Ofir, Collaborative trading from Telegram (Part 2: the Trade Manager)

Continuing on from the first part presenting Ofir Dashboard which allows you to follow your trading from Telegram, this article shows how to trade directly from Ofir through Trade Manager.

Ofir Trade Manager is about:

- Managing open positions (including the ones opened outside Ofir)

- Opening positions

The first important aspect of trade management is defining your Money Management rules, through three parameters:

- Risk per trade : the portion of equity you accept to risk for each trade.

- Reward ratio : your profit target for each trade. This is given as a multiplier of the risk. For example, if your risk per trade is 1%, put 2 if your reward target is 2%

- Risk per day : the portion of equity you accept to risk each day. This value will be used by Ofir to monitor your daily drawdown. For example, if this value is reached, Ofir will alert you and disable any new automatic positions. This can also be used to automatically protect all open positions.

Managing positions

Protect

If you open a position outside Ofir (manually from MT4 or through an EA), protection is immediately activated if the position has no configured Stop Loss. The SL will be automatically placed, following the Risk per Trade parameter. The Take Profit is calculated using the Reward parameter.

Protect works also for Stop and Limit orders.

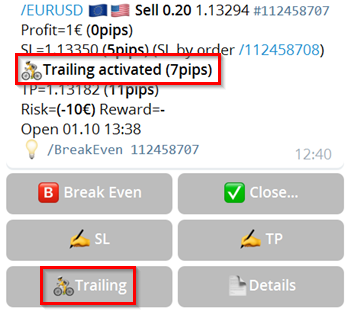

Trailing

Trailing Stop is a very popular feature in MT4 to automatically adjust the Stop Loss when a position becomes profitable. Ofir extends this features in many aspects:

- Managed (on/off) from Telegram

- Activated (or not) by default for each new position

- Start when the position is in profit or at the beginning

- Maintains the distance between the StopLoss and the current price constant. If you change the StopLoss, Ofir will take into account the new distance for trailing

- Can be synchronized among a group of positions

- Real time trailing or only when candle closes. This gives more room to the position to retrace.

The trailing mechanism doesn’t only apply only to StopLoss. It can be used also for pending orders (BUY/SELL STOP/LIMIT)

Hedging

Hedging is an advanced method of managing StopLoss by replacing it by a Stop Order (Sell Stop for a Buy position or Buy Stop for a Sell position). This method will be described later in a dedicated article.

Break Even

Putting a position in Break Even consists of placing the StopLoss at a profit level (Higher than entry price for a Buy Position or Lower than entry price for a Sell Position).

Break Even results from:

- Trailing a position,

- Activated by the user using the position contextual menu

- Activated automatically by Ofir if the parameter “% TP to place Break Even” is used. For example, asking a Break Even if 50% of the TP is reached. The parameter “% close when Break Even” can be used to ask Ofir to partially close the position when Break Even is reached.

Multiple Take Profit

Ofir supports up to 3 TPs for a position. This is achieved by splitting each position into several positions.

Example:

- Initial position: Size=1 Lot, SL=50 pips, TP=100 Ppps

- Parameters:

- TP1=50% of TP, Close 25% of position

- TP2=75% of TP, Close 50% of position

- TP3=100% of TP, Close 25% (remaining lots)

- Ofir splits the position in 3:

- 0.25 Lots, SL=50 pips, TP=50 pips

- 0.50 Lots, SL=50 pips, TP=75 pips

- 0.25 Lots, SL=50 pips, TP=100 pips

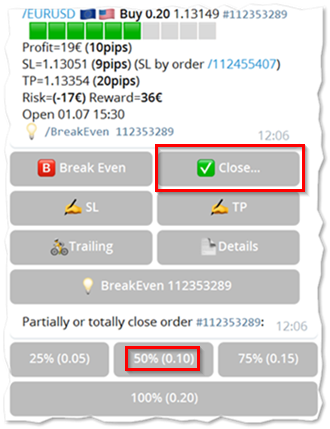

Closing

Ofir allows you to close positions from Telegram by choosing partial close (100%, 75%, 50% or 25%) in the menu or by entering the number of lots to close.

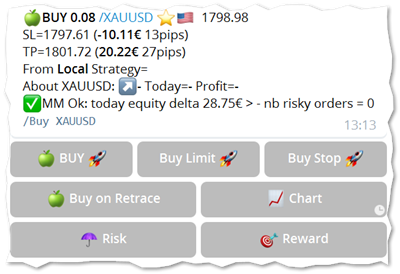

Opening positions

Ofir opens positions in 3 ways:

- Using the option Trade in the main menu

- Typing a command (e.g /BUY EURUSD 1.1392 SL=1.138 TP=1.4105)

- In response to a signal sent by an indicator, a channel, a partner (in Collaborative trading) or an alarm.

Trading from the menu

In Ofir's main menu (or in the symbol contextual menu), press on Trade.

- Select the symbol. The Symbol menu displays the trend for each symbol (Bullish or Bearish).

- Then select operation (Buy or Sell).

