USD/JPY: the Nikkei index breaks records, and the yen remains under pressure

After a 6-week continuous growth, the Japanese stock index Nikkei reached several multi-year highs, bargaining at the end of today's Asian session near the mark of 21500.00. At the same time, amid the growth of the Japanese stock market, the yen remains under pressure and is down against the dollar, since early September.

This Sunday in Japan, early elections will be held, and it is expected that the ruling coalition of Prime Minister Shinzo Abe will remain in power. Abe supports soft monetary policy, which contributes to the growth of the stock market and the reduction of the yen.

Head of the Central Bank of Japan Haruhiko Kuroda again promised to continue the implementation of extra soft monetary policy and expressed confidence in the strength of the country's economy. In his opinion, the current policy corresponds to short-term and long-term target levels of the Bank of Japan. "The recent improvement in the situation was caused by the balanced growth of domestic and external demand, and I believe in significant economic growth stability," Kuroda said. At present, the Bank of Japan expects that inflation will reach 2% by March 2020, but this forecast can be revised at the end of October, when the next meeting of the Bank of Japan on monetary policy (October 31) will take place.

At a meeting last month, the Bank of Japan reiterated its commitment to buy government bonds in the amount of 80 trillion yen per year. The head of the Bank of Japan at a subsequent press conference promised that "we will patiently adhere to the policy of powerful mitigation in order to achieve inflation of 2%" and "take additional mitigation measures, if necessary".

At the same time, the dollar is growing again in the foreign exchange market. As it became known, the US Senate approved the draft budget 51 votes to 49, which is one of the conditions for unlocking the procedure that the Republicans plan to use to make changes in the taxation system with the help of the votes of only the Republican Party.

"Adoption of the budget is critical for tax reform that will strengthen our economy after several years of stagnation under the previous administration", said Mitch McConnell, leader of the Republican majority in the Senate.

The given news stimulated the growth of the dollar. The index of the dollar WSJ rose from the opening of today's trading day at 0.4% and reached a maximum for the month near the 87.00 mark. The yield of 10-year US government bonds rose to 2,360% from the level of 2,323%, recorded on Thursday night in New York.

After yesterday's decline, the pair USD / JPY is rising again today. Tensions between the US and North Korea declined, and investors again returned to buying US assets.

After the release of good economic indicators for the United States, investors say that the interest rates are now more likely to be raised again in December, and the economic growth in the US is stable, investors say in favor of raising the interest rate and receiving encouraging news from the White House.

According to the CME Group, the probability of a rate hike in December is taken into account by investors at 93%.

In general, the fundamental factors say (at the moment) in favor of further growth in the USD/JPY.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support and resistance levels

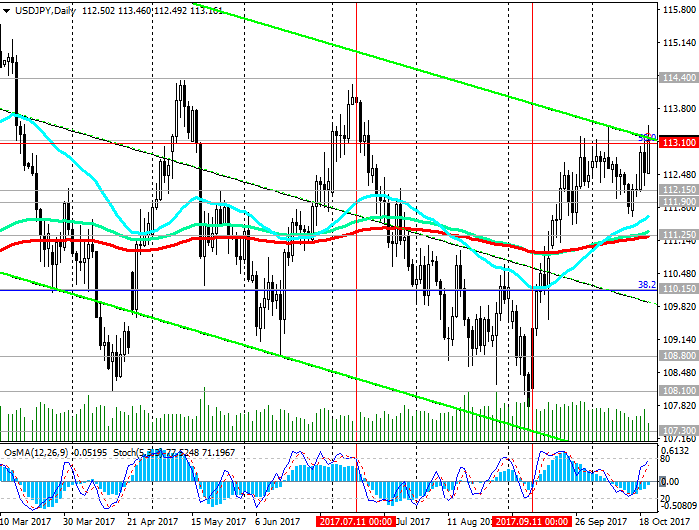

In the course of today's European session, the USD/JPY is trying to develop an upward trend and is making an attempt to break through the resistance level 113.10 (the top line of the descending channels on the 4-hour, daily, weekly charts, as well as the Fibonacci 50% correction to the pair growth since August last year and level 99.90).

While USD / JPY is trading above the key support level of 111.25 (EMA200, EMA144 on the daily chart, EMA50 on the weekly chart), its positive dynamics persists. In case of breakdown of the resistance level 113.10, the target of the growth will be level 114.40 (the upper limit of the range between the levels 108.10 and 114.40).

The different focus of the monetary policies of the Fed and the Bank of Japan is a powerful fundamental factor in favor of further growth in the USD / JPY.

The alternative scenario implies a return of USD / JPY to the level of 111.25 and a resumption of decline in the downlink on the weekly chart, the lower limit of which runs near the level of 106.50 (Fibonacci level of 23.6%). The nearest targets will be support levels of 111.00, 110.15 (Fibonacci level of 38.2%).

The signal for opening short positions will be the break of the short-term support level 111.90 (EMA200 on the 4-hour chart).

Support levels: 112.15, 111.90, 111.25, 111.00, 110.15, 110.00, 108.80, 108.10, 107.30, 107.00, 106.50, 105.00

Resistance levels: 113.10, 113.50, 114.40, 115.00, 116.00

Trading Scenarios

Buy Stop 113.50. Stop Loss 112.90. Take-Profit 114.00, 114.40, 115.00, 116.00

Sell Stop 112.90. Stop Loss 113.50. Take-Profit 112.15, 111.90, 111.25, 111.00, 110.15, 110.00, 108.80, 108.10, 107.30, 107.00, 106.50, 105.00

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com