AUD/USD: there are no arguments in favor of raising RBA interest rates

Unlike the Fed, other major global central banks are in no hurry to tighten their monetary policies. After earlier this week the RB of Australia and the RB of New Zealand decided not to change their interest rates, on Thursday another central bank, the Bank of England, decided to leave the interest rate at the current level of 0.5%, which coincided with the expectations of market participants. The rhetoric of the accompanying statements and comments of representatives of these banks was also mild.

In a tone to these statements on Thursday, the leaders of the Bank of Japan also spoke. Thus, the head of the Bank of Japan Haruhiko Kuroda said that the Japanese central bank will continue the large-scale mitigation program, since inflation is still far from the target level of 2%. "It's too early to discuss the timing and methods of getting out of soft politics. We will continue to buy ETF, REIT at the current pace", Kuroda added. Board Member of the Bank of Japan Hitoshi Suzuki supported Kuroda, noting that "the conditions necessary to further accelerate the rate of price growth" are created, thanks to a strong labor market, as well as the government's efforts to increase wages and increase productivity.

During today's Asian session, the RBA published comments on its decision to keep the interest rate at the current level. The key rate of the RBA remains at a record low for the RBA of 1.5% since mid-2016, and economists believe that the central bank will not change it after 2019.

The Reserve Bank of Australia predicts the retention of slow inflation and the inability to achieve full employment over the next few years. The RBA expects that core inflation will accelerate gradually and reach the lower boundary of the target range of 2% -3% by mid-2019. And the pace of core inflation is critical for the RBA monetary policy. The main source of uncertainty for the RBA remains the slow growth of wages. Acceleration of wage growth is a prerequisite for achieving the target inflation range of 2% -3%. The RBA gave a forecast for unemployment - 5.25% by the end of 2018. Currently, the unemployment rate is 5.5%. Thus, unemployment will remain above 5%, which, according to the RBA, does not correspond to full employment and significantly reduces the need for monetary tightening, despite the fact that economic growth in the country will accelerate and by mid-2019 will be 3.5% per annum.

Thus, the RBA's forecasts reflect the comments of the managing director Philip Lowe, who on Thursday said there was no argument in favor of raising interest rates in the short term.

At the same time, the Fed, it seems, does not intend to back away from its plans to tighten monetary policy. So, the president of the Federal Reserve Bank of Kansas City and the member of the FOMC with the right to vote, Esther George, said on Thursday that the Committee on Open Market Operations now intends to raise rates three times this year and three times in 2019. According to her, "this is a logical basic scenario in case the prospects do not change significantly".

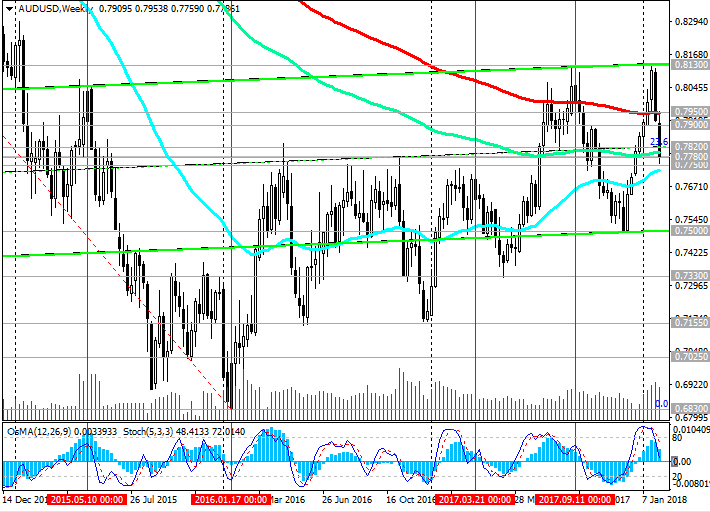

Despite the fact that many economists are skeptical about the current strengthening of the US dollar, considering that its growth will be short-term and provide opportunities for its sale at higher levels, a more accurate long-term trading strategy for the AUD / USD will be a short position.

Against the background of a different focus of monetary policy in the US and Australia, we can expect further decline in the AUD/USD.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

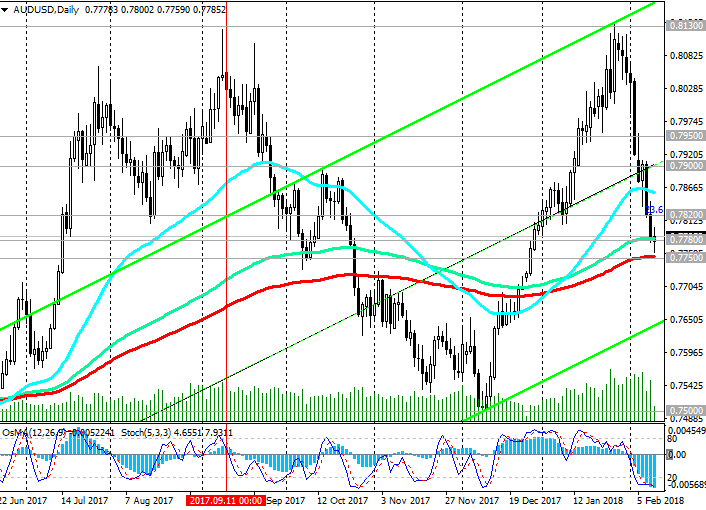

Support levels: 0.7780, 0.7750, 0.7620, 0.7500,

0.7330

Resistance levels: 0.7820, 0.7900, 0.7950, 0.8000, 0.8130

Trading Scenarios

Sell Stop 0.7740. Stop-Loss 0.7830. Take-Profit 0.7700, 0.7620, 0.7500, 0.7330

Buy Stop 0.7830. Stop-Loss 0.7740. Take-Profit 0.7900, 0.7950, 0.8000, 0.8130

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com