This is part of the larger UTM Manager Guide - Other - 30 January 2023 - Traders' Blogs (mql5.com)

The Adaptive Risk Management Formula Language in UTM Manager offers traders a versatile platform to define risk adjustments based on account performance metrics and recent trade outcomes.

Overview:

The formula's design ensures ease of understanding for all, from novices to seasoned traders, enabling each to create unique risk management strategies. NOTE: Drawdown-Based formulas are disabled If 'Custom account balance mode' has been activated or Trade Insights does not function.

Formula Structure:

Formulas follow the pattern: condition: risk adjustment. Dive into the components:

Comparison Operators:

- BELOW (less than)

- ABOVE (greater than)

Separators:

- Colon (:): Differentiates the condition from its corresponding risk adjustment.

- Comma (,): Separates elements within a condition, such as percentage and reference balance.

- Semicolon (;): Demarcates individual segments of the formula, facilitating the fusion of combined strategies.

Priority in Formula Evaluation:

In the Adaptive Risk Management Formula Language, the sequence of conditions matters. When multiple conditions can be true simultaneously, the formula uses a "first-come-first-serve" principle. This means that the first condition (from the left) that satisfies the criteria takes precedence over subsequent conditions.

For example, consider the following formula:

BALANCE BELOW -2, 10000: -50; BALANCE ABOVE 2.5, 10000: 30; RANGE -2 to 3, 10000: 10

If a trader's balance is $9800 (which is 2% below $10,000), the first condition ( BALANCE BELOW -2, 10000: -50 ) would be true, and therefore the risk adjustment of -50% would be applied, even though the third condition ( RANGE -2 to 3, 10000: 10 ) is also true. The sequence in which the conditions are listed ensures that the formula identifies the most specific condition to apply the appropriate risk adjustment.

Always be cautious and strategic when listing multiple conditions, ensuring that the priority order aligns with your specific trading objectives.

1. Balance-Based Risk Management:

Fine-tune your risk by contrasting your existing balance with a reference balance.

a. Specific Thresholds:

BALANCE BELOW percentage, ref_balance: risk_adjustment

🔍 Example: To reduce risk by 50% when your balance descends by 2% from a $10,000 benchmark:

BALANCE BELOW -2, 10000: -50

BALANCE ABOVE percentage, ref_balance: risk_adjustment

🔍 Example: To enhance risk by 30% when your balance rises by 2.5% from a starting $10,000:

BALANCE ABOVE 2.5, 10000: 30

b. Balance Ranges:

RANGE min_percentage to max_percentage, ref_balance: risk_adjustment

🔍 Example: For variations between -2% and +2% from a $10,000 reference, preserving the standard risk strategy:

RANGE -2 to 2, 10000: 0

c. Conditional Boost:

BOOST ABOVE percentage, ref_balance: risk_adjustment

🔍 Example: Elevating risk by 40% when your balance is over 4% from a $6,000 reference and your last trade was a win:

BOOST ABOVE 4, 6000: 40

Understanding the Boost Mechanism:

-

Winning Trade Criterion: A trade is recognized as a "win" if its realized Risk-Reward (RR) ratio meets or exceeds the 'Win Threshold in Realized RR' in 'Trade Insights' setting. For instance, setting a threshold at '1.0' means any trade with a realized RR of 1.0 or above is considered a win.

-

Losing Trade Criterion: Conversely, a trade is recognized as a "loss" if its realized Risk-Reward (RR) ratio falls below the 'Loss Threshold in Realized RR' in 'Trade Insights' setting. For example, if the threshold is set to '-1.0', any trade with a realized RR below -1.0 is considered a loss.

-

Custom Account Balance Mode: If the Custom account balance mode is activated, the boost condition becomes non-operational because it relies on insights derived from trade outcomes.

-

Persistence and Deactivation of the Boost: Once the boost is activated due to a winning trade, it remains in effect until a trade meets the losing criterion. The boost will be reactivated with any subsequent trades that meet the winning criterion, while our condition is still met.