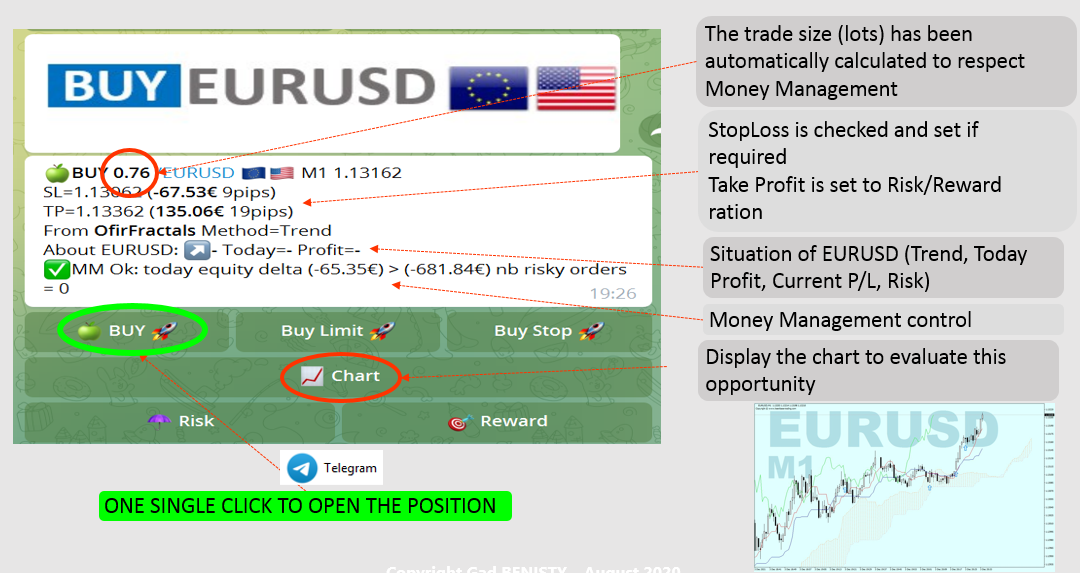

Ofir prepares a new entry with the appropriate size (lots), SL and TP, taking into account your Money Management (risk per trade, reward).

Decision-making support: Ofir show the status of the selected symbol (trend, daily equity change, PnL, nb of open lots, nb of opened risky positions

At this stage you can press the Buy/Sell buttons:

- Buy/Sell : to open the position at market price

- Buy/Sell Limit : to open a Buy Limit or Sell Limit position. This position will be shifted using the SL pips

- Buy/Sell Stop : to open a Buy Stop or Sell Stop position. This position will be shifted using the SL pips

- Buy/Sell on retrace : this is an Ofir-exclusive feature which is as an alternative to pending orders. Ofir will create a task to open the position when the price retraces

By pressing the Chart button, Ofir displays the screenshot of this position. This screenshot can be tailored to your needs by adding your preferred indicators.

Risk (SL) and Reward (TP) can be changed, before pressing the Buy/Sell button to open the position.

Trading by typing commands

Ofir has also a Command-Line interface to be used for advanced functions (or for old school users), for sharing actions with other traders or for enabling other applications to be integrated with Ofir (this will be detailed in a future article about Ofir Integration).

The Ofir command set is fully described in the user manual.

Let’s see some examples:

| Command | Action |

|---|---|

| /SELL XAUUSD 1793.91 SL=1799.9 TP=1783.4 | Open a Sell position for XUAUSD at 1793.91 , with the given SL and TP. If, meanwhile, the market price has changed, the position will be adjusted to the new market price |

| /SELL XAUUSD SL=50 TP=100 | Open a Sell Position for XAUUSD at market price, SL and TP are recognized as pips value (instead of price) |

| /SELL XAUUSD SL=MAX10 | Open a Sell Position for XAUUSD at market price, SL is set to the maximum distance of the last 10 closing candles. TP will be calculated using the SL and the reward parameters |

| /SELL XAUUSD SL=30 TP=R2 | Open a Sell Position for XAUUSD at market price, SL is set to 30 pips. TP is set to the R2 resistance value in Pivot method. TP=R should set TP to the next Rn value |

| /CLOSE 12817271 0.03 | Close the position #12817271. If lots (0.03) is entered, it will be a partial close. |

| /12817271 BREAKEVEN | Put the position #12817271 in Break Even. |

| /12817271 TRAILING ON/OFF | Trailing activated (or inactivated) for position #12817271. |

Trading in response to a signal

As seen before, trading can be initiated by the user, with the Telegram menu or by entering commands.

Trading can also be initiated by other sources and pushed to the user:

- Signals from Indicators

- Signals from Telegram Channels

- Signals from other traders when Ofir becomes Collaborative

A signal received by Ofir is parsed and presented as a “Ready to click” position.

In the next article, we will give more details about trading with signals:

- How to define a specific trading strategy for a signal (e.g changing the risk rate or activating features only for this signal)

- How to automatically open positions when you receive a signal by giving credence to the signal

- How to connect Ofir to a Telegram Channel in order to receive signals

- How to integrate your indicators as signal providers in Ofir

- How to share signals with other traders (collaborative trading)

Thanks for reading

You can contact me on Telegram @GadBen75 if you need more information or are interested in joining the Ofir Early Adopters Group