Economists believe that the European Central Bank, following its meeting on Thursday, is likely to refrain from cutting rates, but will lower expectations for GDP growth in 2021.

Given the modest outlook for economic growth and inflation, which economists estimate will remain well below the target until 2023, the ECB is likely to increase the PEPP program by 500 billion euros from the current 1.35 trillion euros and extend the TLTRO program.

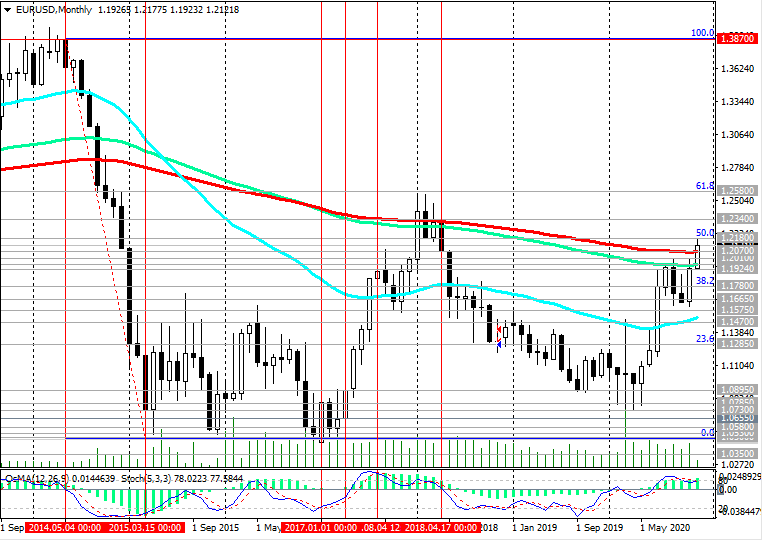

It is difficult to predict the market reaction to the decisions of the ECB, which will be adopted on Thursday. Nevertheless, in the context of a weakening dollar, primarily due to the aggressive stimulating policy of the FRS and expectations of a new package of measures to support the US economy and the US population from the government, we will most likely see further growth in the EUR / USD despite the fact that

it is traded above its 32-month high and strong long-term resistance level passing through 1.2070 mark (see "Technical Analysis and Trading Recommendations").

Recall that the ECB will publish its rate decision on Thursday at 12:45 (GMT). The ECB press conference will begin at 13:30. During this period of time, one should expect an increase in volatility in the financial market, and primarily in the euro quotes and in the EUR / USD pair. The more unexpected the results of this ECB meeting turn out to be, the stronger the volatility will be.

The publication of important macro statistics is not expected today. Nevertheless, market participants will follow the progress of the meeting of the Bank of Canada. Its decision on the interest rate will be published at 15:00 (GMT).

*) for trading, I choose THIS BROKER and use VPS (to get a bonus, enter the promo code - zomro_17601)