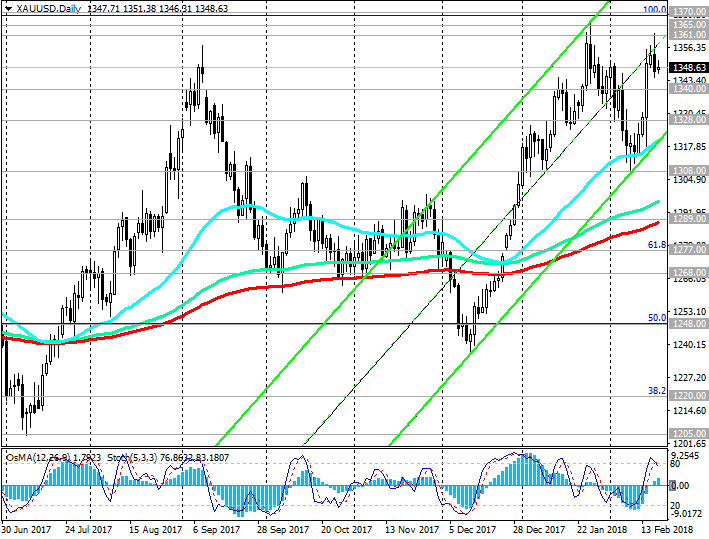

After on Friday the price of gold updated the monthly maximum, having risen to the mark of 1361.00 dollars per troy ounce, then the price went to the corrective phase. The XAU / USD declined, retreating to the mark near the support level of 1348.00 (the opening price of the month). Last month, the price of gold reached the next local multi-month high near the mark of 1365.00 dollars per ounce. The last time near this mark the price was in July 2016.

Nevertheless, with regard to the further dynamics of the price of gold, there are two opposing opinions of experts. The first view is that, amid rising inflation, the Fed will begin to raise interest rates at a faster rate, which will increase the interest to the dollar purchases. Gold does not bring investment income and is used, mainly, as a hedging instrument for risks during the period of economic or political instability in the world. In periods of increasing interest rates, gold, as a rule, becomes cheaper, giving way to assets that generate revenue, such as government bonds. Due to the growth of inflation expectations, the yield of 10-year US Treasury bonds returned to almost 3%.

In this sense, the publication on Wednesday (19:00 GMT) of the minutes from the January meeting of the Fed, the latter under the leadership of Janet Yellen, will be of interest to investors this week. The minutes of the meeting may give market participants an idea that the Fed's management is thinking about the possible economic consequences of reforming the tax system and about accelerating inflation in the US.

The contrary opinion of experts is that, despite the expected increase in interest rates, gold still has good chances for growth as a means of protecting against the growth of consumer inflation.

Thus, the probability of further growth in gold prices outweighs the likelihood of their decline. Taking into account the multi-month cycles, the long-term targets for the growth of the gold price will be the levels of 1390.00, 1425.00 dollars per troy ounce.

In view of the fact that the US has a day off ("President's Day"), and American banks and exchanges are closed, the sluggish dynamics of trading on financial markets is expected until the end of the trading day.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

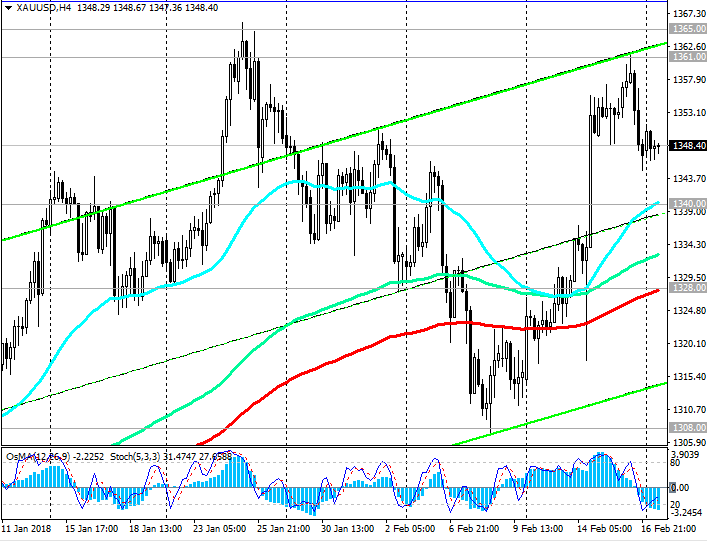

Support levels: 1340.00, 1328.00, 1308.00,

1289.00, 1277.00, 1268.00, 1248.00

Resistance levels: 1361.00, 1365.00, 1370.00, 1390.00, 1425.00

Trading Scenarios

Sell Stop 1343.00. Stop-loss 1358.00. Take-Profit 1340.00, 1328.00

Buy Stop 1358.00. Stop-Loss 1343.00. Take-Profit 1361.00, 1365.00, 1370.00, 1390.00, 1425.00

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com