Combined Risk Strategy Example:

Imagine commencing with a $10,000 balance. Merging specific thresholds, balance ranges, and conditional boosts:

BALANCE BELOW -2, 10000: -50; RANGE -2 to 2, 10000: 10; BOOST ABOVE 2, 10000: 50

d. Exponential Balance-Based Challenge Passer:

This section focuses on an exponential risk reduction strategy for prop firm challenges, decreasing risk as the balance drops and including a boost for positive trends.

BALANCE BELOW -9, 10000: -90; BALANCE BELOW -8, 10000: -60; BALANCE BELOW -7, 10000: -40; BALANCE BELOW -5, 10000: -20; BOOST ABOVE 2, 10000: 20

The approach involves aggressive risk reduction as the balance falls below specified thresholds from a $10,000 benchmark, and a boost when the balance is positively over 2% from the reference.

2. Drawdown-Based Risk Management:

Adapt risk levels by gauging the current drawdown. When Custom account balance mode is activated, drawdown-based formulas are void as they rely on insights.

a. Specific Thresholds:

DRAWDOWN BELOW percentage: risk_adjustment

🔍 Example: Reducing risk by 60% when confronting a -6% drawdown or worse:

DRAWDOWN BELOW -6: -60

DRAWDOWN ABOVE percentage: risk_adjustment

🔍 Example: Increasing risk by 10% when the drawdown is above -4%:

DRAWDOWN ABOVE -4: 10 b. Stepping Drawdown System:

Create a stepping drawdown system to manage risk in a more nuanced manner. The sequence of conditions matters, and the first condition that satisfies the criteria takes precedence. Example if your normal risk is 1.0%.

🔍 Example: Implementing a stepping drawdown system to reduce risk by 75% at a -5% drawdown, 50% at a -3% drawdown, 25% at a -1% drawdown, and increase risk to +50% when the drawdown is above -1%:

DRAWDOWN BELOW -5: -75;

DRAWDOWN BELOW -3: -50;

DRAWDOWN BELOW -1: -25;

DRAWDOWN ABOVE -1: 50 In this example, if the drawdown is -6%, the first condition is true, and the risk adjustment of -75% would be applied. The sequence ensures that the formula identifies the most specific condition to apply the appropriate risk adjustment.

c. Drawdown-Based Boost System:

You can also create a "boost system" based on the drawdown, specifically designed to increase your risk when conditions are optimal.

🔍 Example: Boosting risk by 50% when there is no drawdown, meaning the last trade was a win:

DRAWDOWN ABOVE 0: 50

In this scenario, the formula checks if the account is not in a drawdown state (drawdown is exactly 0). If both conditions are met, your risk is boosted by 50%. This strategy aims to capitalize on a winning streak by increasing the stake when conditions appear favorable.

