DJIA: investors analyze the results of the last meeting of the Fed

The decision of the Fed to increase the interest rate by 0.25%, and adhere to the previously planned plan for further tightening of monetary policy, was negatively welcomed by investors, which caused a decline in both the dollar and the major US stock indexes.

If dollar buyers were disappointed that the Fed did not directly state the probability of 4 rate increases this year, then the stock market participants are disappointed that the Fed has confirmed the direction of its monetary policy for its further tightening.

Seven of the fifteen participants in the last meeting of the Fed still expect at least four increases this year.

The Fed revised its GDP growth forecasts up by 2.7% this year and 2.4% in 2019 against earlier forecasts of 2.5% and 2.1%, respectively. The Fed also expects that unemployment, which remained at 4.1% in October, will fall to 3.8% this year against 3.9% in the December forecast.

With the opening of today's trading day, the major US indices are declining.

Investors analyze the comments of the Fed, the dynamics of the monetary policy of the world's central banks and the prospects for increasing tensions in trade.

Investors believe that the Fed's confidence in the US economy and its restrained tone, ultimately, should positively affect the stock market. However, the prospect of further intensifying trade tensions could put pressure on stock indices.

Later on Thursday, the White House will announce a series of restrictive measures directed against China, including import duties on Chinese goods with a total value of at least $ 30 billion.

Donald Trump previously repeatedly pointed to the inadmissibility of a huge deficit in the US trade balance in trade with China.

As you know, the US foreign trade deficit in January amounted to a record $ 56.6 billion. And the introduction of import duties in the US should contribute, on the one hand, to increasing the competitiveness of national producers, and on the other hand, indirectly contribute to reducing the deficit of the foreign trade balance.

At the same time, in the long run, world trade wars do not contribute to the growth of the world economy and stock markets.

Today (at 12:00 GMT) the decision on monetary policy should be announced by the Bank of England. Investors will wait for hints of possible actions on the tightening of monetary policy in May.

Volatility in this period of time will grow throughout the financial market, which must be taken into account when making trading decisions.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

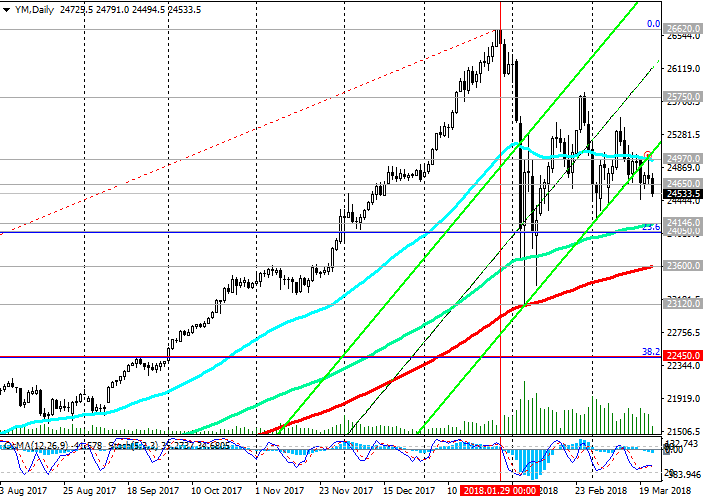

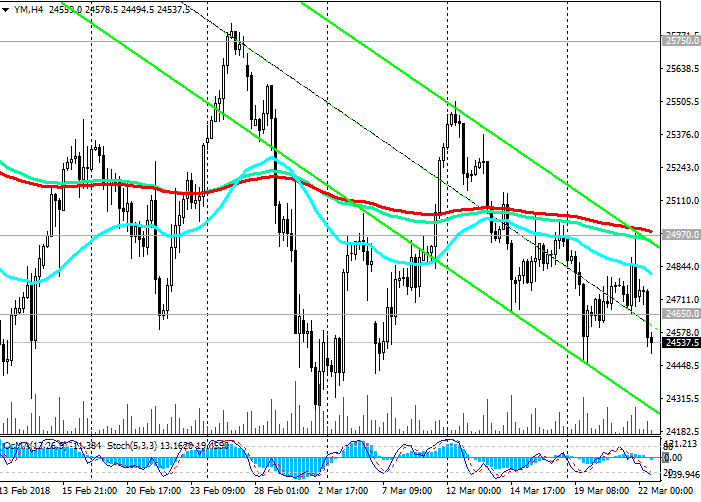

Support levels: 24146.0, 24050.0, 23600.0,

23120.0, 23000.0, 22450.0

Resistance levels: 24650.0, 24970.0, 25750.0, 26620.0

Trading Scenarios

Buy Stop 24850.0. Stop-Loss 24400.0. Take-Profit 25200.0, 25750.0, 26620.0

Sell Stop 24400.0. Stop-Loss 24850.0. Take-Profit 24050.0, 23600.0, 23120.0, 23000.0, 22450.0

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com