Triangular arbitrage with predictions

Introduction

This article is about the triangular arbitrage strategy, it has an example of two triangular arbitrages, and this is done with deep learning models, which are added to the downloads, and a EA which is also added to the downloads. Triangular arbitrage leverages discrepancies in exchange rates to generate risk-free profits.

What is triangular arbitrage?

Arbitrage is very curious, it's been prohibited from the bookies of sports betting. Imagine you have some winning odds of 1.25 for Real Madrid to win the champions 2024, and Borussia Dortmund has 3.60 odds, that means Madrid has 100/1.25 = 80 % of probabilities to win and Borussia 27.7 % to win. If you add those two, you have 107.7%, that is because bookies want to win money and that over 100 % is their commission. But, imagine you find Bookie number 2 and hey offer odds for Borussia of 19% probabilities to win, odds of 5.26. Then you could bet in Bookie number 1 to Real Madrid and Bookie number 2 for Borussia, and if you bet the appropriate quantity to each team, you will win money in the game, because both add less than 100%. This is a simple way to explain why its prohibited in sports betting and what is arbitrage.

Imagine you are a "legal" person and you don't want to have your sports account closed by doing arbitrage, you know that even if you bet for Madrid, you could do "legal" arbitrage if you waited for minute 70' of the game if draw or wait to Real Madrid to score to have those odds for Borussia and have a win win... this seams a bit risky, but here is where we can take advantage of Deep Learning, we know Real Madrid is gonna score, so you are gonna have those odds with a 98 % of probabilities (we know this with cointegration between the predictions and the real values). This is what's new with Deep Learning and Arbitrage.

So, now that we know what is arbitrage and how we win more with help of Deep Learning, what is triangular arbitrage? well, its the same as arbitrage, but using three pairs. Why? because it's used in forex and cryptos, why? because forex and cryptos use this formula for a symbol A / B, and if you have to solve this you need three equations (A / B ) * (B/C) * (C/A), so when this is >1 you multiply the right way, and when <1 the left way.

Why can or can't you do triangular arbitrage with all accounts?

If you have a zero spread account, the triangular arbitrage would be done in one second or less. If you have spread, it's impossible to beat the spread in such times. But, as I said before, don't worry, this EA is really profitable in both ways. My account is not zero spread, so this article will have an example with spreads.

What do we need for this EA?

This EA uses predictions made in python to ONNX models to use them in MT5 EA's. This is why I'm going to go over the whole process to keep sure every can use this EA. If you know how to make an ONNX model, you can skip to the EA.

You will have to install for your first time:

- Python 3.10

You can find this in Microsoft's Store, just click install.

- Visual Studio Code

You can find this in Microsoft's Store, just click install, and it will do everything for you.

After this, you need to install Visual Studio 2019 or C++ from here (it will be asked to be installed with one library of python):

https://learn.microsoft.com/en-US/cpp/windows/latest-supported-vc-redist?view=msvc-170#visual-studio-2015-2017-2019-and-2022 Once this is done, you have to add the python scritps folder to the path variables.

You must also add ".py" to the PATHEXT.

Once all this is done, we can now install the libraries, like this.

Open VSC -> Terminal -> New Terminal

VSC might ask you to install python extensions (just click 0k).

and just copy past this (and press Enter):

pip install MetaTrader5==5.0.4200 pip install pandas==2.2.1 pip install scipy==1.12.0 pip install statsmodels==0.14.1 pip install numpy==1.26.4 pip install tensorflow==2.15.0 pip install tf2onnx==1.16.1 pip install scikit-learn==1.4.1.post1 pip install keras==2.15.0 pip install matplotlib==3.8.3

Should be no errors, if not, you can ask here.

Once this is all installed and have had no errors, we can proceed to the .py testing model. I will copy paste this example:

