AUD/USD: The RBA kept its benchmark interest rate at 1.5%

During today's Asian trading session, the Australian dollar was growing.

First, it rose against the background of more positive than expected retail sales figures for October. According to the data, retail sales in October in Australia increased by 0.5%, exceeding expectations. In September, the indicator grew only by 0.1%, and in August and July, retail sales in Australia decreased by 0.6% and 0.2%, respectively.

Then, the Australian dollar received support from positive data from China, according to which activity in the services sector of China in November grew at a faster pace. The index of supply managers (PMI) for the service sector of China, calculated by Caixin Media Co. and research company Markit, in November it increased to 51.9 against 51.2 in October.

Later (at 03:30 GMT), the RBA decision was published, according to which the interest rate was saved at the current level of 1.5%. This RBA decision was expected, and it did not make a strong impression on market participants. The Australian dollar reacted rather weakly to the decision of the RBA.

In the accompanying statement of the RBA it was stated that "interest rates correspond to the goals in relation to GDP, inflation. Low rates support the Australian economy, and a higher rate of the Australian dollar will slow the economic recovery".

RBA Governor Philip Lowe reiterated that, in the opinion of the board, "it is advisable to leave monetary policy unchanged at this meeting in order to maintain a stable growth of the economy and achieve a target inflation rate over time".

Contradictory economic indicators (record low wage growth rate, surplus labor market resources and weak inflationary pressures) contribute to the cautious approach of RBA leaders towards monetary policy. Therefore, in the foreseeable future, interest rates are likely to remain unchanged.

At the same time, strong macro data and positive news on the success of the presidential administration in promoting tax reform continue to flow from the US. This will accelerate economic growth in the country and increase inflation. This, in turn, will allow the Fed to aggressively tighten monetary policy, which will increase the attractiveness of the dollar and the assets of the American stock market.

Thus, a different focus of monetary policy in Australia and the US will further reduce AUD / USD in the medium term.

From the news for today we are waiting for data from the USA. At 14:45 (GMT) will be published indexes of business activity in the service sector (PMI), which is an indicator of the state of the services sector in the US economy. According to the forecast, a slight decrease is expected after a strong growth in October (59.0 versus 60.1 in October). Nevertheless, the result above 50 is considered positive and strengthens the US dollar. It is likely that the decline in the US dollar, if the data will be weaker than the forecast values, will be short-term in nature.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support and resistance levels

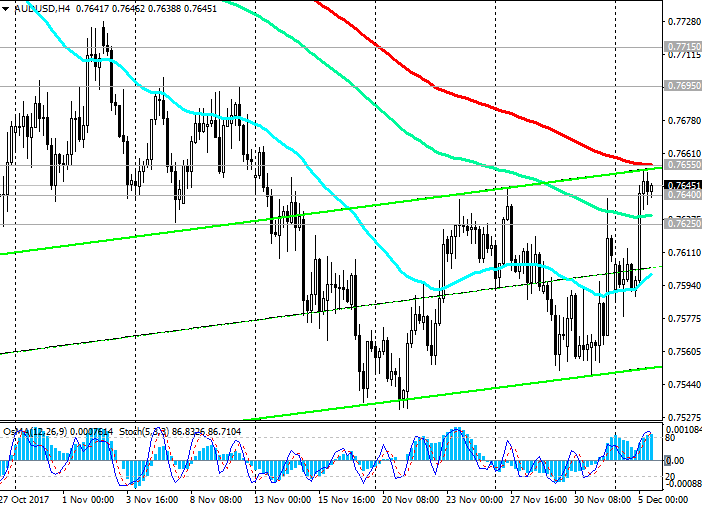

Indicators OsMA and Stochastics on the 4-hour, daily charts are on the buyers side. Therefore, if the resistance level of 0.7655 breaks, the AUD / USD growth will continue to the resistance level of 0.7695 (EMA200 on the daily chart).

Nevertheless, the downward dynamics prevails.

Support levels: 0.7625, 0.7600, 0.7520, 0.7500, 0.7460

Resistance levels: 0.7640, 0.7655, 0.7695, 0.7715, 0.7740, 0.7800, 0.7850, 0.7885, 0.7950

Trading Scenarios

Sell in the market. Stop-Loss 0.7665. Take-Profit 0.7625, 0.7600, 0.7520, 0.7500, 0.7460

Buy Stop 0.7665. Stop-Loss 0.7620. Take-Profit 0.7695, 0.7715, 0.7740, 0.7800, 0.7850, 0.7885, 0.7950

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com