EUR/USD

The European currency shows mixed trading dynamics, testing 1.0020 for a breakout. The EUR/USD pair is trying to recover after a moderate decline the day before, which interrupted the instrument's three-day rally and did not allow it to consolidate on new local highs from September 13. The reason for the appearance of negative dynamics was the corrective sentiment in the market. Market participants are preparing for today's publication of macroeconomic statistics from the US on the dynamics of consumer prices for October, which may have a significant impact on the position of the US Federal Reserve on the issue of further tightening of monetary policy, as record inflation remains one of the main drivers of an active increase in interest rates. Analysts' current forecasts suggest that the Consumer Price Index will slow down from 8.2% to 8.0% in annual terms, and in monthly terms it may accelerate from 0.4% to 0.6%. Tomorrow statistics on the dynamics of consumer prices for October will be presented by Germany, and experts predict a value of 11.6%. In addition, representatives of the European Central Bank (ECB) Luis de Guindos, Fabio Panetta and Philip Lane are expected to speak during the day and comment on the publication of forecasts for the growth of the European economy.

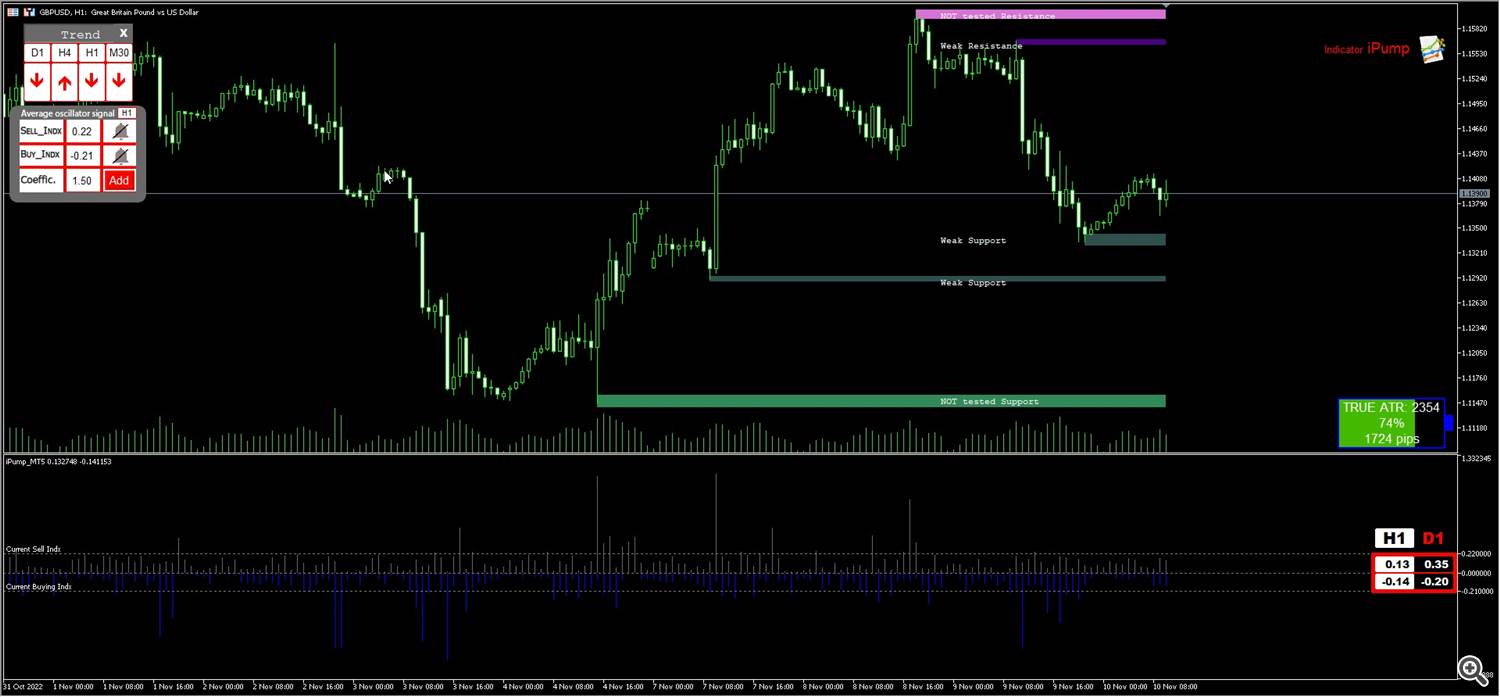

GBP/USD

The British pound is trading with a weak uptrend, again testing the level of 1.1400 after a rather active decline the day before. The US dollar recovered the day before as market participants actively closed short positions ahead of the publication of October statistics on consumer inflation. The market expects a moderate reduction in inflationary pressure, which, in turn, should affect the policy of the US Federal Reserve, as the pace of further interest rate hikes may slow down. At the same time, the forecasts for the monthly Consumer Price Index still assume quite active growth from 0.4% to 0.6%. Tomorrow, quarterly data on the dynamics of Gross Domestic Product (GDP) will be published in the UK: traders expect confirmation of a decline in the national economy by 0.5%, which will mean the transition to a recession. Also, investors are waiting for the publication of the budget plan of the new UK government led by Rishi Sunak on November 17. It is expected that the document will provide for large-scale cuts in government spending while sharply increasing the fiscal burden on households and businesses.

AUD/USD

The Australian dollar shows mixed trading dynamics, holding near 0.6410. The day before, the AUD/USD pair showed a rather active decline, which was provoked by a corrective recovery of the US currency. At the moment, market activity remains subdued again, as market participants await the publication of macroeconomic statistics from the US on consumer price dynamics. Analysts have rather high expectations for it, counting on the fact that in the near future the US Federal Reserve will ease monetary policy. If inflation really shows a slowdown at least in annual terms, the regulator is very likely to raise interest rates in December by 50 basis points. Certain pressure on the position of the instrument on Thursday is also exerted by statistics from Australia: the Consumer Inflation Expectations index from the Melbourne Institute rose in November from 5.4% to 6.0%, which turned out to be significantly higher than market expectations at the level of 5.7%. However, the indicator correlates with the latest protocols of the Reserve Bank of Australia (RBA), according to which the peak of inflation in the country has not yet been passed.

📈 In the review, I used the iPump indicator