# python libraries import MetaTrader5 as mt5 import tensorflow as tf import numpy as np import pandas as pd import tf2onnx from datetime import timedelta, datetime # input parameters symbol1 = "EURGBP" symbol2 = "GBPUSD" symbol3 = "EURUSD" sample_size1 = 200000 optional = "_M1_test" timeframe = mt5.TIMEFRAME_M1 #end_date = datetime.now() end_date = datetime(2024, 3, 4, 0) inp_history_size = 120 sample_size = sample_size1 symbol = symbol1 optional = optional inp_model_name = str(symbol)+"_"+str(optional)+".onnx" if not mt5.initialize(): print("initialize() failed, error code =",mt5.last_error()) quit() # we will save generated onnx-file near the our script to use as resource from sys import argv data_path=argv[0] last_index=data_path.rfind("\\")+1 data_path=data_path[0:last_index] print("data path to save onnx model",data_path) # and save to MQL5\Files folder to use as file terminal_info=mt5.terminal_info() file_path=terminal_info.data_path+"\\MQL5\\Files\\" print("file path to save onnx model",file_path) # set start and end dates for history data #end_date = datetime.now() #end_date = datetime(2024, 5, 1, 0) start_date = end_date - timedelta(days=inp_history_size*20) # print start and end dates print("data start date =",start_date) print("data end date =",end_date) # get rates eurusd_rates = mt5.copy_rates_from(symbol, timeframe , end_date, sample_size ) # create dataframe df=pd.DataFrame() df = pd.DataFrame(eurusd_rates) print(df) # Extraer los precios de cierre directamente datas = df['close'].values """# Calcular la inversa de cada valor inverted_data = 1 / datas # Convertir los datos invertidos a un array de numpy si es necesario data = inverted_data.values""" data = datas.reshape(-1,1) # Imprimir los resultados """data = datas""" # scale data from sklearn.preprocessing import MinMaxScaler scaler=MinMaxScaler(feature_range=(0,1)) scaled_data = scaler.fit_transform(data) # training size is 80% of the data training_size = int(len(scaled_data)*0.80) print("Training_size:",training_size) train_data_initial = scaled_data[0:training_size,:] test_data_initial = scaled_data[training_size:,:1] # split a univariate sequence into samples def split_sequence(sequence, n_steps): X, y = list(), list() for i in range(len(sequence)): # find the end of this pattern end_ix = i + n_steps # check if we are beyond the sequence if end_ix > len(sequence)-1: break # gather input and output parts of the pattern seq_x, seq_y = sequence[i:end_ix], sequence[end_ix] X.append(seq_x) y.append(seq_y) return np.array(X), np.array(y) # split into samples time_step = inp_history_size x_train, y_train = split_sequence(train_data_initial, time_step) x_test, y_test = split_sequence(test_data_initial, time_step) # reshape input to be [samples, time steps, features] which is required for LSTM x_train =x_train.reshape(x_train.shape[0],x_train.shape[1],1) x_test = x_test.reshape(x_test.shape[0],x_test.shape[1],1) # define model from keras.models import Sequential from keras.layers import Dense, Activation, Conv1D, MaxPooling1D, Dropout, Flatten, LSTM from keras.metrics import RootMeanSquaredError as rmse from tensorflow.keras import callbacks model = Sequential() model.add(Conv1D(filters=256, kernel_size=2, activation='relu',padding = 'same',input_shape=(inp_history_size,1))) model.add(MaxPooling1D(pool_size=2)) model.add(LSTM(100, return_sequences = True)) model.add(Dropout(0.3)) model.add(LSTM(100, return_sequences = False)) model.add(Dropout(0.3)) model.add(Dense(units=1, activation = 'sigmoid')) model.compile(optimizer='adam', loss= 'mse' , metrics = [rmse()]) # Set up early stopping early_stopping = callbacks.EarlyStopping( monitor='val_loss', patience=5, restore_best_weights=True, ) # model training for 300 epochs history = model.fit(x_train, y_train, epochs = 300 , validation_data = (x_test,y_test), batch_size=32, callbacks=[early_stopping], verbose=2) # evaluate training data train_loss, train_rmse = model.evaluate(x_train,y_train, batch_size = 32) print(f"train_loss={train_loss:.3f}") print(f"train_rmse={train_rmse:.3f}") # evaluate testing data test_loss, test_rmse = model.evaluate(x_test,y_test, batch_size = 32) print(f"test_loss={test_loss:.3f}") print(f"test_rmse={test_rmse:.3f}") # save model to ONNX output_path = data_path+inp_model_name onnx_model = tf2onnx.convert.from_keras(model, output_path=output_path) print(f"saved model to {output_path}") output_path = file_path+inp_model_name onnx_model = tf2onnx.convert.from_keras(model, output_path=output_path) print(f"saved model to {output_path}") # finish mt5.shutdown() #prediction using testing data #prediction using testing data test_predict = model.predict(x_test) print(test_predict) print("longitud total de la prediccion: ", len(test_predict)) print("longitud total del sample: ", sample_size) plot_y_test = np.array(y_test).reshape(-1, 1) # Selecciona solo el último elemento de cada muestra de prueba plot_y_train = y_train.reshape(-1,1) train_predict = model.predict(x_train) #print(plot_y_test) #calculate metrics from sklearn import metrics from sklearn.metrics import r2_score #transform data to real values value1=scaler.inverse_transform(plot_y_test) #print(value1) # Escala las predicciones inversas al transformarlas a la escala original value2 = scaler.inverse_transform(test_predict.reshape(-1, 1)) #print(value2) #calc score score = np.sqrt(metrics.mean_squared_error(value1,value2)) print("RMSE : {}".format(score)) print("MSE :", metrics.mean_squared_error(value1,value2)) print("R2 score :",metrics.r2_score(value1,value2)) #sumarize model model.summary() #Print error value11=pd.DataFrame(value1) value22=pd.DataFrame(value2) #print(value11) #print(value22) value111=value11.iloc[:,:] value222=value22.iloc[:,:] print("longitud salida (tandas de 1 minuto): ",len(value111) ) #print("en horas son " + str((len(value111))*60*24)+ " minutos") print("en horas son " + str(((len(value111)))/60)+ " horas") print("en horas son " + str(((len(value111)))/60/24)+ " dias") # Calculate error error = value111 - value222 import matplotlib.pyplot as plt # Plot error plt.figure(figsize=(10, 6)) plt.scatter(range(len(error)), error, color='blue', label='Error') plt.axhline(y=0, color='red', linestyle='--', linewidth=1) # Línea horizontal en y=0 plt.title('Error de Predicción ' + str(symbol)) plt.xlabel('Índice de la muestra') plt.ylabel('Error') plt.legend() plt.grid(True) plt.savefig(str(symbol)+str(optional)+'.png') rmse_ = format(score) mse_ = metrics.mean_squared_error(value1,value2) r2_ = metrics.r2_score(value1,value2) resultados= [rmse_,mse_,r2_] # Abre un archivo en modo escritura with open(str(symbol)+str(optional)+"results.txt", "w") as archivo: # Escribe cada resultado en una línea separada for resultado in resultados: archivo.write(str(resultado) + "\n") # finish mt5.shutdown() #show iteration-rmse graph for training and validation plt.figure(figsize = (18,10)) plt.plot(history.history['root_mean_squared_error'],label='Training RMSE',color='b') plt.plot(history.history['val_root_mean_squared_error'],label='Validation-RMSE',color='g') plt.xlabel("Iteration") plt.ylabel("RMSE") plt.title("RMSE" + str(symbol)) plt.legend() plt.savefig(str(symbol)+str(optional)+'1.png') #show iteration-loss graph for training and validation plt.figure(figsize = (18,10)) plt.plot(history.history['loss'],label='Training Loss',color='b') plt.plot(history.history['val_loss'],label='Validation-loss',color='g') plt.xlabel("Iteration") plt.ylabel("Loss") plt.title("LOSS" + str(symbol)) plt.legend() plt.savefig(str(symbol)+str(optional)+'2.png') #show actual vs predicted (training) graph plt.figure(figsize=(18,10)) plt.plot(scaler.inverse_transform(plot_y_train),color = 'b', label = 'Original') plt.plot(scaler.inverse_transform(train_predict),color='red', label = 'Predicted') plt.title("Prediction Graph Using Training Data" + str(symbol)) plt.xlabel("Hours") plt.ylabel("Price") plt.legend() plt.savefig(str(symbol)+str(optional)+'3.png') #show actual vs predicted (testing) graph plt.figure(figsize=(18,10)) plt.plot(scaler.inverse_transform(plot_y_test),color = 'b', label = 'Original') plt.plot(scaler.inverse_transform(test_predict),color='g', label = 'Predicted') plt.title("Prediction Graph Using Testing Data" + str(symbol)) plt.xlabel("Hours") plt.ylabel("Price") plt.legend() plt.savefig(str(symbol)+str(optional)+'4.png') ################################################################################################ EURJPY 1 # python libraries import MetaTrader5 as mt5 import tensorflow as tf import numpy as np import pandas as pd import tf2onnx # input parameters inp_history_size = 120 sample_size = sample_size1 symbol = symbol2 optional = optional inp_model_name = str(symbol)+"_"+str(optional)+".onnx" if not mt5.initialize(): print("initialize() failed, error code =",mt5.last_error()) quit() # we will save generated onnx-file near the our script to use as resource from sys import argv data_path=argv[0] last_index=data_path.rfind("\\")+1 data_path=data_path[0:last_index] print("data path to save onnx model",data_path) # and save to MQL5\Files folder to use as file terminal_info=mt5.terminal_info() file_path=terminal_info.data_path+"\\MQL5\\Files\\" print("file path to save onnx model",file_path) # set start and end dates for history data from datetime import timedelta, datetime #end_date = datetime.now() #end_date = datetime(2024, 5, 1, 0) start_date = end_date - timedelta(days=inp_history_size*20) # print start and end dates print("data start date =",start_date) print("data end date =",end_date) # get rates eurusd_rates2 = mt5.copy_rates_from(symbol, timeframe , end_date, sample_size) # create dataframe df=pd.DataFrame() df2 = pd.DataFrame(eurusd_rates2) print(df2) # Extraer los precios de cierre directamente datas2 = df2['close'].values """inverted_data = 1 / datas # Convertir los datos invertidos a un array de numpy si es necesario data = inverted_data.values""" data2 = datas2.reshape(-1,1) # Convertir los datos invertidos a un array de numpy si es necesario #data = datas.values # Imprimir los resultados # scale data from sklearn.preprocessing import MinMaxScaler scaler2=MinMaxScaler(feature_range=(0,1)) scaled_data2 = scaler2.fit_transform(data2) # training size is 80% of the data training_size2 = int(len(scaled_data2)*0.80) print("Training_size:",training_size2) train_data_initial2 = scaled_data2[0:training_size2,:] test_data_initial2 = scaled_data2[training_size2:,:1] # split a univariate sequence into samples def split_sequence(sequence, n_steps): X, y = list(), list() for i in range(len(sequence)): # find the end of this pattern end_ix = i + n_steps # check if we are beyond the sequence if end_ix > len(sequence)-1: break # gather input and output parts of the pattern seq_x, seq_y = sequence[i:end_ix], sequence[end_ix] X.append(seq_x) y.append(seq_y) return np.array(X), np.array(y) # split into samples time_step = inp_history_size x_train2, y_train2 = split_sequence(train_data_initial2, time_step) x_test2, y_test2 = split_sequence(test_data_initial2, time_step) # reshape input to be [samples, time steps, features] which is required for LSTM x_train2 =x_train2.reshape(x_train2.shape[0],x_train2.shape[1],1) x_test2 = x_test2.reshape(x_test2.shape[0],x_test2.shape[1],1) # define model from keras.models import Sequential from keras.layers import Dense, Activation, Conv1D, MaxPooling1D, Dropout, Flatten, LSTM from keras.metrics import RootMeanSquaredError as rmse from tensorflow.keras import callbacks model = Sequential() model.add(Conv1D(filters=256, kernel_size=2, activation='relu',padding = 'same',input_shape=(inp_history_size,1))) model.add(MaxPooling1D(pool_size=2)) model.add(LSTM(100, return_sequences = True)) model.add(Dropout(0.3)) model.add(LSTM(100, return_sequences = False)) model.add(Dropout(0.3)) model.add(Dense(units=1, activation = 'sigmoid')) model.compile(optimizer='adam', loss= 'mse' , metrics = [rmse()]) # Set up early stopping early_stopping = callbacks.EarlyStopping( monitor='val_loss', patience=5, restore_best_weights=True, ) # model training for 300 epochs history2 = model.fit(x_train2, y_train2, epochs = 300 , validation_data = (x_test2,y_test2), batch_size=32, callbacks=[early_stopping], verbose=2) # evaluate training data train_loss2, train_rmse2 = model.evaluate(x_train2,y_train2, batch_size = 32) print(f"train_loss={train_loss2:.3f}") print(f"train_rmse={train_rmse2:.3f}") # evaluate testing data test_loss2, test_rmse2 = model.evaluate(x_test2,y_test2, batch_size = 32) print(f"test_loss={test_loss2:.3f}") print(f"test_rmse={test_rmse2:.3f}") # save model to ONNX output_path = data_path+inp_model_name onnx_model = tf2onnx.convert.from_keras(model, output_path=output_path) print(f"saved model to {output_path}") output_path = file_path+inp_model_name onnx_model = tf2onnx.convert.from_keras(model, output_path=output_path) print(f"saved model to {output_path}") # finish mt5.shutdown() #prediction using testing data #prediction using testing data test_predict2 = model.predict(x_test2) print(test_predict2) print("longitud total de la prediccion: ", len(test_predict2)) print("longitud total del sample: ", sample_size) plot_y_test2 = np.array(y_test2).reshape(-1, 1) # Selecciona solo el último elemento de cada muestra de prueba plot_y_train2 = y_train2.reshape(-1,1) train_predict2 = model.predict(x_train2) #print(plot_y_test) #calculate metrics from sklearn import metrics from sklearn.metrics import r2_score #transform data to real values value12=scaler2.inverse_transform(plot_y_test2) #print(value1) # Escala las predicciones inversas al transformarlas a la escala original value22 = scaler2.inverse_transform(test_predict2.reshape(-1, 1)) #print(value2) #calc score score2 = np.sqrt(metrics.mean_squared_error(value12,value22)) print("RMSE : {}".format(score2)) print("MSE :", metrics.mean_squared_error(value12,value22)) print("R2 score :",metrics.r2_score(value12,value22)) #sumarize model model.summary() #Print error value112=pd.DataFrame(value12) value222=pd.DataFrame(value22) #print(value11) #print(value22) value1112=value112.iloc[:,:] value2222=value222.iloc[:,:] print("longitud salida (tandas de 1 min): ",len(value1112) ) #print("en horas son " + str((len(value1112))*60*24)+ " minutos") print("en horas son " + str(((len(value1112)))/60)+ " horas") print("en horas son " + str(((len(value1112)))/60/24)+ " dias") # Calculate error error2 = value1112 - value2222 import matplotlib.pyplot as plt # Plot error plt.figure(figsize=(10, 6)) plt.scatter(range(len(error2)), error2, color='blue', label='Error') plt.axhline(y=0, color='red', linestyle='--', linewidth=1) # Línea horizontal en y=0 plt.title('Error de Predicción ' + str(symbol)) plt.xlabel('Índice de la muestra') plt.ylabel('Error') plt.legend() plt.grid(True) plt.savefig(str(symbol)+str(optional)+'.png') rmse_2 = format(score2) mse_2 = metrics.mean_squared_error(value12,value22) r2_2 = metrics.r2_score(value12,value22) resultados2= [rmse_2,mse_2,r2_2] # Abre un archivo en modo escritura with open(str(symbol)+str(optional)+"results.txt", "w") as archivo: # Escribe cada resultado en una línea separada for resultado in resultados2: archivo.write(str(resultado) + "\n") # finish mt5.shutdown() #show iteration-rmse graph for training and validation plt.figure(figsize = (18,10)) plt.plot(history2.history['root_mean_squared_error'],label='Training RMSE',color='b') plt.plot(history2.history['val_root_mean_squared_error'],label='Validation-RMSE',color='g') plt.xlabel("Iteration") plt.ylabel("RMSE") plt.title("RMSE" + str(symbol)) plt.legend() plt.savefig(str(symbol)+str(optional)+'1.png') #show iteration-loss graph for training and validation plt.figure(figsize = (18,10)) plt.plot(history2.history['loss'],label='Training Loss',color='b') plt.plot(history2.history['val_loss'],label='Validation-loss',color='g') plt.xlabel("Iteration") plt.ylabel("Loss") plt.title("LOSS" + str(symbol)) plt.legend() plt.savefig(str(symbol)+str(optional)+'2.png') #show actual vs predicted (training) graph plt.figure(figsize=(18,10)) plt.plot(scaler2.inverse_transform(plot_y_train2),color = 'b', label = 'Original') plt.plot(scaler2.inverse_transform(train_predict2),color='red', label = 'Predicted') plt.title("Prediction Graph Using Training Data" + str(symbol)) plt.xlabel("Hours") plt.ylabel("Price") plt.legend() plt.savefig(str(symbol)+str(optional)+'3.png') #show actual vs predicted (testing) graph plt.figure(figsize=(18,10)) plt.plot(scaler2.inverse_transform(plot_y_test2),color = 'b', label = 'Original') plt.plot(scaler2.inverse_transform(test_predict2),color='g', label = 'Predicted') plt.title("Prediction Graph Using Testing Data" + str(symbol)) plt.xlabel("Hours") plt.ylabel("Price") plt.legend() plt.savefig(str(symbol)+str(optional)+'4.png') ############################################################################################## JPYUSD # python libraries import MetaTrader5 as mt5 import tensorflow as tf import numpy as np import pandas as pd import tf2onnx # input parameters inp_history_size = 120 sample_size = sample_size1 symbol = symbol3 optional = optional inp_model_name = str(symbol)+"_"+str(optional)+".onnx" if not mt5.initialize(): print("initialize() failed, error code =",mt5.last_error()) quit() # we will save generated onnx-file near the our script to use as resource from sys import argv data_path=argv[0] last_index=data_path.rfind("\\")+1 data_path=data_path[0:last_index] print("data path to save onnx model",data_path) # and save to MQL5\Files folder to use as file terminal_info=mt5.terminal_info() file_path=terminal_info.data_path+"\\MQL5\\Files\\" print("file path to save onnx model",file_path) # set start and end dates for history data from datetime import timedelta, datetime #end_date = datetime.now() #end_date = datetime(2024, 5, 1, 0) start_date = end_date - timedelta(days=inp_history_size*20) # print start and end dates print("data start date =",start_date) print("data end date =",end_date) # get rates eurusd_rates3 = mt5.copy_rates_from(symbol, timeframe , end_date, sample_size) # create dataframe df3=pd.DataFrame() df3 = pd.DataFrame(eurusd_rates3) print(df3) # Extraer los precios de cierre directamente datas3 = df3['close'].values """# Calcular la inversa de cada valor inverted_data = 1 / datas # Convertir los datos invertidos a un array de numpy si es necesario data = inverted_data.values""" data3 = datas3.reshape(-1,1) # Imprimir los resultados """data = datas""" # scale data from sklearn.preprocessing import MinMaxScaler scaler3=MinMaxScaler(feature_range=(0,1)) scaled_data3 = scaler3.fit_transform(data3) # training size is 80% of the data training_size3 = int(len(scaled_data3)*0.80) print("Training_size:",training_size3) train_data_initial3 = scaled_data3[0:training_size3,:] test_data_initial3 = scaled_data3[training_size3:,:1] # split a univariate sequence into samples def split_sequence(sequence, n_steps): X, y = list(), list() for i in range(len(sequence)): # find the end of this pattern end_ix = i + n_steps # check if we are beyond the sequence if end_ix > len(sequence)-1: break # gather input and output parts of the pattern seq_x, seq_y = sequence[i:end_ix], sequence[end_ix] X.append(seq_x) y.append(seq_y) return np.array(X), np.array(y) # split into samples time_step = inp_history_size x_train3, y_train3 = split_sequence(train_data_initial3, time_step) x_test3, y_test3 = split_sequence(test_data_initial3, time_step) # reshape input to be [samples, time steps, features] which is required for LSTM x_train3 =x_train3.reshape(x_train3.shape[0],x_train3.shape[1],1) x_test3 = x_test3.reshape(x_test3.shape[0],x_test3.shape[1],1) # define model from keras.models import Sequential from keras.layers import Dense, Activation, Conv1D, MaxPooling1D, Dropout, Flatten, LSTM from keras.metrics import RootMeanSquaredError as rmse from tensorflow.keras import callbacks model = Sequential() model.add(Conv1D(filters=256, kernel_size=2, activation='relu',padding = 'same',input_shape=(inp_history_size,1))) model.add(MaxPooling1D(pool_size=2)) model.add(LSTM(100, return_sequences = True)) model.add(Dropout(0.3)) model.add(LSTM(100, return_sequences = False)) model.add(Dropout(0.3)) model.add(Dense(units=1, activation = 'sigmoid')) model.compile(optimizer='adam', loss= 'mse' , metrics = [rmse()]) # Set up early stopping early_stopping = callbacks.EarlyStopping( monitor='val_loss', patience=5, restore_best_weights=True, ) # model training for 300 epochs history3 = model.fit(x_train3, y_train3, epochs = 300 , validation_data = (x_test3,y_test3), batch_size=32, callbacks=[early_stopping], verbose=2) # evaluate training data train_loss3, train_rmse3 = model.evaluate(x_train3,y_train3, batch_size = 32) print(f"train_loss={train_loss3:.3f}") print(f"train_rmse={train_rmse3:.3f}") # evaluate testing data test_loss3, test_rmse3 = model.evaluate(x_test3,y_test3, batch_size = 32) print(f"test_loss={test_loss3:.3f}") print(f"test_rmse={test_rmse3:.3f}") # save model to ONNX output_path = data_path+inp_model_name onnx_model = tf2onnx.convert.from_keras(model, output_path=output_path) print(f"saved model to {output_path}") output_path = file_path+inp_model_name onnx_model = tf2onnx.convert.from_keras(model, output_path=output_path) print(f"saved model to {output_path}") # finish mt5.shutdown() #prediction using testing data #prediction using testing data test_predict3 = model.predict(x_test3) print(test_predict3) print("longitud total de la prediccion: ", len(test_predict3)) print("longitud total del sample: ", sample_size) plot_y_test3 = np.array(y_test3).reshape(-1, 1) # Selecciona solo el último elemento de cada muestra de prueba plot_y_train3 = y_train3.reshape(-1,1) train_predict3 = model.predict(x_train3) #print(plot_y_test) #calculate metrics from sklearn import metrics from sklearn.metrics import r2_score #transform data to real values value13=scaler3.inverse_transform(plot_y_test3) #print(value1) # Escala las predicciones inversas al transformarlas a la escala original value23 = scaler3.inverse_transform(test_predict3.reshape(-1, 1)) #print(value2) #calc score score3 = np.sqrt(metrics.mean_squared_error(value13,value23)) print("RMSE : {}".format(score3)) print("MSE :", metrics.mean_squared_error(value13,value23)) print("R2 score :",metrics.r2_score(value13,value23)) #sumarize model model.summary() #Print error value113=pd.DataFrame(value13) value223=pd.DataFrame(value23) #print(value11) #print(value22) value1113=value113.iloc[:,:] value2223=value223.iloc[:,:] print("longitud salida (tandas de 1 hora): ",len(value1113) ) #print("en horas son " + str((len(value1113))*60*24)+ " minutos") print("en horas son " + str(((len(value1113)))/60)+ " horas") print("en horas son " + str(((len(value1113)))/60/24)+ " dias") # Calculate error error3 = value1113 - value2223 import matplotlib.pyplot as plt # Plot error plt.figure(figsize=(10, 6)) plt.scatter(range(len(error3)), error3, color='blue', label='Error') plt.axhline(y=0, color='red', linestyle='--', linewidth=1) # Línea horizontal en y=0 plt.title('Error de Predicción ' + str(symbol)) plt.xlabel('Índice de la muestra') plt.ylabel('Error') plt.legend() plt.grid(True) plt.savefig(str(symbol)+str(optional)+'.png') rmse_3 = format(score3) mse_3 = metrics.mean_squared_error(value13,value23) r2_3 = metrics.r2_score(value13,value23) resultados3= [rmse_3,mse_3,r2_3] # Abre un archivo en modo escritura with open(str(symbol)+str(optional)+"results.txt", "w") as archivo: # Escribe cada resultado en una línea separada for resultado in resultados3: archivo.write(str(resultado) + "\n") # finish mt5.shutdown() #show iteration-rmse graph for training and validation plt.figure(figsize = (18,10)) plt.plot(history3.history['root_mean_squared_error'],label='Training RMSE',color='b') plt.plot(history3.history['val_root_mean_squared_error'],label='Validation-RMSE',color='g') plt.xlabel("Iteration") plt.ylabel("RMSE") plt.title("RMSE" + str(symbol)) plt.legend() plt.savefig(str(symbol)+str(optional)+'1.png') #show iteration-loss graph for training and validation plt.figure(figsize = (18,10)) plt.plot(history3.history['loss'],label='Training Loss',color='b') plt.plot(history3.history['val_loss'],label='Validation-loss',color='g') plt.xlabel("Iteration") plt.ylabel("Loss") plt.title("LOSS" + str(symbol)) plt.legend() plt.savefig(str(symbol)+str(optional)+'2.png') #show actual vs predicted (training) graph plt.figure(figsize=(18,10)) plt.plot(scaler3.inverse_transform(plot_y_train3),color = 'b', label = 'Original') plt.plot(scaler3.inverse_transform(train_predict3),color='red', label = 'Predicted') plt.title("Prediction Graph Using Training Data" + str(symbol)) plt.xlabel("Hours") plt.ylabel("Price") plt.legend() plt.savefig(str(symbol)+str(optional)+'3.png') #show actual vs predicted (testing) graph plt.figure(figsize=(18,10)) plt.plot(scaler3.inverse_transform(plot_y_test3),color = 'b', label = 'Original') plt.plot(scaler3.inverse_transform(test_predict3),color='g', label = 'Predicted') plt.title("Prediction Graph Using Testing Data" + str(symbol)) plt.xlabel("Hours") plt.ylabel("Price") plt.legend() plt.savefig(str(symbol)+str(optional)+'4.png') ################################################################################################ ############################################################################################## """ import onnxruntime as ort import numpy as np # Cargar el modelo ONNX sesion = ort.InferenceSession("EURUSD_M1_inverse_test.onnx") # Obtener el nombre de la entrada y la salida del modelo input_name = sesion.get_inputs()[0].name output_name = sesion.get_outputs()[0].name # Crear datos de entrada de prueba como un array de numpy # Asegúrate de que los datos de entrada coincidan con la forma y el tipo esperado por el modelo input_data = [1,120] #np.random.rand(1, 10).astype(np.float32) # Ejemplo: entrada de tamaño [1, 10] # Realizar la inferencia result = sesion.run([output_name], {input_name: input_data}) # Imprimir el resultado print(result) """

