(02 MARCH 2019)WEEKLY MARKET OUTLOOK 1:Reason Stocks Rally Continues

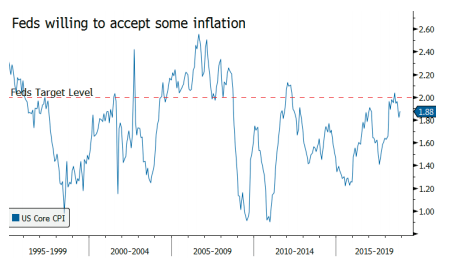

Recent developments have shifted the US back into « goldilocks » conditions for stock prices. Historically, stocks rally in environments with: 1) weak inflation trend 2) low interest rates 3) stable monetary policy 4) solid economic growth and 5) improved outlook for corporate earnings growth. There is increased evidence that each of these conditions will be in place for 2019, which is making the outlook for equity prices look brighter. Developments from Fed policy markets suggest that the path to hike interest rates toward neutral is no longer a priority. Members have opened the concept of accepting additional risk that inflation pressure will continue sending readings above the Fed’s 2% target. Fed forecasts indicate that after a brief rise, it will remain below 2% for several years. Should this happen, it would be positive for equity prices but negative for bonds. Investors revaluing a tight US monetary policy triggered a volatile fourth quarter, with meaningful risk reductions and repricing of stocks. Cynics declare that the sudden shift in Fed policy was a result of stock price decline and pressure from President Trump. But another angle would be that the Fed understood that inflation failed to accelerate as the labor market tightened, no longer seeing the need to tighten prematurely until inflation becomes a critical issue. The Fed is now data dependent, with the length of the pause depending on wage and price pressures. We would expect that Fed to jump into action, should inflation accelerate well above target. In our view, that Fed is unlikely to shift from its neutral bias in the near term and is likely to announce that it will halt balance sheet reduction (a dovish action).

Moving forward, our five conditions for a positive trend in stocks should persist but there are known risks. US economic growth should retain a decent pace despite signs of cooling. The fiscally injected adrenaline pace of 2018 should moderate but recession in 2019 is still a low probability event. The global economy has also slowed, while fears of a trade war are not helping. But there are signals of stabilization, with expectations of 3.5% GDP growth for 2019. Finally, the US election is likely to have real disruption potential. Battle lines have been drawn and the fight will not wait until 2020. As in 1860, this presidential election will be extremely contentious, forcing investors to question the stability of US democratic pillars.