EUR/USD: euro strengthened, despite growing political uncertainty

Despite the growth of political uncertainty in Europe, where protest meetings took place in Barcelona last weekend, the euro is growing with the opening of today's trading day. Concerns about the integrity of the Eurozone again intensified after the referendum in Catalonia, held on October 1. This region of Spain voted for secession. The Spanish government called the vote unconstitutional.

The euro's position suffered as early as last month, when the German Bundestag elections were held. The ruling "Christian Democratic Union" (CDU) received 33% of the votes of the deputies - the weakest result for this party since 1949. New elections in Germany are unlikely, but it is possible that if the winning ruling party, Angela Merkel, has problems in finding supporters for the bloc. Political instability in this country could have the most negative impact on the positions of the single currency.

Nevertheless, investors believe in the future of the European economy. The Sentix indicator of investor confidence released today was in October with a value of 29.7 (the forecast was 28.5 and 28.2 in the previous month). This is the leading indicator of the economic health of the Eurozone, as changes in investor sentiment may be an early signal for future economic activity.

The German industrial production figures published in August show that the country's economy has overcome the seasonal decline and has returned to growth. Germany's industrial production in August grew by 2.6% compared with July (forecast was + 0.7%). Production orders in Germany in August rose by 3.6% (+ 0.7% in the previous report) and 7.8% in annual terms (+ 4.7% in the previous report). At the same time, export orders in the manufacturing sector in Germany grew by 4.3%. Such positive data were presented by the Statistical Office of Germany last Friday.

Germany remains the center of the European Union, and its economy is the locomotive of the European economy. Positive macro statistics from Germany can testify to positive growth prospects not only of the German, but of the entire Eurozone economy.

The volume of trading today in financial markets was small due to the day off (Columbus Day) in the US. Volatility in the financial markets will grow again on Tuesday.

Technical analysis

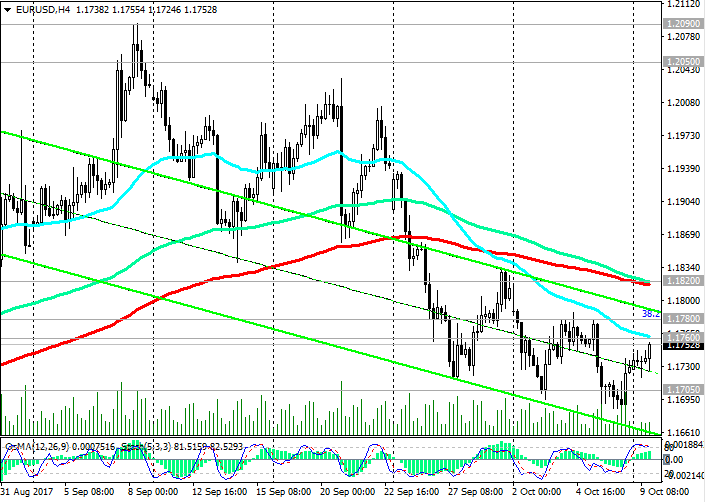

The EUR / USD is trading at the bottom of the upward channel on the daily chart, below resistance levels 1.1760 (EMA200 on the 1-hour chart), 1.1780 (EMA50 on the daily chart and 38.2% Fibonacci level), 1.1820 (EMA200 on the 4-hour chart). The breakdown of these levels will provoke the resumption of growth within the uplink on the weekly chart with a long target of 1.2180 (the upper bound of the channel and the Fibonacci level of 50%). The first signal for growth will be a breakdown of the short-term resistance level at 1.1760.

The alternative scenario involves a breakdown of the support level 1.1705 (the lower limit of the uplink on the daily chart), which will cause a decline to the support level 1.1630 (EMA200 on the weekly chart). The break of this level will open the way to support levels 1.1360 (EMA200 on the daily chart), 1.1285 (Fibonacci level of 23.6% of corrective growth from the lows reached in February 2015 in the last wave of global decline of the pair from the level of 1.3900).

Indicators OsMA and Stochastics on the daily, weekly, monthly charts are on the side of sellers.

Support levels: 1.1705, 1.1630, 1.1360, 1.1285

Resistance levels: 1.1760, 1.1780, 1.1820, 1.1925, 1.2000, 1.2050, 1.2090, 1.2100, 1.2180

Trading recommendations

Sell Stop 1.1710. Stop-Loss 1.1770. Take-Profit 1.1670, 1.1630, 1.1600, 1.1400

Buy Stop 1.1770. Stop-Loss 1.1710. Take-Profit 1.1800, 1.1820, 1.1870, 1.1925, 1.2000, 1.2050, 1.2090, 1.2100, 1.2180