This .py will make three ONNX and also some graphs and data so you can check if everything is all right.

The data comes in a txt file, and each number stands for RMSE, MSE and R2 respectively.

Before running this script, you must specify the symbols, sample size, timeframe, and ending date (from to count backwards periods).

The optional variable, is a string where you can add something like M1 Ticks or the end_date ... whatever you whant to save the onnx files and the graphs and data.

symbol1 = "EURGBP" symbol2 = "GBPUSD" symbol3 = "EURUSD" sample_size1 = 200000 optional = "_M1_test" timeframe = mt5.TIMEFRAME_M1 #end_date = datetime.now() end_date = datetime(2024, 3, 4, 0)

If you want to test in the strategy tester, modify the date as you want. If you want to trade, you just have to use this end_date.

end_date = datetime.now() *** If you are trading in a non spread account, you can try using ticks instead of periods, you just have to change: ***

eurusd_rates = mt5.copy_rates_from(symbol, timeframe , end_date, sample_size)

with this one:

eurusd_rates = mt5.copy_ticks_from(symbol, end_date, sample_size, mt5.COPY_TICKS_ALL)

where you will have Bid and Ask ticks. I think there is a limitation of number of ticks, If you need more ticks, you can download all ticks from a symbol with this: Download all data from a symbol that is free.

To run the .py file, just open it with VSC and hit RUN -> Run Without Debugging (while having MT5 opened).

and just wait it to finish.

You will end up with a bunch of graphs, txt's and ONNX files. You have to save the ONNX file in the MQL5/Files folder, and specify the same path in the EA code.

If will still do that job thanks to this line:

# and save to MQL5\Files folder to use as file terminal_info=mt5.terminal_info() file_path=terminal_info.data_path+"\\MQL5\\Files\\" print("file path to save onnx model",file_path)

But its important, that if you want to have many ONNX files, and you have them inside other folders, you must specify the path.

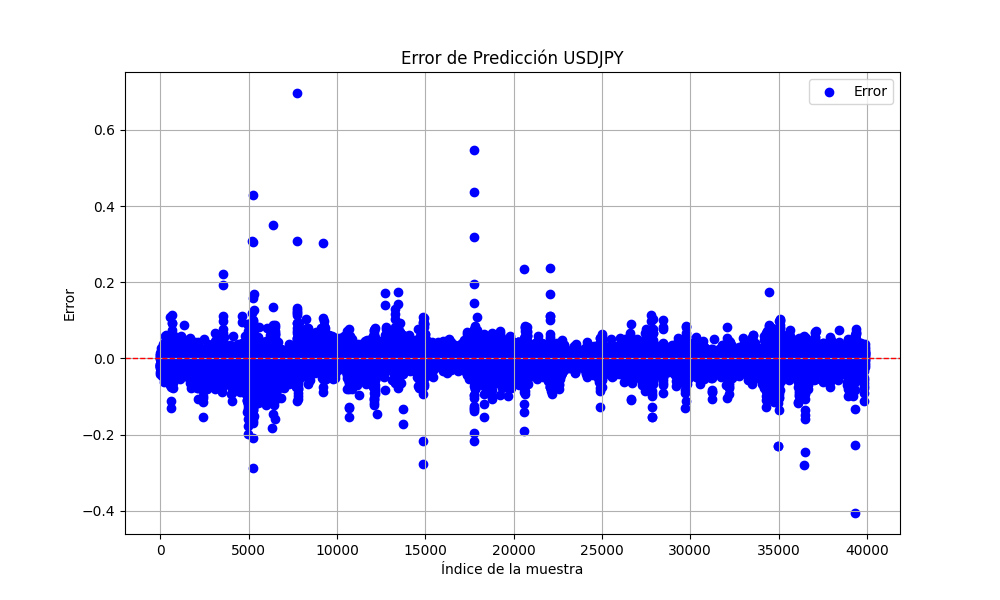

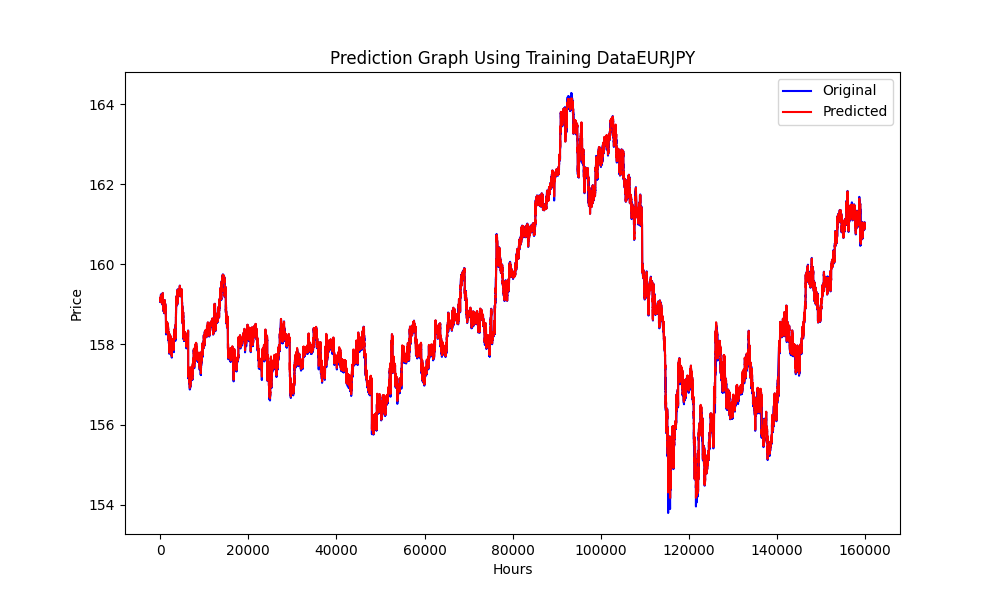

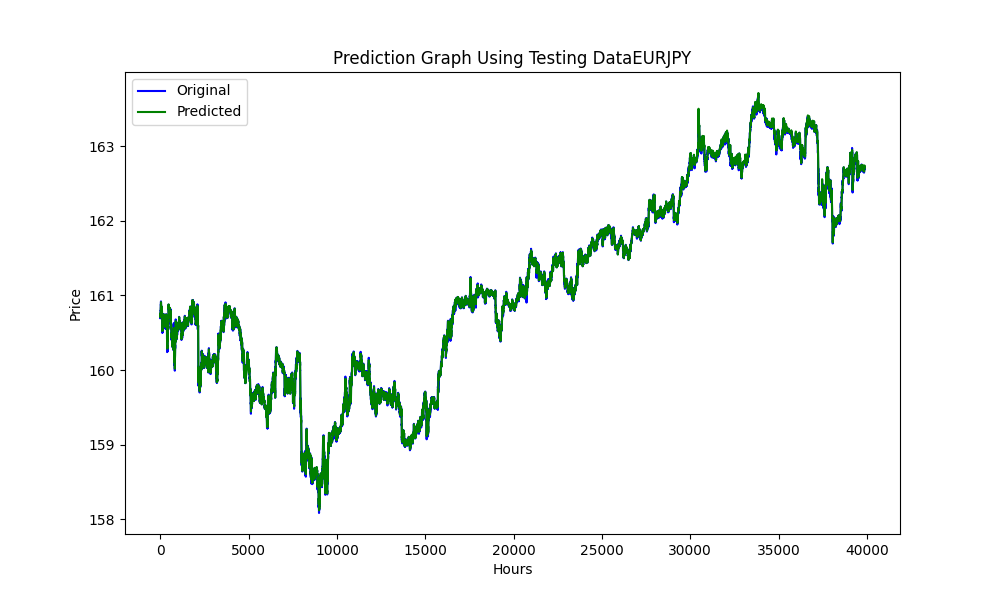

This .py exports images like this ones:

this graphs with the RMSE,MSE and R2 values

0.023019903957086384 0.0005299159781934813 0.999707563612641

With all this, we can know if our models are overfitted, or underfitted.

In this case:

RMSE measures the standard deviation of the residuals (prediction errors). Residuals are a measure of how far from the regression line data points are; RMSE is a measure of how spread out these residuals are. In other words, it tells you how concentrated the data is around the line of best fit.

A smaller RMSE value indicates better fit. The RMSE value you have is very small, suggesting that the model fits the dataset very well.

MSE is like RMSE but squares the errors before averaging them, which gives higher weight to larger errors. It's another measure of the quality of an estimator—it is always non-negative, and values closer to zero are better.

The very small MSE value further confirms that the model predictions are very close to the actual data points.

R2 is a statistical measure that represents the proportion of the variance for a dependent variable that's explained by an independent variable or variables in a regression model. An 𝑅2 value of 1 indicates that the regression predictions perfectly fit the data.

Our R2 value is very close to 1, indicating that your model explains almost all the variability around the mean, which is excellent.

Overall, these metrics suggest that your model is performing exceptionally well in predicting or fitting to your dataset.

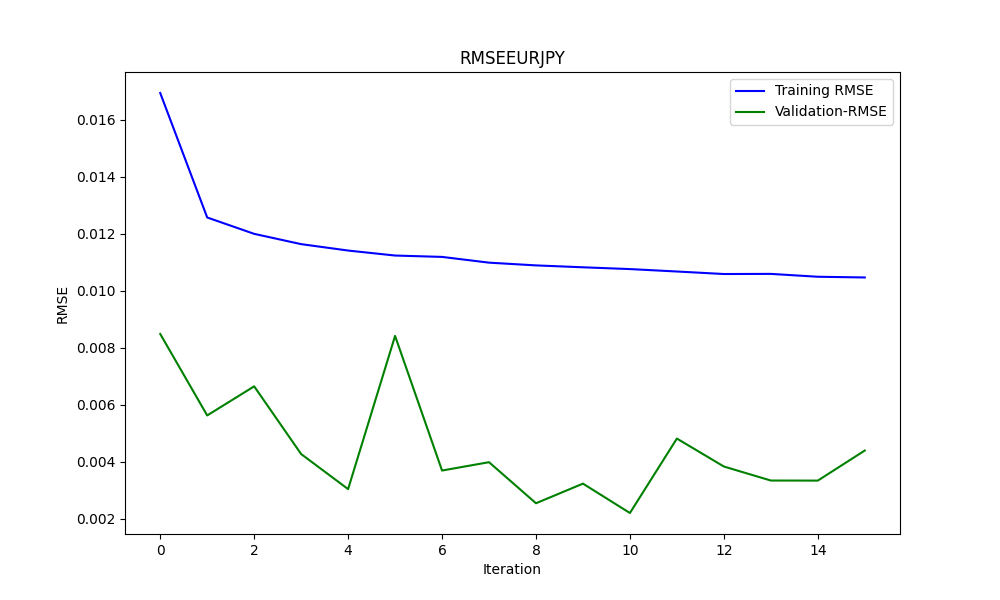

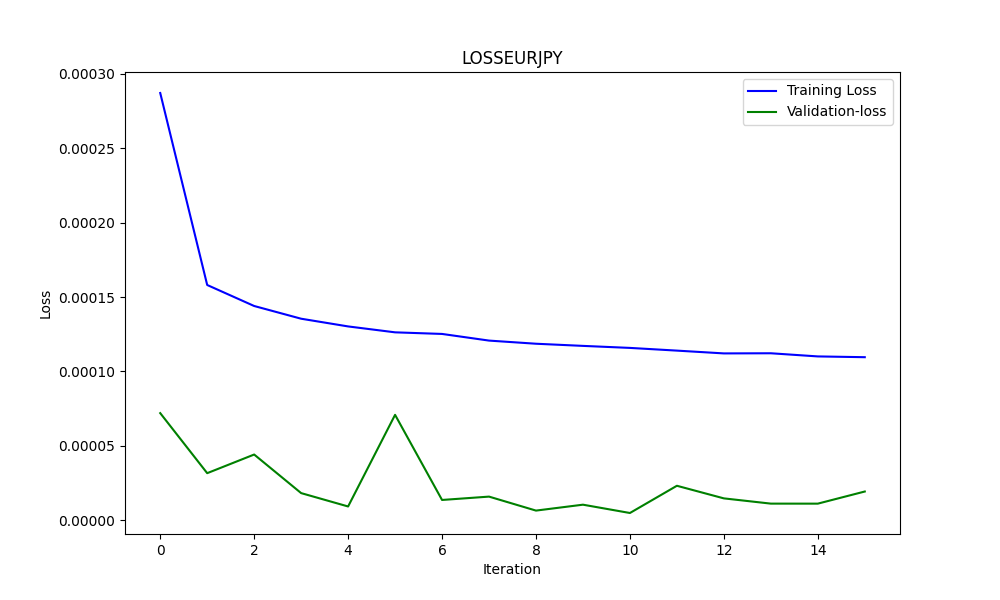

And to know if it overfitted, we use the graphs, for example in this case, the second one.

Here’s an analysis based on the graph:

-

Training Loss (Blue Line):

- This line shows a steep decline initially, indicating that the model is quickly learning from the training dataset. As the iterations progress, the training loss continues to decrease, but at a slower rate, which is typical as the model starts to converge towards a minimum.

-

Validation Loss (Green Line):

- The validation loss remains extremely low and fairly stable throughout the training process. This suggests that the model is generalizing well and not just memorizing the training data. The small fluctuations indicate variability in the validation set performance across iterations but remain within a very narrow band.

Overall, the graph suggests a very successful training process with excellent convergence and generalization. The low validation loss is particularly promising, as it indicates that the model should perform well on unseen data, assuming the validation set is representative of the general problem space.

Once all this is done. Lets pass to the EA.

Expert Advisor for Triangular Arbitrage with predictions

//+------------------------------------------------------------------+ //| ONNX_Triangular EURUSD-USDJPY-EURJPY.mq5| //| Copyright 2024, Javier S. Gastón de Iriarte Cabrera. | //| https://www.mql5.com/en/users/jsgaston/news | //+------------------------------------------------------------------+ #property copyright "Copyright 2024, Javier S. Gastón de Iriarte Cabrera." #property link "https://www.mql5.com/en/users/jsgaston/news" #property version "1.04" #property strict #include <Trade\Trade.mqh> #define MAGIC (965334) #resource "/Files/art/arbitrage triangular/eurusdjpy/EURUSD__M1_test.onnx" as uchar ExtModel[] #resource "/Files/art/arbitrage triangular/eurusdjpy/USDJPY__M1_test.onnx" as uchar ExtModel2[] #resource "/Files/art/arbitrage triangular/eurusdjpy/EURJPY__M1_test.onnx" as uchar ExtModel3[] CTrade ExtTrade; #define SAMPLE_SIZE 120 input double lotSize = 3.0; //input double slippage = 3; // Add these inputs to allow dynamic control over SL and TP distances input double StopLossPips = 50.0; // Stop Loss in pips input double TakeProfitPips = 100.0; // Take Profit in pips //input double maxSpreadPoints = 10.0; input ENUM_TIMEFRAMES Periodo = PERIOD_CURRENT; //+------------------------------------------------------------------+ //| | //+------------------------------------------------------------------+ string symbol1 = Symbol(); input string symbol2 = "USDJPY"; input string symbol3 = "EURJPY"; int ticket1 = 0; int ticket2 = 0; int ticket3 = 0; int ticket11 = 0; int ticket22 = 0; int ticket33 = 0; input bool isArbitrageActive = true; double spreads[1000]; // Array para almacenar hasta 1000 spreads int spreadIndex = 0; // Índice para el próximo spread a almacenar long ExtHandle=INVALID_HANDLE; //int ExtPredictedClass=-1; datetime ExtNextBar=0; datetime ExtNextDay=0; float ExtMin=0.0; float ExtMax=0.0; long ExtHandle2=INVALID_HANDLE; //int ExtPredictedClass=-1; datetime ExtNextBar2=0; datetime ExtNextDay2=0; float ExtMin2=0.0; float ExtMax2=0.0; long ExtHandle3=INVALID_HANDLE; //int ExtPredictedClass=-1; datetime ExtNextBar3=0; datetime ExtNextDay3=0; float ExtMin3=0.0; float ExtMax3=0.0; float predicted=0.0; float predicted2=0.0; float predicted3=0.0; float predicted2i=0.0; float predicted3i=0.0; float lastPredicted1=0.0; float lastPredicted2=0.0; float lastPredicted3=0.0; float lastPredicted2i=0.0; float lastPredicted3i=0.0; int Order=0; input double targetProfit = 100.0; // Eur benefit goal input double maxLoss = -50.0; // Eur max loss input double perVar = 0.005; // Percentage of variation to make orders ulong tickets[6]; // Array para almacenar los tickets de las órdenes double sl=0.0; double tp=0.0; int Abrir = 0; //+------------------------------------------------------------------+ //| Expert initialization function | //+------------------------------------------------------------------+ int OnInit() { ExtTrade.SetExpertMagicNumber(MAGIC); Print("EA de arbitraje ONNX iniciado"); //--- create a model from static buffer ExtHandle=OnnxCreateFromBuffer(ExtModel,ONNX_DEFAULT); if(ExtHandle==INVALID_HANDLE) { Print("OnnxCreateFromBuffer error ",GetLastError()); return(INIT_FAILED); } //--- since not all sizes defined in the input tensor we must set them explicitly //--- first index - batch size, second index - series size, third index - number of series (only Close) const long input_shape[] = {1,SAMPLE_SIZE,1}; if(!OnnxSetInputShape(ExtHandle,ONNX_DEFAULT,input_shape)) { Print("OnnxSetInputShape error ",GetLastError()); return(INIT_FAILED); } //--- since not all sizes defined in the output tensor we must set them explicitly //--- first index - batch size, must match the batch size of the input tensor //--- second index - number of predicted prices (we only predict Close) const long output_shape[] = {1,1}; if(!OnnxSetOutputShape(ExtHandle,0,output_shape)) { Print("OnnxSetOutputShape error ",GetLastError()); return(INIT_FAILED); } //////////////////////////////////////////////////////////////////////////////////////// //--- create a model from static buffer ExtHandle2=OnnxCreateFromBuffer(ExtModel2,ONNX_DEFAULT); if(ExtHandle2==INVALID_HANDLE) { Print("OnnxCreateFromBuffer error ",GetLastError()); return(INIT_FAILED); } //--- since not all sizes defined in the input tensor we must set them explicitly //--- first index - batch size, second index - series size, third index - number of series (only Close) const long input_shape2[] = {1,SAMPLE_SIZE,1}; if(!OnnxSetInputShape(ExtHandle2,ONNX_DEFAULT,input_shape2)) { Print("OnnxSetInputShape error ",GetLastError()); return(INIT_FAILED); } //--- since not all sizes defined in the output tensor we must set them explicitly //--- first index - batch size, must match the batch size of the input tensor //--- second index - number of predicted prices (we only predict Close) const long output_shape2[] = {1,1}; if(!OnnxSetOutputShape(ExtHandle2,0,output_shape2)) { Print("OnnxSetOutputShape error ",GetLastError()); return(INIT_FAILED); } ///////////////////////////////////////////////////////////////////////////////////////////////////////////// //--- create a model from static buffer ExtHandle3=OnnxCreateFromBuffer(ExtModel3,ONNX_DEFAULT); if(ExtHandle3==INVALID_HANDLE) { Print("OnnxCreateFromBuffer error ",GetLastError()); return(INIT_FAILED); } //--- since not all sizes defined in the input tensor we must set them explicitly //--- first index - batch size, second index - series size, third index - number of series (only Close) const long input_shape3[] = {1,SAMPLE_SIZE,1}; if(!OnnxSetInputShape(ExtHandle3,ONNX_DEFAULT,input_shape3)) { Print("OnnxSetInputShape error ",GetLastError()); return(INIT_FAILED); } //--- since not all sizes defined in the output tensor we must set them explicitly //--- first index - batch size, must match the batch size of the input tensor //--- second index - number of predicted prices (we only predict Close) const long output_shape3[] = {1,1}; if(!OnnxSetOutputShape(ExtHandle3,0,output_shape3)) { Print("OnnxSetOutputShape error ",GetLastError()); return(INIT_FAILED); } return(INIT_SUCCEEDED); } //+------------------------------------------------------------------+ //| Expert deinitialization function | //+------------------------------------------------------------------+ void OnDeinit(const int reason) { if(ExtHandle!=INVALID_HANDLE) { OnnxRelease(ExtHandle); ExtHandle=INVALID_HANDLE; } if(ExtHandle2!=INVALID_HANDLE) { OnnxRelease(ExtHandle2); ExtHandle2=INVALID_HANDLE; } if(ExtHandle3!=INVALID_HANDLE) { OnnxRelease(ExtHandle3); ExtHandle3=INVALID_HANDLE; } } //+------------------------------------------------------------------+ //| Expert tick function | //+------------------------------------------------------------------+ void OnTick() { SymbolProcessor processor; // Crear instancia de SymbolProcessor string A = processor.GetFirstThree(symbol1); string B = processor.GetLastThree(symbol1); string C = processor.GetFirstThree(symbol2); string D = processor.GetLastThree(symbol2); string E = processor.GetFirstThree(symbol3); string F = processor.GetLastThree(symbol3); if((A != E) || (B != C) || (D != F)) { Print("Wrongly selected symbols"); return; } //--- check new day if(TimeCurrent()>=ExtNextDay) { GetMinMax(); GetMinMax2(); GetMinMax3(); //--- set next day time ExtNextDay=TimeCurrent(); ExtNextDay-=ExtNextDay%PeriodSeconds(Periodo); ExtNextDay+=PeriodSeconds(Periodo); } //--- check new bar if(TimeCurrent()<ExtNextBar) { return; } //--- set next bar time ExtNextBar=TimeCurrent(); ExtNextBar-=ExtNextBar%PeriodSeconds(); ExtNextBar+=PeriodSeconds(); //--- check min and max float close=(float)iClose(symbol1,Periodo,0); if(ExtMin>close) ExtMin=close; if(ExtMax<close) ExtMax=close; float close2=(float)iClose(symbol2,Periodo,0); if(ExtMin2>close2) ExtMin2=close2; if(ExtMax2<close2) ExtMax2=close2; float close3=(float)iClose(symbol3,Periodo,0); if(ExtMin3>close3) ExtMin3=close3; if(ExtMax3<close3) ExtMax3=close3; lastPredicted1=predicted; lastPredicted2=predicted2; lastPredicted3=predicted3; lastPredicted2i=predicted2i; lastPredicted3i=predicted3i; //--- predict next price PredictPrice(); PredictPrice2(); PredictPrice3(); /* */ double price1 = SymbolInfoDouble(symbol1, SYMBOL_BID);///////////////// double price2 = SymbolInfoDouble(symbol2, SYMBOL_BID); double price2i = 1/price2; double price3 = SymbolInfoDouble(symbol3, SYMBOL_ASK); double price3i = 1/price3; double price11 = SymbolInfoDouble(symbol1, SYMBOL_ASK);///////////////// double price22 = SymbolInfoDouble(symbol2, SYMBOL_ASK); double price22i = 1/price22; double price33 = SymbolInfoDouble(symbol3, SYMBOL_BID); double price33i = 1/price33; predicted2i = 1/predicted2; predicted3i = 1/predicted3; //double lotSize = 1.0; // Lote base double lotSize2 = lotSize * predicted / predicted2; /// tengo dudas con usar el invertido o no invertido double lotSize3 = lotSize * predicted / predicted3; double lotSize22 = lotSize * predicted / predicted2; /// tengo dudas con usar el invertido o no invertido double lotSize33 = lotSize * predicted / predicted3; // Redondear lotes a un múltiplo aceptable por tu bróker lotSize2 = NormalizeDouble(lotSize2, 2); // Asume 2 decimales para lotes lotSize3 = NormalizeDouble(lotSize3, 2); lotSize22 = NormalizeDouble(lotSize22, 2); // Asume 2 decimales para lotes lotSize33 = NormalizeDouble(lotSize33, 2); int totalPositions = PositionsTotal(); if(Order==1 || Order==2) { // Verificar y cerrar órdenes si se cumplen las condiciones Print("Verificar y cerrar órdenes si se cumplen las condiciones"); CheckAndCloseOrders(); } if(!isArbitrageActive || ArePositionsOpen()) { Print("Arbitraje inactivo o ya hay posiciones abiertas."); return; } double varia11 = 100.0 - (close*100/predicted); double varia21 = 100.0 - (close2*100/predicted2); double varia31 = 100.0 - (predicted3*100/close3); double varia12 = 100.0 - (predicted*100/close); double varia22 = 100.0 - (predicted2*100/close2); double varia32 = 100.0 - (close3*100/predicted3); if((varia11 > perVar) && (varia21 > perVar) && (varia31 > perVar)) { Print("se debería proceder a apertura de ordenes de derechas"); Abrir = 1; } if((varia12 > perVar) && (varia22 > perVar) && (varia32 > perVar)) { Print("se debería proceder a apertura de ordenes de izquierdas"); Abrir = 2; } if(Abrir == 1 && (predicted*predicted2*predicted3i>1)) { Print("orden derecha"); // Inicia el arbitraje si aún no está activo if(isArbitrageActive) { if((ticket1 == 0 && ticket2 == 0 && ticket3 ==0) && (Order==0) && totalPositions ==0) { Print("Preparando para abrir órdenes"); Order = 1; MqlTradeRequest request; MqlTradeResult result; { MqlRates rates[]; ArraySetAsSeries(rates,true); int copied=CopyRates(symbol1,0,0,1,rates); CalculateSL(true,rates[0].close,symbol1); CalculateTP(true,rates[0].close,symbol1); if(ExtTrade.Buy(lotSize, symbol1, rates[0].close, sl, tp, "Arbitraje")) { tickets[0] = ExtTrade.ResultDeal(); // Getting the ticket of the last trade Print("Order placed with ticket: ", tickets[0]); } else { Print("Failed to place order: ", GetLastError()); } } { MqlRates rates[]; ArraySetAsSeries(rates,true); int copied=CopyRates(symbol2,0,0,1,rates); CalculateSL(true,rates[0].close,symbol2); CalculateTP(true,rates[0].close,symbol2); if(ExtTrade.Buy(lotSize2, symbol2, rates[0].close, sl, tp, "Arbitraje")) { tickets[1] = ExtTrade.ResultDeal(); // Getting the ticket of the last trade Print("Order placed with ticket: ", tickets[1]); } else { Print("Failed to place order: ", GetLastError()); } } { MqlRates rates[]; ArraySetAsSeries(rates,true); int copied=CopyRates(symbol3,0,0,1,rates); CalculateSL(false,rates[0].close,symbol3); CalculateTP(false,rates[0].close,symbol3); if(ExtTrade.Sell(lotSize3, symbol3, rates[0].close, sl, tp, "Arbitraje")) { tickets[2] = ExtTrade.ResultDeal(); // Getting the ticket of the last trade Print("Order placed with ticket: ", tickets[2]); } else { Print("Failed to place order: ", GetLastError()); } } ticket1=1; ticket2=1; ticket3=1; Abrir=0; return; } else { Print(" no se puede abrir ordenes"); } } } if(Abrir == 2 && (predicted*predicted2*predicted3i<1)) { Print("Orden Inversa"); // Inicia el arbitraje si aún no está activo if(isArbitrageActive) { if((ticket11 == 0 && ticket22 == 0 && ticket33 ==0) && (Order==0) && totalPositions==0) { Print("Preparando para abrir órdenes"); Order = 2; MqlTradeRequest request; MqlTradeResult result; { MqlRates rates[]; ArraySetAsSeries(rates,true); int copied=CopyRates(symbol1,0,0,1,rates); CalculateSL(false,rates[0].close,symbol1); CalculateTP(false,rates[0].close,symbol1); if(ExtTrade.Sell(lotSize, symbol1, rates[0].close, sl, tp, "Arbitraje")) { tickets[3] = ExtTrade.ResultDeal(); // Getting the ticket of the last trade Print("Order placed with ticket: ", tickets[3]); } else { Print("Failed to place order: ", GetLastError()); } } { MqlRates rates[]; ArraySetAsSeries(rates,true); int copied=CopyRates(symbol2,0,0,1,rates); CalculateSL(false,rates[0].close,symbol2); CalculateTP(false,rates[0].close,symbol2); if(ExtTrade.Sell(lotSize2, symbol2, rates[0].close, sl, tp, "Arbitraje")) { tickets[4] = ExtTrade.ResultDeal(); // Getting the ticket of the last trade Print("Order placed with ticket: ", tickets[4]); } else { Print("Failed to place order: ", GetLastError()); } } { MqlRates rates[]; ArraySetAsSeries(rates,true); int copied=CopyRates(symbol3,0,0,1,rates); CalculateSL(true,rates[0].close,symbol3); CalculateTP(true,rates[0].close,symbol3); if(ExtTrade.Buy(lotSize3, symbol3, rates[0].close, sl, tp, "Arbitraje")) { tickets[5] = ExtTrade.ResultDeal(); // Getting the ticket of the last trade Print("Order placed with ticket: ", tickets[5]); } else { Print("Failed to place order: ", GetLastError()); } } ticket11=1; ticket22=1; ticket33=1; Abrir=0; return; } else { Print(" no se puede abrir ordenes"); } } } } //+------------------------------------------------------------------+ //| Postions are open function | //+------------------------------------------------------------------+ bool ArePositionsOpen() { // Check for positions on symbol1 if(PositionSelect(symbol1) && PositionGetDouble(POSITION_VOLUME) > 0) return true; // Check for positions on symbol2 if(PositionSelect(symbol2) && PositionGetDouble(POSITION_VOLUME) > 0) return true; // Check for positions on symbol3 if(PositionSelect(symbol3) && PositionGetDouble(POSITION_VOLUME) > 0) return true; return false; } //+------------------------------------------------------------------+ //| Price prediction function | //+------------------------------------------------------------------+ void PredictPrice(void) { static vectorf output_data(1); // vector to get result static vectorf x_norm(SAMPLE_SIZE); // vector for prices normalize //--- check for normalization possibility if(ExtMin>=ExtMax) { Print("ExtMin>=ExtMax"); //ExtPredictedClass=-1; return; } //--- request last bars if(!x_norm.CopyRates(_Symbol,Periodo,COPY_RATES_CLOSE,1,SAMPLE_SIZE)) { Print("CopyRates ",x_norm.Size()); //ExtPredictedClass=-1; return; } float last_close=x_norm[SAMPLE_SIZE-1]; //--- normalize prices x_norm-=ExtMin; x_norm/=(ExtMax-ExtMin); //--- run the inference if(!OnnxRun(ExtHandle,ONNX_NO_CONVERSION,x_norm,output_data)) { Print("OnnxRun"); //ExtPredictedClass=-1; return; } //--- denormalize the price from the output value predicted=output_data[0]*(ExtMax-ExtMin)+ExtMin; //return predicted; } //+------------------------------------------------------------------+ //| Price prediction function | //+------------------------------------------------------------------+ void PredictPrice2(void) { static vectorf output_data2(1); // vector to get result static vectorf x_norm2(SAMPLE_SIZE); // vector for prices normalize //--- check for normalization possibility if(ExtMin2>=ExtMax2) { Print("ExtMin2>=ExtMax2"); //ExtPredictedClass=-1; return; } //--- request last bars if(!x_norm2.CopyRates(symbol2,Periodo,COPY_RATES_CLOSE,1,SAMPLE_SIZE)) { Print("CopyRates ",x_norm2.Size()); //ExtPredictedClass=-1; return; } float last_close2=x_norm2[SAMPLE_SIZE-1]; //--- normalize prices x_norm2-=ExtMin2; x_norm2/=(ExtMax2-ExtMin2); //--- run the inference if(!OnnxRun(ExtHandle2,ONNX_NO_CONVERSION,x_norm2,output_data2)) { Print("OnnxRun"); //ExtPredictedClass=-1; return; } //--- denormalize the price from the output value predicted2=output_data2[0]*(ExtMax2-ExtMin2)+ExtMin2; //--- classify predicted price movement //return predicted2; } //+------------------------------------------------------------------+ //| Price prediction function | //+------------------------------------------------------------------+ void PredictPrice3(void) { static vectorf output_data3(1); // vector to get result static vectorf x_norm3(SAMPLE_SIZE); // vector for prices normalize //--- check for normalization possibility if(ExtMin3>=ExtMax3) { Print("ExtMin3>=ExtMax3"); //ExtPredictedClass=-1; return; } //--- request last bars if(!x_norm3.CopyRates(symbol3,Periodo,COPY_RATES_CLOSE,1,SAMPLE_SIZE)) { Print("CopyRates ",x_norm3.Size()); //ExtPredictedClass=-1; return; } float last_close3=x_norm3[SAMPLE_SIZE-1]; //--- normalize prices x_norm3-=ExtMin3; x_norm3/=(ExtMax3-ExtMin3); //--- run the inference if(!OnnxRun(ExtHandle3,ONNX_NO_CONVERSION,x_norm3,output_data3)) { Print("OnnxRun"); //ExtPredictedClass=-1; return; } //--- denormalize the price from the output value predicted3=output_data3[0]*(ExtMax3-ExtMin3)+ExtMin3; //--- classify predicted price movement //return predicted2; } //+------------------------------------------------------------------+ //| Get minimal and maximal Close for last 120 values | //+------------------------------------------------------------------+ void GetMinMax(void) { vectorf closeMN; closeMN.CopyRates(symbol1,Periodo,COPY_RATES_CLOSE,0,SAMPLE_SIZE); ExtMin=closeMN.Min(); ExtMax=closeMN.Max(); } //+------------------------------------------------------------------+ //| Get minimal and maximal Close for last 120 values | //+------------------------------------------------------------------+ void GetMinMax2(void) { vectorf closeMN2; closeMN2.CopyRates(symbol2,Periodo,COPY_RATES_CLOSE,0,SAMPLE_SIZE); ExtMin2=closeMN2.Min(); ExtMax2=closeMN2.Max(); } //+------------------------------------------------------------------+ //| Get minimal and maximal Close for last 120 values | //+------------------------------------------------------------------+ void GetMinMax3(void) { vectorf closeMN3; closeMN3.CopyRates(symbol3,Periodo,COPY_RATES_CLOSE,0,SAMPLE_SIZE); ExtMin3=closeMN3.Min(); ExtMax3=closeMN3.Max(); } //+------------------------------------------------------------------+ //| Symbols class returns both pairs of a symbol | //+------------------------------------------------------------------+ class SymbolProcessor { public: // Método para obtener los primeros tres caracteres de un símbolo dado string GetFirstThree(string symbol) { return StringSubstr(symbol, 0, 3); } // Método para obtener los últimos tres caracteres de un símbolo dado string GetLastThree(string symbol) { if(StringLen(symbol) >= 3) return StringSubstr(symbol, StringLen(symbol) - 3, 3); else return ""; // Retorna un string vacío si el símbolo es demasiado corto } }; //+------------------------------------------------------------------+ //| Calculate total profit from all open positions for the current symbol //+------------------------------------------------------------------+ double CalculateCurrentArbitrageProfit() { double totalProfit = 0.0; int totalPositions = PositionsTotal(); // Get the total number of open positions // Loop through all open positions for(int i = 0; i < totalPositions; i++) { // Get the ticket of the position at index i ulong ticket = PositionGetTicket(i); if(PositionSelectByTicket(ticket)) // Select the position by its ticket { // Add the profit of the current position to the total profit totalProfit += PositionGetDouble(POSITION_PROFIT); //Print("totalProfit ", totalProfit); } } return totalProfit; // Return the total profit of all open positions } // Función para cerrar todas las órdenes void CloseAllOrders() { string symbols[] = {symbol1, symbol2, symbol3}; for(int i = 0; i < ArraySize(symbols); i++) { if(ExtTrade.PositionClose(symbols[i], 3)) Print("Posición cerrada correctamente para ", symbols[i]); else Print("Error al cerrar posición para ", symbols[i], ": Error", GetLastError()); } // Resetea tickets y ordenes ticket1 = 0; ticket2 = 0; ticket3 = 0; ticket11 = 0; ticket22 = 0; ticket33 = 0; Order = 0; Print("Todas las órdenes están cerradas"); } //+------------------------------------------------------------------+ //| Check and close orders funcion | //+------------------------------------------------------------------+ // Función para verificar y cerrar órdenes void CheckAndCloseOrders() { double currentProfit = CalculateCurrentArbitrageProfit(); // Condiciones para cerrar las órdenes if((currentProfit >= targetProfit || currentProfit <= maxLoss)) { CloseAllOrders(); // Cierra todas las órdenes Print("Todas las órdenes cerradas. Beneficio/Pérdida actual: ", currentProfit); } } //+------------------------------------------------------------------+ //| Get order volume function | //+------------------------------------------------------------------+ double GetOrderVolume(int ticket) { if(PositionSelectByTicket(ticket)) { double volume = PositionGetDouble(POSITION_VOLUME); return volume; } else { Print("No se pudo seleccionar la posición con el ticket: ", ticket); return 0; // Retorna 0 si no se encuentra la posición } } //+------------------------------------------------------------------+ // Function to get the price and calculate SL dynamically double CalculateSL(bool isBuyOrder,double entryPrice,string simbolo) { double pointSize = SymbolInfoDouble(simbolo, SYMBOL_POINT); int digits = (int)SymbolInfoInteger(simbolo, SYMBOL_DIGITS); double pipSize = pointSize * 10; if(isBuyOrder) { sl = NormalizeDouble(entryPrice - StopLossPips * pipSize, digits); tp = NormalizeDouble(entryPrice + TakeProfitPips * pipSize, digits); } else { sl = NormalizeDouble(entryPrice + StopLossPips * pipSize, digits); tp = NormalizeDouble(entryPrice - TakeProfitPips * pipSize, digits); } return sl; } //+------------------------------------------------------------------+ // Function to get the price and calculate TP dynamically double CalculateTP(bool isBuyOrder,double entryPrice, string simbolo) { double pointSize = SymbolInfoDouble(simbolo, SYMBOL_POINT); int digits = (int)SymbolInfoInteger(simbolo, SYMBOL_DIGITS); double pipSize = pointSize * 10; if(isBuyOrder) { sl = NormalizeDouble(entryPrice - StopLossPips * pipSize, digits); tp = NormalizeDouble(entryPrice + TakeProfitPips * pipSize, digits); } else { sl = NormalizeDouble(entryPrice + StopLossPips * pipSize, digits); tp = NormalizeDouble(entryPrice - TakeProfitPips * pipSize, digits); } return tp; } //+------------------------------------------------------------------+ // Function to handle errors and retry bool TryOrderSend(MqlTradeRequest &request, MqlTradeResult &result) { for(int attempts = 0; attempts < 5; attempts++) { if(OrderSend(request, result)) { return true; } else { Print("Failed to send order on attempt ", attempts + 1, ": Error ", GetLastError()); Sleep(1000); // Pause before retrying to avoid 'context busy' errors } } return false; } //+------------------------------------------------------------------+

Explanation of the Expert Advisor

The Strategy

We all now know what triangular arbitrage is, but, I've added to the code, a minimum amount difference between the prediction and the actual close value, this difference is the percentage rate change between those two values, and you can modify that amount with this input:

input double perVar = 0.005; // Percentage of variation to make orders

*** Notice in the code that is has this logic: ***

EUR USD | EUR |^(-1)

---- x --- x | ---- |

USD JPY | JPY | and every thing is adapted to this logic, so if you use another pairs, every thing must be modified.

I will attach anther example (EURUSD - GBPUSD - EURGBP) so you can see the changes, that uses this logic:

EUR | GBP |^(-1) | EUR |^(-1)

---- x | --- | x | ---- |

USD | USD | | GBP | The whole strategy, is based on that when you multiply that logic, if its >1 you can multiply in the right direction, and if its <1 you can multiply on the left direction.

But, the strategy of this Expert Advisor, is that instead of using the actual prices, we will use the predicted prices.

This logic means that if you multiply to the right, you multiply prices, and if you multiply by the inverse, it's a devide. And, to the left, it's all the way around. You can seek this changes in the code.

The lot sizes must be selected accordingly to the highest price, this is why, in this EUR-USD-JPY the minimum lot is around 2 or three lots.

The logic for the lot sizes is this:

double lotSize2 = lotSize * predicted / predicted2; double lotSize3 = lotSize * predicted / predicted3;

where predicted is the predicted price for EURUSD, predicted2 is the price for USDJPY and predicted3 is the price for EURJPY.

The last part of this, is to normalize the lot size to the brokers requirements.

lotSize2 = NormalizeDouble(lotSize2, 2); lotSize3 = NormalizeDouble(lotSize3, 2);

Example

For this example, we will use EUR-USD-JPY pairs.

With this logic

EUR USD | EUR |^(-1)

---- x --- x | ---- |

USD JPY | JPY | We will train and test with a 200000 minute periods of time (sample size), till the 3rd of April. This will give us around 17 days of predictions.

So the test in the strategy tester will run from the 3rd of April to the 21st of the same month and we will select the 1 Minute timeframe.

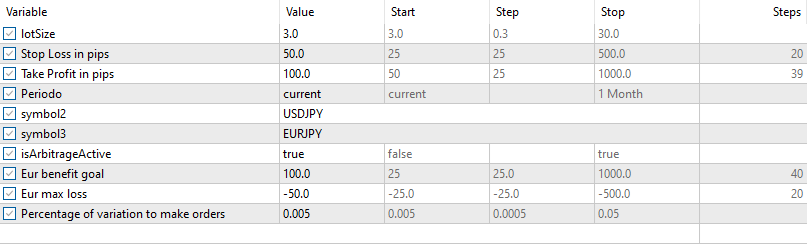

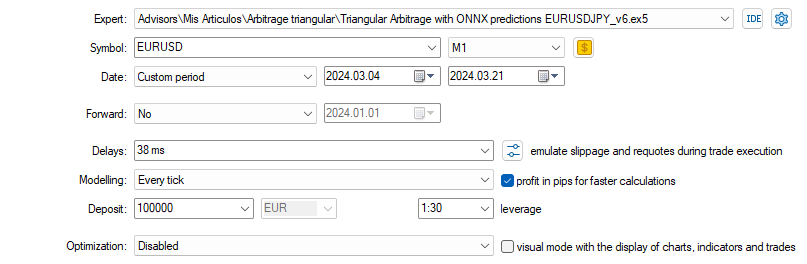

For the first test, we will use this inputs and settings (select carefully the symbols as they are added to the EA (OONX)):

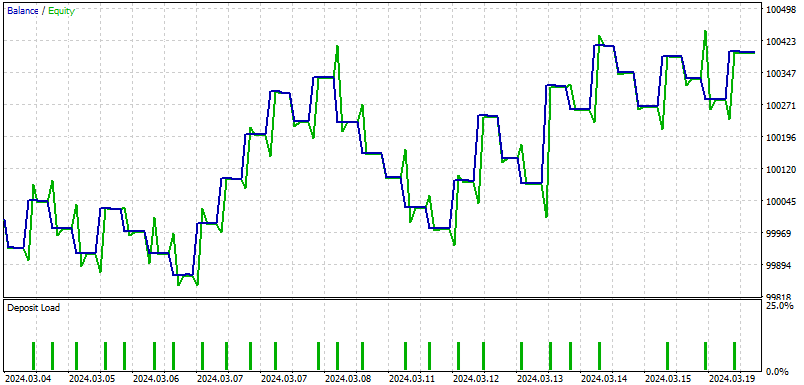

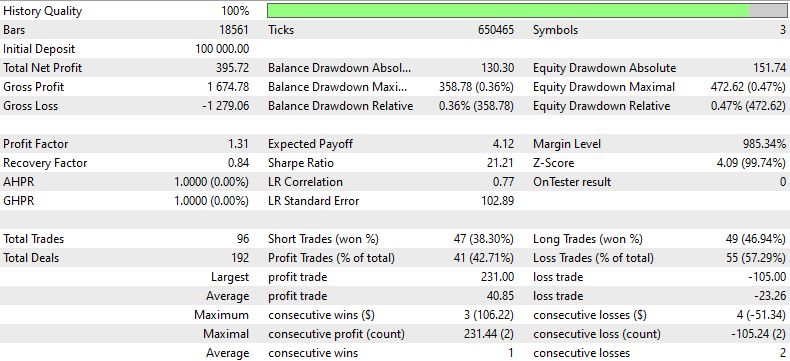

and this are the results:

This is what an IA resumes for the results of this back-testing:

This backtesting report provides a detailed analysis of a trading strategy's performance over a given period using historical data. The strategy started with an initial deposit of $100,000 and ended with a total net profit of $395.72, despite a significant gross loss of $1,279.06 compared to the gross profit of $1,674.78. The profit factor of 1.31 indicates that the gross profit exceeded the gross loss by 31%, showcasing the strategy's ability to generate profit over loss.

The strategy executed a total of 96 trades, with a roughly equal split between winning and losing trades, as indicated by the percentages of short trades won (38.30%) and long trades won (46.94%). The strategy had more losing trades overall (55 or 57.29%), emphasizing a need for improvement in trade selection or exit strategies.

The recovery factor of 0.84 suggests moderate risk, with the strategy recovering 84% of the maximum drawdown. Additionally, the maximum drawdown was relatively high at $358.78 (0.36% of the account), indicating that while the strategy was profitable, it also faced significant declines from which it had to recover.

The back-test also showed substantial drawdowns in terms of equity, with a maximal equity drawdown of 0.47% of the account. This, coupled with the sharp ratio of 21.21, suggests that the returns were considerably higher than the risk taken, which is positive. However, the low average consecutive wins (3 trades) versus higher average consecutive losses (2 trades) suggest that the strategy might benefit from refining its approach to maintain consistency in winning trades.

Conclusion

In this article, we break down the exciting concept of triangular arbitrage using predictions, all through the user-friendly MT5 platform and Python programming. Imagine having a secret formula that lets you play a smart game of currency exchange, spinning dollars into euros, then yen, and back to dollars, aiming to end up with more than you started. This isn't magic; it's all about using special predictive models called ONNX and triangular arbitrage, which learn from past currency prices to predict future ones, guiding your trading moves.

The piece is super helpful for setting everything up, showing you how to install all the tools you'll need, like Python and Visual Studio Code, and how to get your computer ready to start testing. The article explains in simple terms, making sure you know how to adjust the strategy whether your trading account is basic or fancy.

Overall, this article is a fantastic resource for anyone looking to get into the forex trading game, using some of the smartest tech available. It guides you through the nitty-gritty of setting up and running your trading system, so you can try your hand at trading with an edge, thanks to the latest in artificial intelligence and machine learning. Whether you're a newbie to coding or trading, this guide has your back, showing you step by step how to make the digital leap into automated trading.

I hope you enjoid reading this article as I did making it.

Learn how to trade the Fair Value Gap (FVG)/Imbalances step-by-step: A Smart Money concept approach

Learn how to trade the Fair Value Gap (FVG)/Imbalances step-by-step: A Smart Money concept approach

Neural networks made easy (Part 69): Density-based support constraint for the behavioral policy (SPOT)

Neural networks made easy (Part 69): Density-based support constraint for the behavioral policy (SPOT)

Population optimization algorithms: Binary Genetic Algorithm (BGA). Part II

Population optimization algorithms: Binary Genetic Algorithm (BGA). Part II

Developing an MQL5 RL agent with RestAPI integration (Part 3): Creating automatic moves and test scripts in MQL5

Developing an MQL5 RL agent with RestAPI integration (Part 3): Creating automatic moves and test scripts in MQL5

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Check out the new article: Triangular arbitrage with predictions.

Author: Javier Santiago Gaston De Iriarte Cabrera

Check out the new article: Triangular arbitrage with predictions.

Author: Javier Santiago Gaston De Iriarte Cabrera

Thank you, this is enlightening.

Thanks Javier, for the article. Very educative.

You're welcome! Thanks'!

Thank you, this is enlightening.

Thanks!