I still remember what my 6th grade computer teacher told our class on the first day of the semester. We were using Commodore Pet computers at the time and a lot has changed since then but the concept hasn’t. He told us “computers do not do what you want them to do, they do what you tell them to do.” This saying definitely holds true in automated trading. Expert advisors are loyal creatures that will do exactly what you tell them to do. They don’t make mistakes, they don’t ask for more pay, go on strike, or get lazy. They do exactly what you tell them to do, within the bounds of what your broker allows them to do. You probably noticed, the title of this post is not “Stupid Things Robots Do,” that is because I am the only one that does stupid things in my miniature trading business. I sometimes TELL them to do something that doesn’t match what I WANT them to do. Usually this is due to a lack of attention to detail. Sometimes however, it is because I want them to do better than I expect or better than I have programmed to do. Below I have listed 3 stupid things I have done when telling my loyal “employees” what to do.

Stupid Thing #1. Believing that running an EA is a turnkey operation: Although these stupid things aren’t listed in any specific order, this is probably the most important lesson I’ve learned to date about automated trading. An EA is like an employee, more specifically an unskilled laborer. We use them to carry out a very specific list of instructions over and over. Sometimes though, doing exactly as instructed can be a bad thing. At my day job we refer to this as “malicious compliance”, doing something you know is wrong with a spiteful attitude because it is what you were told to do. Obviously, EA’s aren’t spiteful but they are never aware that they may be doing the wrong things either. So, like an employee who may not always do the right thing, expert advisors require oversight. This was a big mistake I made when I launched my first expert advisor. The EA had backtested great for the previous year and was profitable over the past two years. When I went live with it, I put it on and walked away. I did monitor its performance but didn’t question whether or not I should leave it on or turn it off. I just had the attitude that it would do fine over the long run if left alone. While this line of thinking may not seem that unreasonable, in reality it is. To think that an Expert Advisor that I built is going to win no matter what, in all market conditions (or at least be profitable on average over long term) is really quite arrogant. If I have created an EA that will make money no matter what, I have effectively created the Holy Grail. Needless to say, shortly after launching my inaugural EA, the USDMXN hit a strong up trend and my EA was still allowed to take short positions. While “maybe” if I would’ve left it alone, it would’ve recovered, I was watching my account be decimated and eventually had to change my strategy. I made a simple change to my strategy that involved more frequent monitoring and changing whether or not I allowed the EA to take short/long positions. For example during strong bullish trends, I would disable short positions and during strong bearish trends I would disable long positions. More frequent involvement or “oversight” of the EA did improve performance but I’ve still got work to do.

Stupid Thing #2. Running an EA on the same currency pair in two windows: Yes, I know this one sounds really bad and it is. This one was stupid enough that it got the attention of my broker. I have been running a strategy that I see a lot of potential in. It is called the Honeymoon Finch, it is a strategy of Rob Booker. Since the strategy detail is Rob’s intellectual property, all I can say is that it involves running EA’s on many currency pairs with small trade sizes and using a “master EA” to control the many. For fans of Lord of the Rings, I will say “one robot to rule them all.” Well, after initially achieving some success with this strategy I decided I wanted to run more currency pairs. Rob provides a list of currency pairs that he suggests running with the Honeymoon Finch. I was already running ten of them and I added five more. So I opened five more windows in MT4 and ran the Finch Robot on the additional currency pairs. However, I failed to look close enough at what I was already running and it turns out that one of the currency pairs I added, I had already been running. Because I am in the United States I am subject to the FIFO (first-in, first-out) rule which requires trades to be exited in a specific order. So when I ended up with two EA’s trying to close trades of the same lot size on the same currency pair in the “wrong” order, it raised flags with the broker. By the way, I never knew they kept track of this. I always assumed that since the computers don’t allow trades that break the rules, the broker didn’t care how many times you tried (not that I would ever try intentionally). Apparently, after so many flags they lock out the trading account. What is worse (and I don’t know why they do it this way), they don’t actually close the trades when they lock out your account. The open positions stay open and your ability to open or close trades with MT4 goes away. So my trades were effectively stuck until I could speak to my broker. This was a very helpless feeling. Fortunately, these trades were on my demo account, I was running the same strategy in parallel with my live account but always make changes on my demo account first.

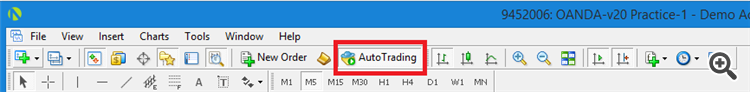

Stupid Thing #3. Turn automated trading off from the “master” enable auto trading button instead of turning off each individual robot: I did this one recently when I took a pause on the Honeymoon Finch style trading. I used this button:

instead of closing the windows or turning off all of the EA’s individually. The problem with this is that the EA’s think they are still trading even though the MT4 account will not allow it. Since the EA’s don’t get confirmation that the trade was completed, they keep trying to place the order. Depending how your EA notifications are written into the code, you may get notifications. In my case, after I did this (it was my live account), my phone started blowing up with messages that trades were opening on my live account. I was able to look at my account and see that no trades were actually opening but it still made me very nervous getting those messages about my live account.

The stupid things that I didn’t list here all involve lack of attention to detail and are obvious “little” things that can result in losses. Things like not entering the settings correctly or not backtesting correctly, these are obvious and I won’t bore you with details of the times I have made these errors. The reason that I am sharing these things is not so you can laugh at me (it is OK if you do, I deserve it) but you can avoid making these mistakes yourself. Remember, trading is a tough business and we need every edge we can get, we can’t afford to make stupid mistakes.