Forex Summary (2021-2024):

*Performance:*

- - 2021 Profit: 87.58%

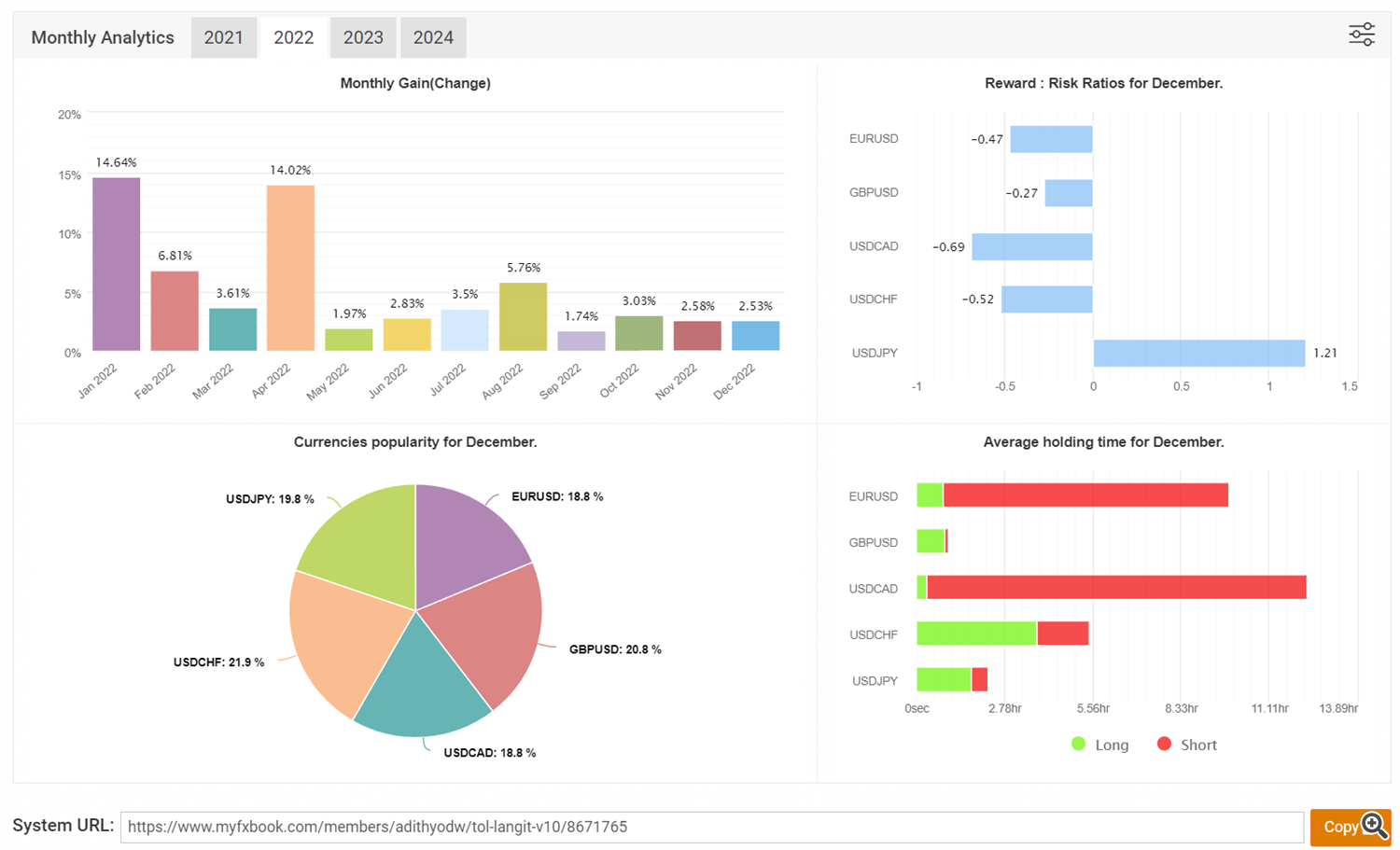

- - 2022 Profit: 83.06%

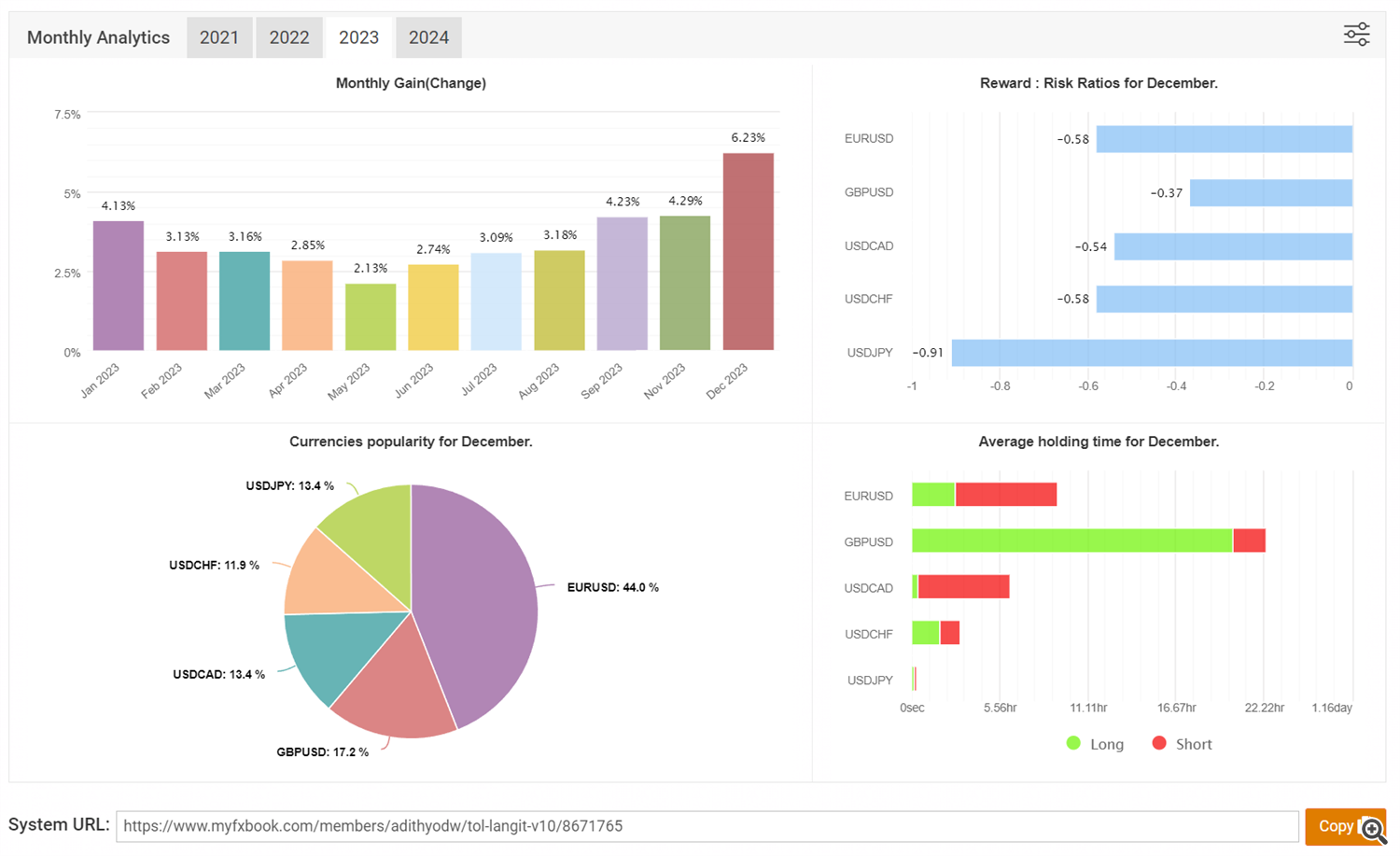

- - 2023 Profit: 46.87%

*Strategy Overview:*

Despite market volatility, our strategy remains focused on a stable 3-5% monthly return with a very low-risk setup (0.01 per $1000). With a low-risk and stable system, we managed to survive the volatile markets throughout 2021-2023.

FREE LIVE SIGNAL : https://t.me/tol_langit

Major events affecting the forex market from 2021 to 2024:

1. COVID-19 Pandemic (2020-present):

Initial Panic (2020-2021): Widespread market volatility, risk aversion, and flight to safe havens like the US dollar. Emerging market currencies experienced significant depreciation.

Recovery and Policy Divergence (2021-2022): Gradual market recovery and differentiation in monetary policy across major economies. US Dollar initially strengthened due to faster vaccine rollout and Fed hawkishness, but later weakened as other economies recovered.

New Variants and Uncertainties (2023-2024): Emergence of new COVID-19 variants triggered temporary market turbulence but less severe than initially. Focus shifted to inflation and geopolitical tensions.

2. US Elections:

2020 US Presidential Election: Limited immediate impact on forex markets as Biden's victory was largely anticipated. However, longer-term policy concerns regarding stimulus and fiscal spending potentially influenced market sentiment.

2022 Midterm Elections: Republican gains in Congress raised potential for policy gridlock and reduced fiscal spending, initially strengthening the US dollar but later fading due to continued economic momentum.

