Review of trades of the Owl Smart Levels strategy for the week from September 25 to 29, 2023

Today I present you an overview of trades made using the Owl strategy - smart levels for the EURUSD, GBPUSD and AUDUSD currency pairs for the week from September 25 to 29, 2023. There were a total of 11 trades opened in all currency pairs. The Owl Smart Levels indicator traded most of the currency pairs downward against the dollar. In general, the trading turned out to be quite trendy, which is favorable for working with our indicator.

For convenience and timely receipt of signals I use the Owl Smart Levels Indicator. The main trading timeframe is M15, while the H1 and H4 timeframes are used to confirm the trend direction of the higher timeframe.

EURUSD review

The Owl Smart Levels indicator gave the first signal to open a trade on EURUSD on Monday afternoon.

Fig. 1. EURUSD SELL 0.14, OpenPrice = 1.06410, StopLoss = 1.06521, TakeProfit = 1.06050, Profit = $48.65.

Having found a successful entry point on the downward trend, Owl Smart Levels offered to open a trade, which closed at TakeProfit and brought a profit of 48$.

On Tuesday, the market spent almost the whole day in the dead zone, and the next trade took place only on Wednesday evening.

Fig. 2. EURUSD SELL 0.11, OpenPrice = 1.05091, StopLoss = 1.05230, TakeProfit = 1.04641, Profit = $0.43.

The trade had to be closed by the signal of the big indicator arrow reversal and the loss was prevented in time with the "profit" of a few cents.

On Thursday the market was mostly in the dead zone, and the last trade on the asset was opened on Friday in the middle of the working day, this time for buying.

Fig. 3. EURUSD BUY 0.09, OpenPrice = 1.07249, StopLoss = 1.07392, TakeProfit = 1.06785, Profit = -$3.70.

The trade, as well as the previous one, had to be closed on the indicator signal with a loss of several dollars.

GBPUSD review

The Owl Smart Levels indicator suggested opening the first trade on the asset on Monday afternoon.

Fig. 4. GBPUSD SELL 0.10, OpenPrice = 1.22344, StopLoss = 1.22487, TakeProfit = 1.21880, Profit = $24.44.

This trade was closed quite successfully. Despite the fact that it had to be closed by the indicator signal about the change of trading direction, at the moment of its closing the trade was able to bring a profit of 24$.

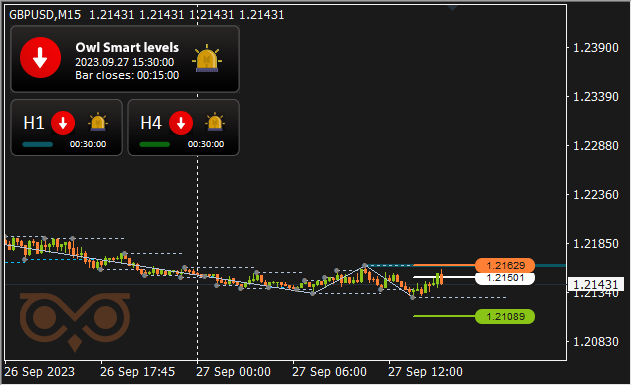

The next trade, also for sale, was opened on Tuesday morning.

Fig. 5. GBPUSD SELL 0.10, OpenPrice = 1.21900, StopLoss = 1.22048, TakeProfit = 1.21422, Profit = $48.45.

Here, as they say in sports, a "clean victory" was achieved and the trade was closed by TakeProfit, bringing the long-awaited and familiar profit of 48$. After that the Owl Smart Levels indicator repeated this success once again.

Fig. 6. GBPUSD SELL 0.12, OpenPrice = 1.21501, StopLoss = 1.21629, TakeProfit = 1.21089, Profit = $48.28.

The trade was also classically closed by TakeProfit and brought the same positive result of 48$.

Thursday the market spent most of the time in the dead zone. Unfortunately, the series of positive trades was interrupted, and the last trade on this asset, opened for buying on Friday afternoon, turned out to be unprofitable.

Fig. 7. GBPUSD BUY 0.09, OpenPrice = 1.22441, StopLoss = 1.22279, TakeProfit = 1.22967 Profit = -$15.

And even the delayed signal of the big arrow reversal, which is quite rare, did not help here. Therefore, the result amounted to minus 15$.

AUDUSD review

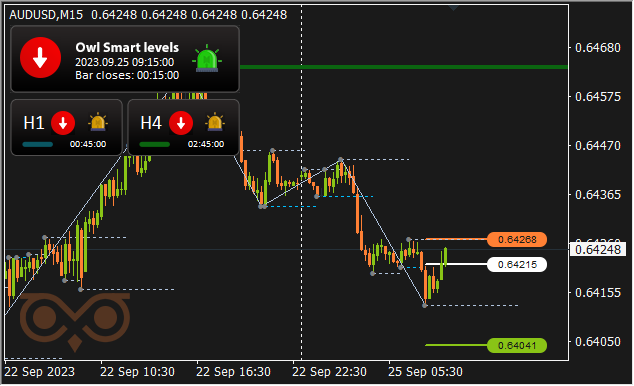

All trades in AUDUSD were for selling, and the first one was opened on Monday morning.

Fig. 8. AUDUSD SELL 0.28, OpenPrice = 0.64215, StopLoss = 0.64268, TakeProfit = 0.64041, Profit = -$15.

Having pleased with two successful trades in a row, the indicator missed a small series of two losing trades without giving a timely signal. The trade also brought a loss of 15$. The indicator opened the next trade in the evening of the same day.

Fig. 9. AUDUSD SELL 0.18, OpenPrice = 0.64187, StopLoss = 0.64286, TakeProfit = 0.63869, Profit = -$7.25.

Here, finally, the big arrow of the indicator clearly worked, and the trade was closed relatively on time with a loss of 7$.

On Tuesday morning a new trade was opened, also on sale.

Fig. 10. AUDUSD SELL 0.11, OpenPrice = 0.64120, StopLoss = 0.64281, TakeProfit = 0.63600, Profit = -$4.02.

The big arrow of the indicator warned in time about the necessity to close this trade, and the loss on it amounted to only 4$.

On Wednesday afternoon the last trade on the asset was opened.

Fig. 11. AUDUSD SELL 0.19, OpenPrice = 0.63716, StopLoss = 0.63811, TakeProfit = 0.63410, Profit = -$17.50.

The screenshot shows that there is a struggle of positions at the level of about 0.63800 and the market is determined with the direction of movement. Unfortunately, the indicator in this situation did not manage to signal in time to cancel the trade, and it cost us minus 17.50$. But by this moment, let's say, looking ahead, that the Owl Smart Levels indicator has already earned more than 100$.

On Thursday the market was in the dead zone, and on Friday there were no trades on the asset as well.

Results:

So, 11 trades were made during the last trading week. Five of them were profitable and six were unprofitable. It can be noted that the market favorably changed in its trend movement, and it allowed the Owl Smart Levels indicator to return to the "design capacity". Therefore, the final table looks quite optimistic.

We will see how the trading will look like and how the market will behave, as well as what trades will be offered to us to open Owl Smart Levels on Monday, during the upcoming trading week.

See other reviews of the Owl Smart Levels strategy:

I'm Sergei Ermolov, follow me and don't miss more useful tools for profitable trading on the Forex market.