Fundamental and Technical Analysis EURUSD for 21.09.2020

For this analysis I use iPump indicator

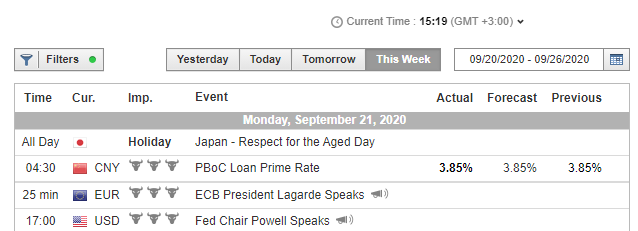

Important news for today

Current dynamics EURUSD for 21.09.2020

On the other hand, a significant strengthening of the dollar is hindered by increased tensions in relations between the United States and China. Over the weekend, the Chinese authorities published a regulation on the list of unreliable organizations, which will include companies, organizations and individuals that threaten the interests and security of the PRC. It is expected to be used to pressure US companies operating in China if the US continues to obstruct large Chinese corporations such as Huawei from doing business.

Support levels: 1.1750, 1.1718, 1.1596, 1.1474.

And at this the review came to an end. I wish you profitable trades, remember that your success should not depend on any one trade, you need to try to be in the black at the distance, and for this it is enough to earn only 3 out of 10 trades, how? - your reward to risk ratio should be more than one to three. Therefore, always remember about the 📈

risk (use forex calculator), consider it correctly and then your trading will be successful! Wish you a successful trading day your SeniorTrader.

In order not to miss the following market overview, as well as to be aware of the news of the project SeniorTrder Subscribe to our telegram channel 👉Telegram Channnel https://t.me/SeniorTrader_Channel

Tools that I use in trading

Easy Trade Pad

Free version https://www.mql5.com/en/market/product/54895 (work only EURUSD)

Full version https://www.mql5.com/en/market/product/47587

iPump indicator

The iPump indicator was used for this analysis

https://www.mql5.com/en/market/product/39895

Indicator defining the trend, levels, overbought / oversold

EA Pump and Dump Pro

EA Pump and Dump Pro -multifunctional Expert Advisor using trading tactics - buying in areas of strong oversold, selling in overbought areas.

https://www.mql5.com/en/market/product/51395

https://www.mql5.com/en/market/product/51395

Using averaging and piramiding strategy for overclocking a deposit.

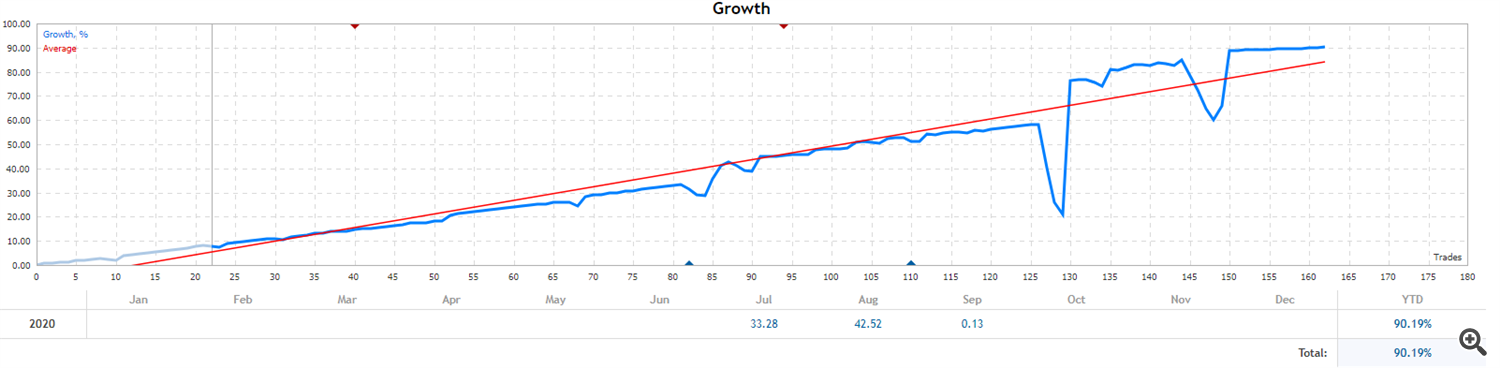

EA Long Term Strategy

https://www.mql5.com/en/market/product/35069

Trading strategy with fix stop loss ( safe strategy).

The entry point is looked for based on several indicators using trend control.

#EURUSD 21.09.2020 Fundamental and Technical Analysis