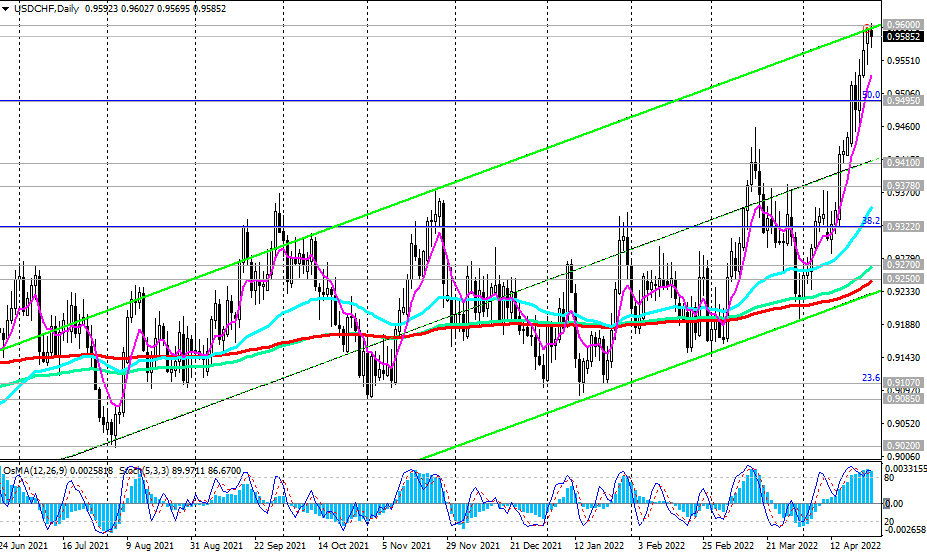

Despite the fact that the franc enjoys the status of a defensive asset and is strengthening against other major currencies, it continues to weaken against the US dollar. Thus, the USD/CHF pair today updated another high since July 2020, exceeding 0.9600 (for more details, see "USD/CHF: technical analysis and trading recommendations for 04/26/2022").

Not in favor of the franc was also released today's statistics, indicating a decrease in the surplus of the foreign trade balance of Switzerland in March to 2.988 billion francs from 5.882 billion francs in February, which also turned out to be worse than the forecast for a decline to 4.890 billion francs.

Tomorrow (at 08:00 GMT) the ZEW Expectations Index will be published, assessing the business climate, the situation on the employment market and other aspects that affect the daily conduct of business in Switzerland, and on Friday (at 07:00 GMT) - the index of leading indicators KOF, which is considered an indicator of economic stability in Switzerland. Both indicators are unlikely to cause the franc to strengthen, as they are expected to be weak (-9.1 and 99.3 after -27.8 and 99.7, respectively, in the previous month).

On Friday (08:00 GMT), the speech of the head of the SNB, Thomas Jordan, is also scheduled. Investors will be waiting for signals from him regarding further plans for the monetary policy of the SNB. The signal to open new long positions will be the update of today's high of 0.9600.

Support levels: 0.9570, 0.9495, 0.9410, 0.9378, 0.9300, 0.9270, 0.9250

Resistance levels: 0.9600, 0.9670, 0.9960, 1.0000, 1.0235, 1.0480

*) see also “Technical analysis and trading recommendations” -> Telegram

**) Get no deposit StartUp bonus up to 1500.00 USD

Source: InstaForex