's largest gold-backed exchange-traded fund, said its holdings rose 0.9 ton to 800.09 ton on Wednesday, the third straight daily increase.

Continued violence in Ukraine and the Middle East may be prompting investors to seek safety in gold. Those conflicts have helped push bullion up around 7 percent this year.

Gold extended losses to a fifth session on Thursday, dropping to a two-week low after the U.S. dollar strengthened on indications from the U.S. Federal Reserve that it could raise interest rates sooner than expected.

A surprisingly strong recovery in the U.S. job market could lead the Fed to raise interest rates earlier than it had been anticipating, minutes from the Fed's July meeting showed, although most officials wanted further evidence before changing their view.

Spot gold hit a two-week low of $1,284.80 an ounce and traded down 0.5 percent on the day at $1,285.81 at 0324 GMT. U.S. gold was down about $8 at $1,287.

"Gold is under pressure because of the stronger dollar," said one precious metals trader. "More data today should test gold's support and it is very likely that gold will go to $1,280 and below."

Read MoreThe other commodity that's leaping on the Ukraine war

Gold failed to move up despite a dip in Asian shares, which came under pressure as a disappointing Chinese manufacturing survey stoked concern about the regional giant.

The U.S. dollar traded at 11-month highs against a basket of major currencies because of the slightly hawkish tone in the U.S. central bank's minutes.

Thursday's data on U.S. weekly jobless claims and euro zone and U.S. manufacturing data should be the next triggers for gold, and markets are also waiting for Fed chair Janet Yellen's comments at the Jackson Hole central bankers' gathering on Friday.

Investors fear that strong data could prompt the Fed to increase rates soon. Higher interest rates would dull the appeal of non-interest-bearing assets such as gold.

Read MoreUkraine's Poroshenko to attend crisis talks with Putin

Meanwhile, SPDR Gold Trust, the world's largest gold-backed exchange-traded fund, said its holdings rose 0.9 ton to 800.09 ton on Wednesday, the third straight daily increase.

Continued violence in Ukraine and the Middle East may be prompting investors to seek safety in gold. Those conflicts have helped push bullion up around 7 percent this year.

1

: