This is part of the larger UTM Manager Guide - Other - 30 January 2023 - Traders' Blogs (mql5.com)

Risk Management

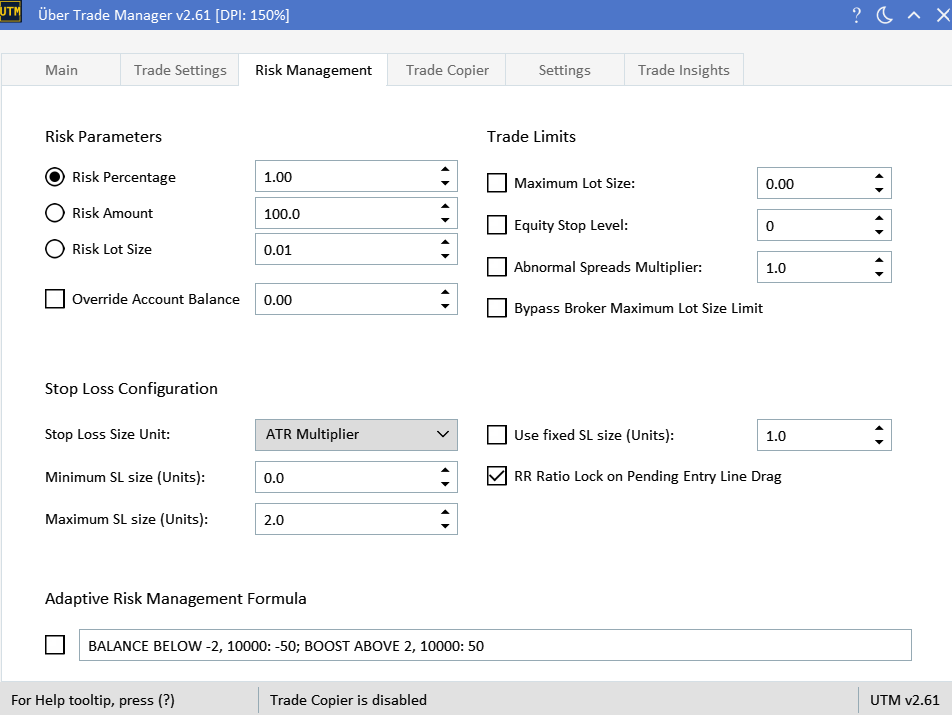

Risk Parameters

The 'Risk Parameters' group offers various options for managing your trading risk. You can choose to risk a percentage of your account, a fixed money amount, or a fixed lot size. If the calculated lot size exceeds the highest leverage in lot size your account can afford, it will automatically be reduced to the maximum lot size your account can execute, and an alert will be triggered. Conversely, if the lot size falls below the broker's minimum allowed lot size, it will be automatically increased to meet that minimum. Additionally, if the 'bypass broker max lot size' setting is disabled and the lot size exceeds the broker's maximum allowed size, it will be reduced to the maximum lot size permitted by the broker. These adjustments ensure that your trades are not rejected due to lot size restrictions. For more advanced risk strategies, consider using the 'adaptive risk management formula.Override Account Balance

In scenarios where not all your capital is stored with the broker, the 'Override Account Balance' option ensures your on-chart statistics remain accurate. Note: Trade Insights Statistics AND Drawdown based risk management formulas are disabled in this mode.

Maximum Lot Size

The "Maximum Lot Size" feature serves as a hard cap on the size of any single trade executed by the manager. If a calculated lot size exceeds this maximum value, the trade will be automatically reduced to fit within this limit.

Equity Stop Level

The 'Equity Stop Level' feature halts all trading activities once your account equity reaches a predefined level. This is an essential tool for preserving capital and is especially beneficial for traders operating under specific equity constraints, such as prop firms. Important: The equity level does not automatically factor in the commissions that will be incurred upon the final closing of positions. To ensure a more accurate representation of your actual available equity, you should manually account for these commissions when setting your equity stop level.

Abnormal Spreads Multiplier

Sets the multiplier for abnormal spread detection. The current spread is compared to the EMA-smoothed average spread. If the current spread exceeds the EMA-smoothed spread multiplied by this factor, the spread is considered abnormal and trade entry will be prevented. For example, a value of 2.0 means the current spread must be more than double the EMA-smoothed spread to prevent trade entry.

Bypass Broker Maximul Lot Size Limit

Activate this feature to break down trades surpassing your broker's maximum lot size limit. On activation, any trade exceeding the lot size limit is automatically fragmented into multiple trades, each within your broker's limit. This is particularly useful for prop firms like FTMO, having a maximum limit of 50 lots per trade. Only the main trade will exhibit buttons and lines to close all split trades concurrently, treating them effectively as one big trade.

Stop Loss Configuration:

The 'Stop Loss Configuration' section allows you to specify the parameters for the stop loss size of your trades. You can choose between a fixed stop loss size in pips or points, or a dynamic size based on the Average True Range (ATR) of the market.

- Minimum SL size: Defines the lower boundary for the stop loss size.

- Maximum SL size: Sets the upper limit for the stop loss size.

- Fixed SL size: If enabled, all trades will use this specified stop loss size, facilitating faster trade execution.

Stop Loss Size Unit:

This setting determines the unit used for the stop loss size.

- Pips or Points: The stop loss size is defined in a fixed number of pips or points.

- ATR Multiplier: The stop loss size is calculated as a multiple of the current ATR, allowing the stop loss to adjust with market volatility. For example, a multiplier of '2' would set the stop loss to twice the value of the ATR.

Locking RR on Pending Order:

The 'Lock RR on pending dragging (from entry line)' feature keeps the risk-reward ratio intact when moving a pending order from the entry line.

Adaptive Risk Management Formula Language

In the complex realm of trading, risk management stands paramount. The Adaptive Risk Management Formula Language introduced in the UTM Manager is a game-changing tool that empowers traders. It's a tailored approach to defining risk, based on the dynamics of account performance and recent trades.

The formula encompasses:

-

Balance-Based Risk Management: Modify risk based on your current balance against a reference. It can react to specific thresholds, balance ranges, or even conditional boosts.

-

Drawdown-Based Risk Management: Alter risk by evaluating the ongoing drawdown. NOTE: Drawdown-Based formulas are disabled If 'Custom account balance mode' has been activated or Trade Insights does not function.

For a deep dive into crafting and implementing these bespoke risk management strategies, check out the comprehensive guide.