DJIA: the index completes the week in a negative territory

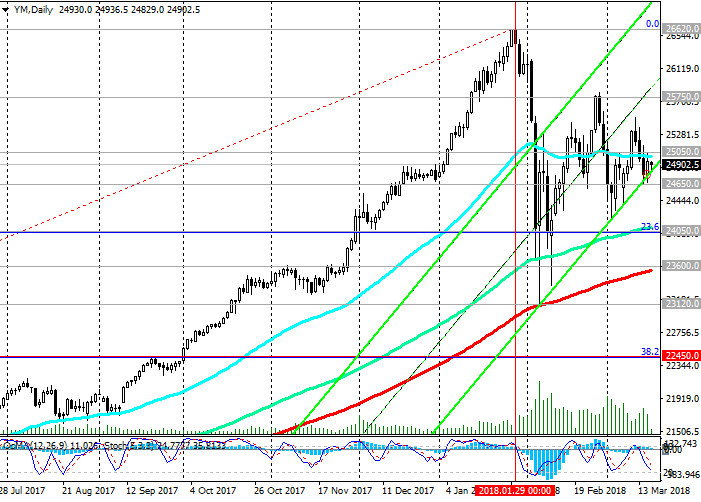

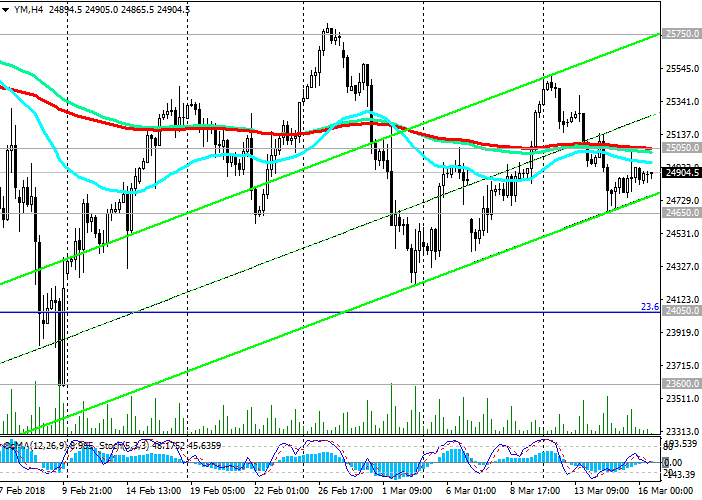

On Thursday, the US stock index Dow Jones Industrial Average rose 0.5% to 24873.00 points. Nevertheless, the DJIA seems to be wrapping up this week and the first half of the month in negative territory. DIJA remains in the bullish long-term trend; however, the positive momentum of further growth is dying out more and more.

Investors continue to assess the impact of the protectionist trade measures of the Donald Trump administration, and also expect additional signals from the Federal Reserve regarding a more rapid increase in interest rates in the United States.

After earlier in March, US President Donald Trump signed a decree on the introduction of import duties on steel and aluminum, representatives of the world's largest economies protested against US protectionist actions. The EU has already prepared a package of countermeasures against American goods. In response, Trump promised to introduce a tax on cars imported from the EU. Now the White House is exploring the possibility of implementing a package of initiatives aimed against China, including duties on the import of certain goods.

However, China is the largest holder of US government bonds and stock assets. If China, in response to the US protectionist actions, begins to massively get rid of them, then this may cause a new wave of sales on the US stock market.

The yield on 10-year US Treasury bonds rose to 2.824% from 2.815% on Wednesday, staying close to the psychologically important level of 3.000%. The increase in bond yields in early 2018 was one of the reasons for the decline in world stock markets. Profitability can grow even more on the background of the normalization of monetary policy and the further strengthening of the world economy. If their profitability exceeds the mark of 3.000%, it will sharply increase the degree of anxiety and lead to another wave of sales of stock assets, according to many economists.

Investors are still cautious after the sharp sales observed in early February.

Now investors are preparing for the Fed meeting, which will be held next week (March 20-21). It is expected that the Fed will raise the rate by 0.25%. Market participants will carefully study the text of the Fed's accompanying statement on this decision in order to understand the prospects for monetary policy. At the December meeting, the leaders of the Federal Reserve planned 3 rate increases in 2018 and 2 increases in 2019. If the Federal Reserve signals to the Fed's determination to tighten monetary policy at a faster pace, the outlook for the US stock market will deteriorate significantly.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support levels: 24650.0, 24050.0, 23600.0,

23120.0, 23000.0, 22450.0

Resistance levels: 25050.0, 25750.0, 26620.0

Trading Scenarios

Buy Stop 25070.0. Stop-Loss 24600.0. Take-Profit 25200.0, 25750.0, 26620.0

Sell Stop 24600.0. Stop-Loss 25070.0. Take-Profit 24050.0, 23600.0, 23120.0, 23000.0, 22450.0

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com