3. Ukraine-Russia War (2022-present):

Immediate Shock (2022): Significant volatility and risk aversion, with safe haven currencies like USD, CHF, and JPY appreciating against riskier assets. Russian Ruble plummeted due to sanctions and economic disruption.

Protracted Conflict and Energy Crisis (2023-2024): War's continuation fueled global inflation and exacerbated energy crisis, impacting currencies of energy-dependent economies. Euro initially weakened due to proximity to the conflict but later stabilised.

4. Other Key Events:

Central Bank Policy Divergence: Monetary policy decisions by major central banks, particularly the US Federal Reserve's interest rate hikes and quantitative tightening, significantly impacted currency valuations.

Global Supply Chain Disruptions: Ongoing supply chain bottlenecks and rising commodity prices contributed to inflationary pressures and influenced currency performance.

Cryptocurrency Volatility: Booms and busts in the cryptocurrency market occasionally spilled over into traditional forex markets, impacting risk appetite and trading sentiment.

Volatile Markets:

Emerging Market Currencies: Generally more sensitive to global economic shocks and policy changes, experiencing higher volatility compared to major currencies.

Commodity-Linked Currencies: Those tied to specific commodities (e.g., oil, metals) were heavily influenced by fluctuations in those commodity prices.

Currencies with Geopolitical Risks: Currencies of countries experiencing political instability or conflicts were prone to higher volatility.