The story about the haphazard trade

If suddenly you are working on the market, using intuition and a lot of earning during six months, it's just wonderful. But if the this article should reveal the role of luck to earn trading on the financial markets, so it will be not superfluous to mention about the worst mistake in the haphazard trade. It name is luck.

Imagine a new trader, who thought that the behavior of his cat in the morning gives forecast on the direction of trade during the day. Trader puts StopLoss and TakeProfit equal and trades every day. Capital, which he was able to gather, is $ 1,000. Our trader is not as simple as it seems and decided not to risk it all and put in every transaction of $ 100.

Unsystematic which described in this article - in fact, the usual commonplace event. How many this trader earns in a year? The answer is perhaps very much!

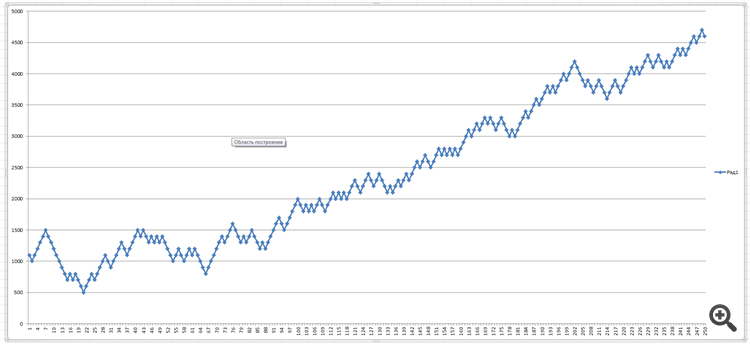

To test this, we introduce the conditions in Excel and simulate possible scenarios, on the sixth update schedule managed to get an interesting chart:

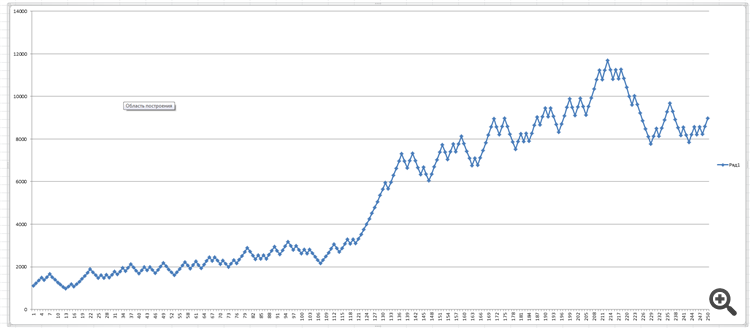

At the exit, we have 450% per annum without reinvesting in the loss of only 50%. What would have happened to our trader, if he had used the most simple of money management - he would have risked 1/10 your account on each trade, ie used the reinvestment:

Try it yourself: TraderSimulator.xlsx (for Excel recalculate, you can press the "save").

The collapse of this situation is that our "brilliant" the trader is likely through the half year throwing the work and begins to live on a grand scale, because he began to earn by his own mind and in general it is only the beginning ... onward millions are waiting for him . I think no need to explain how much energy is required that would again begin to live the old way, when luck will leave such a system.

Any action in the life of a thinking man must have the rationale and the especially the game in the financial markets, which should be something grounded.

Changing of chances

In order not to fall into the trap of luck, as described earlier, you need some way to get a statistical advantage. One way to obtain such an advantage is to provide a trading system.

Trading system - a set of rules and conditions for opening a position, monitoring, and subsequent closure. If a set of rules and conditions do not contain any double interpretation, such a trade can be an automated. The system eliminates the negative trade impact of emotions inherent in games for money.

Of course neither trading system does not remove the effect of luck on the result, the oscillations will be huge, but if you really get an advantage, and money management does not exhaust the deposit the new peaks of balance chart can not long lurk.

On the market is possible and necessary to earn, but for this we need not only the mind, but also hard work. Establish and improve the trading system - there is a point of focus for traders who thinking about tomorrow.