GBP/USD: The dollar is growing before the publication of NFP

After the National Bureau of Statistics of Great Britain presented disappointing data on the foreign trade balance of Great Britain, and also on the level of industrial production for May, the pound declined in the foreign exchange market. Against the euro, the pound fell to the lowest level in nine days, and against the dollar - by 0.4% (by about 60 points), falling to the level of 1.2900. In view of the decline in manufacturing in the manufacturing industry, the decline in UK industrial production was 0.1% compared to the previous month (the forecast was + 0.3%). Published data indicate that in the second quarter of the country's economic growth remains weak. The deficit of foreign trade in Britain at the same time in May increased by almost a billion pounds to 11.9 billion pounds (from 10.6 billion pounds in April and against a forecast of 10.8 billion pounds). The sharp increase in inflation in the UK against the background of Brexit puts pressure on consumer spending, which over the past few years has been the engine of the UK economy's growth. Now, in order to level out the slowdown in the economy, it is necessary that production and trade grow at a faster rate. In fact, the reverse process occurs. In the 1st quarter of 2017, the UK economy grew 0.2% compared to the previous quarter against 0.7% in the fourth quarter of 2016, in the second quarter, the growth in the economy could slow even further and, according to some estimates, move to Negative territory.

During his speech at the forum of the European Central Bank in Portugal in late June, the head of the Bank of England, Mark Carney, said that "partial refusal of stimulus measures is likely to be necessary, since the Bank of England will no longer have to compromise, and the decision-making process will enter in the usual course".

Now, after the release of weak macro data on the hawk positions in the Bank of England suffered a tangible blow. Apparently, disappointing economic data can give the monetary authorities of the UK an opportunity to seriously not think about raising the interest rate, but to stimulate the economy. In any case, the Brexit process will have a negative impact on the economy of the country for a long time. And with any corrective growth in the British currency, there are many investors who will want to sell it, especially after the release of another negative portion of the British macro statistics. Today, investors' attention is focused on the G20 summit, which began in Hamburg, at a meeting of the Russian and US presidents, which is scheduled to begin at 17:00 local time, as well as publication at 12:30 (GMT) of data from the labor market in the United States. Strong performance is expected. The growth of employment in the non-agricultural sector of the US economy in June was, according to economists, 179,000 new jobs, which is 41,000 higher than the previous index, unemployment in June remained at the same level of 4.3%, and the average hourly earnings rose by 0.3% %.

If the forecast is confirmed, the dollar will grow in the foreign exchange market. In any case, when making trading decisions, it is necessary to take into account that when these indicators are published, a surge in volatility is expected in the trades throughout the financial market, including GBP / USD.

*)An advanced fundamental analysis is available on the Tifia website at tifia.com/analytics

Support and resistance levels

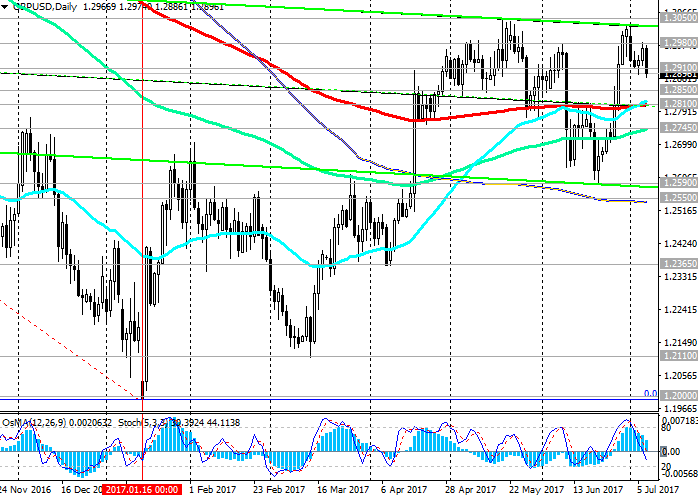

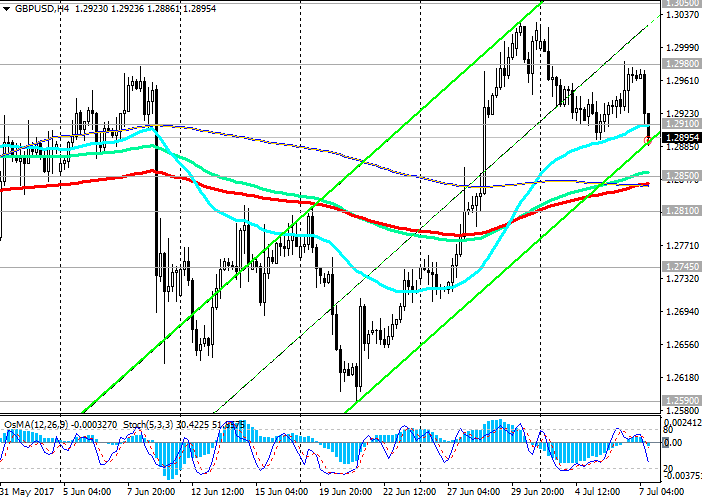

After the publication of macro data for the UK, the GBP / USD pair broke through the short-term support level of 1.2910 (EMA200 at 1-hour) and continues to decline to support level 1.2850 (EMA200 on the 4-hour chart).

Indicators OsMA and Stochastics on the 1-hour, 4-hour, daily charts turned to short positions, signaling the continuation of the downward correction. The next important goal of the pair GBP / USD decline is the level of 1.2810 (EMA200 on the daily chart). In the case of the breakdown of the support level 1.2745 (EMA144 on the daily chart), the GBP / USD decline will accelerate to targets near the levels of 1.2590 (June lows), 1.2550 (the lower limit of the uplink on the weekly chart), 1.2365, 1.2110.

If the positive pound dynamics continues, then the GBP / USD pair will resume growth with the targets of 1.3050 (May highs), 1.3100, 1.3210 (Fibonacci level 23.6% correction to the pair GBP / USD decline in the wave, which began in July 2014 near the level of 1.7200 And the upper limit of the ascending channel on the weekly chart).

Support levels: 1.2850, 1.2810, 1.2745, 1.2700, 1.2640, 1.2590, 1.2550, 1.2365, 1.2110

Resistance levels: 1.2980, 1.3050, 1.3100, 1.3210, 1.3300

Trading Scenarios

Sell Stop 1.2880. Stop-Loss 1.2930. Take-Profit 1.2820, 1.2735, 1.2700, 1.2640, 1.2550, 1.2485

Buy Stop 1.2930. Stop-Loss 1.2880. Take-Profit 1.2980, 1.3050, 1.3100, 1.3210, 1.3300

*) For up-to-date and detailed analytics and news on the forex market visit Tifia company website tifia.com