Nikkey225: The Bank of Japan intends to continue a large-scale program of mitigation

As Haruhiko Kuroda said during today's press conference, the Japanese central bank will continue the large-scale mitigation program, as inflation is still far from the target level of 2%.

This is, almost traditional in recent months, the statement of the head of the Bank of Japan was addressed primarily to those investors who expect that next year the Bank of Japan may begin to wind down its extra soft monetary policy.

If earlier Kuroda spoke about "readiness for the most decisive measures to support the Japanese economy", which implies continuation or expansion of extra soft monetary policy in Japan, today he said that "we (the leadership of the Bank of Japan) will further support the cycle of revenue growth , supporting a moderate increase in wages and prices."

According to official data released today, in November, the unemployment rate in Japan fell to 2.7%. This means that the conditions on the labor market are most favorable for the growth of wages for last 24 years.

The CPI National Consumer Price Index for November, published by the Bureau of Statistics of Japan, came out today with an increase of 0.6% (in annual terms), which is better than the forecast of + 0.3% and + 0.2% in October. CPI is the most significant inflationary barometer of changes in Japan's consumer trends. The growth of the index positively affects the yen's quotations and the stock index.

The Bank of Japan and the authorities of the country are trying to overcome a long period of deflation and stagnation.

Nevertheless, the positive Japanese macro statistics and Kuroda's statement were rather restrainedly perceived on the Japanese stock market.

The yield of 10-year Japanese government bonds rose to 0.045% from 0.035%.

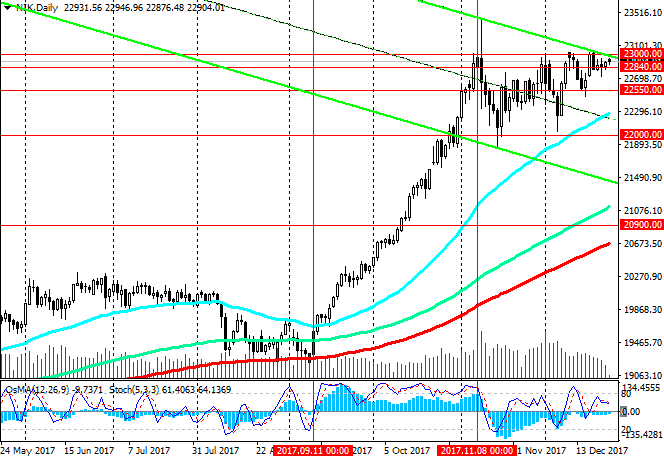

After the Japanese main stock index Nikkey225 jumped by about 20% in the period from September to November, the last few weeks it is just below 23000.00, and today, at the end of the Asian trading session, it was trading near 22900.00.

Today, trading volumes are low because the European stock exchanges, as well as the markets of Australia, New Zealand and Hong Kong are closed today due to the celebration of Boxing Day. However, the US exchanges are working today. Therefore, volatility with the opening of US stock exchanges will increase.

Nevertheless, the full activity of trade will be restored in the next year. On the eve of the New Year celebration, the activity of traders and trading volumes will remain low.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support and resistance levels

After in November the Nikkey225 index reached the annual maximum near the mark of 23430.00, the last weeks the index is traded in the range, the upper limit of which passes near the resistance level of 23000.00. At the same time, the Nikkey225 index keeps positive dynamics, trading in the upward channel on the weekly chart since September 2017.

The last days trading activity is low due to the upcoming New Year holidays.

In case of fastening above the resistance level of 23000.00, growth will resume.

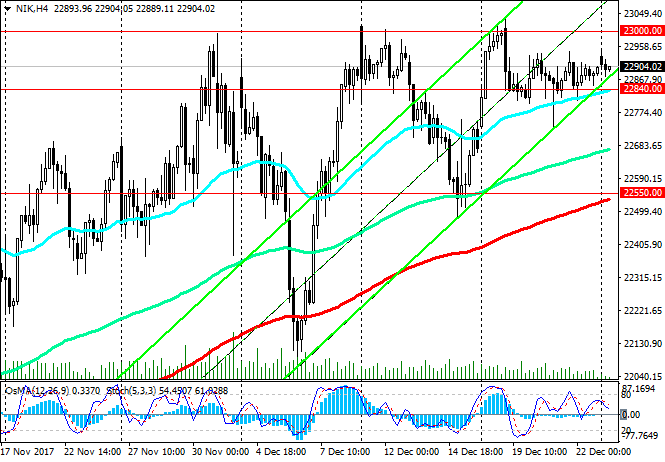

The scenario for the decline will be related to the breakdown of the short-term support level of 22550.00 (EMA200 on the 4-hour chart). The goal of the decline is the support level of 22000.00 (November, December low and the low limit of the range formed between the levels of 23000.00 and 22000.00).

The long-term positive dynamics of the index remains in force, as long as the index trades above the support level of 20900.00 (zone of ЕМА144, ЕМА200 on the daily chart and highs of 2015).

Support levels: 22840.00, 22550.00, 22000.00, 20900.00

Resistance levels: 23000.00, 23450.00

Trading Scenarios

Sell Stop 22700.00. Stop-Loss 23100.00. Objectives 22550.00, 22000.00, 21000.00

Buy Stop 23100.00. Stop-Loss 22700.00. Objectives 23450.00, 24000.00

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com