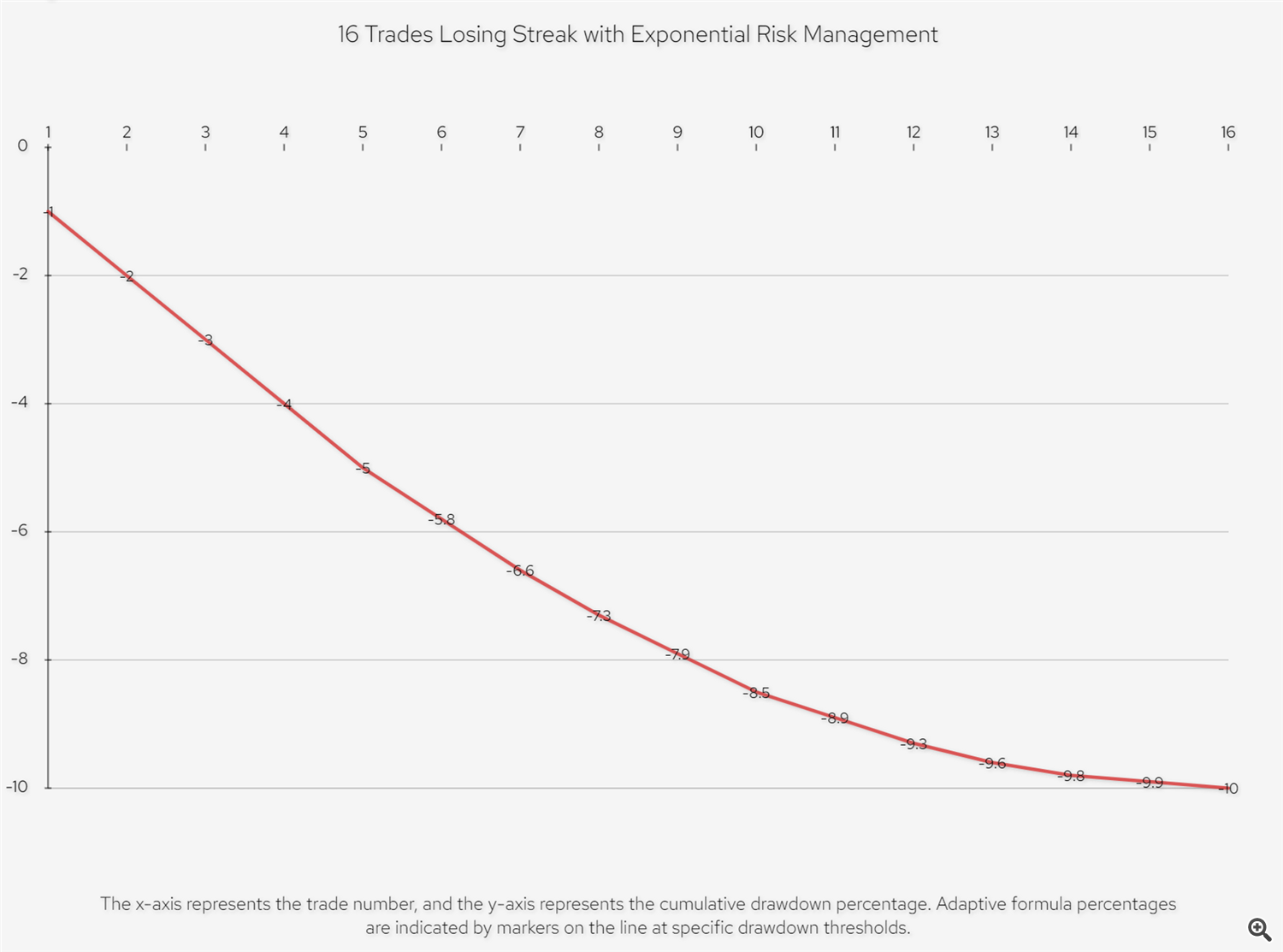

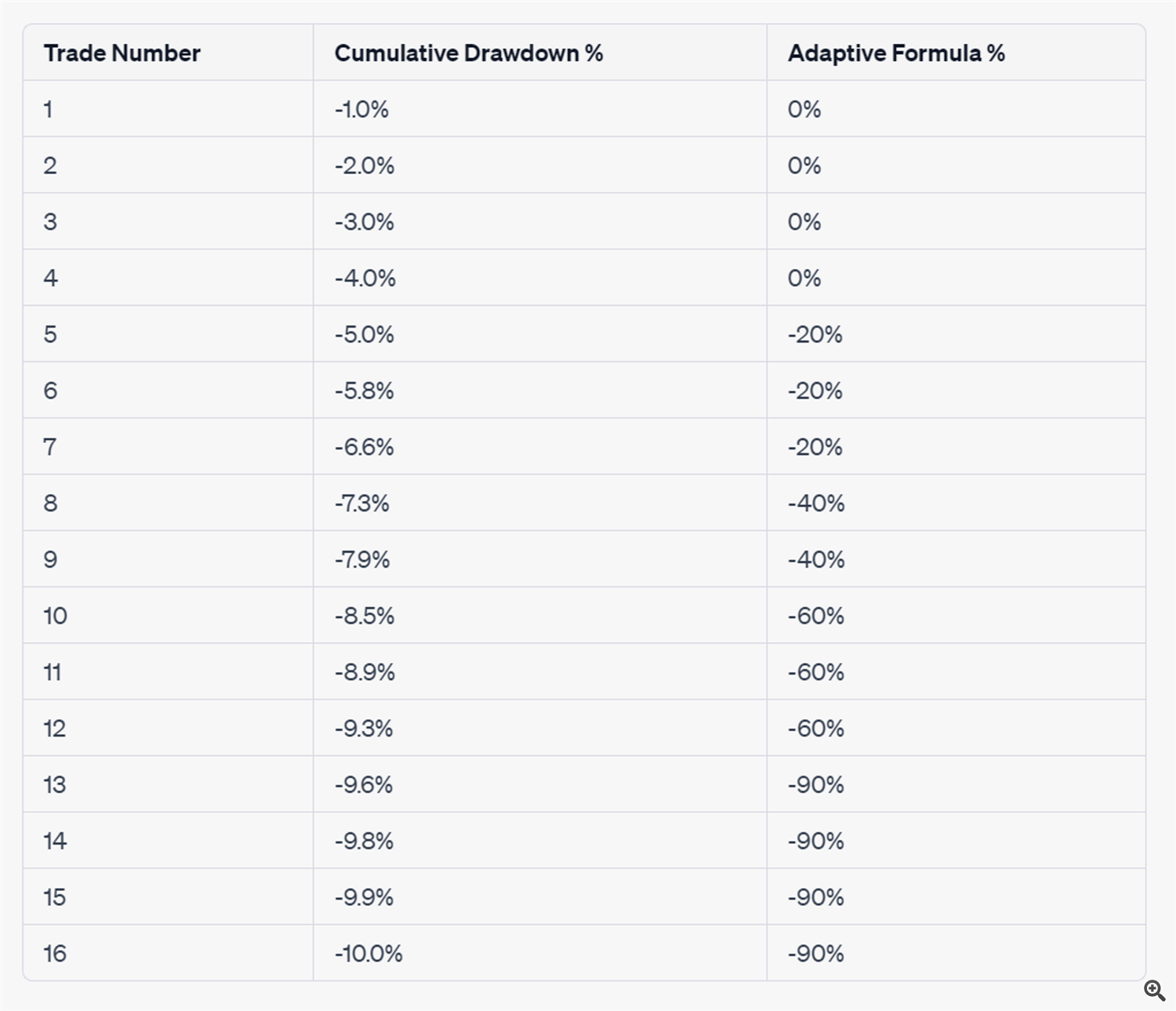

3. Exponential Drawdown-Based Risk Management:

In some trading scenarios, you might want your risk adjustment to be more dynamic, particularly when you're experiencing a losing streak. The Adaptive Risk Management Formula Language allows you to create a risk adjustment strategy that becomes exponentially more aggressive as your drawdown increases.

Formula Example:

DRAWDOWN BELOW -9: -90;

DRAWDOWN BELOW -8: -60;

DRAWDOWN BELOW -7: -40;

DRAWDOWN BELOW -5: -20

How It Works:

-

Initial Phase (-5% Drawdown): At a drawdown of -5%, your risk is reduced by 20%

DRAWDOWN BELOW -5: -20

-

Moderate Phase (-7% to -8% Drawdown): As the drawdown increases to -7% and -8%, the risk reduction becomes 40% and 60% respectively

DRAWDOWN BELOW -7: -40; DRAWDOWN BELOW -8: -60

-

Aggressive Phase (-9% Drawdown): At a drawdown of -9%, the risk reduction jumps to 90%

DRAWDOWN BELOW -9: -90

This formula ensures that as you approach a -10% drawdown, your risk is reduced in an exponential manner, allowing you to preserve your capital more effectively.

Priority and Sequence:

Remember, the sequence in which the conditions are listed is crucial. The formula uses a "first-come-first-serve" principle. In this example, if your drawdown is -9%, the condition DRAWDOWN BELOW -9: -90 will be true, and a risk adjustment of -90% will be applied, overriding any other conditions that might also be true.

By incorporating this exponential drawdown-based risk management strategy, you can adapt to losing streaks more effectively, reducing your risk in a manner that is proportional to the severity of your drawdown.