It seems that the main European stock indexes can finish this week in a negative territory. The election of the president of France is already behind, and the positive momentum begins to fade as weak macro statistics from the Eurozone arrive.

ECB President Mario Draghi earlier this week confirmed that economic recovery is accelerating, but core inflation is still too weak to change the monetary policy of the bank. Here and today in the Eurozone came some macro statistics, which confirm the words of Mario Draghi. So, the preliminary index of consumer prices (CPI) of the Eurozone in May grew by 1.4% (against the forecast of + 1.5% and + 1.9% in April). Unemployment in the Eurozone in April fell by 0.1%, but still remains high (9.3%).

Decrease in indices is observed throughout the world. So, the US stock indexes on Tuesday fell under the pressure of shares of oil and gas and financial companies. The oil and gas subindex in the S & P500 showed the worst results for the day, falling by 1.3%. The European StoxxEurope600 index lost another 0.3% on Tuesday, with banks and insurance companies leading the decline. The EuroStoxx50 index was down yesterday for the fifth consecutive session.

At the beginning of today's European trading session, the EuroStoxx50 index is trading in a narrow range near the mark of 3554.0, however, is under pressure from incoming weak macro statistics for the Eurozone.

As has been repeatedly announced by the leaders, the ECB is unlikely to go on winding up the extra soft monetary policy at the moment. The ECB management believes that the growth of the Eurozone economy is still weak enough to begin curtailing the QE program in the Eurozone. So far, this supports European indices. And still, among investors, there is talk that the ECB may announce the curtailment of the QE program in the Eurozone. The ECB's next meeting on monetary policy will be held on June 8. As ECB leaders said earlier, the rate hike will not begin earlier than the quantitative easing program, at which the European Central Bank will buy European assets worth 60 billion euros a month, will be completed.

Support and resistance levels

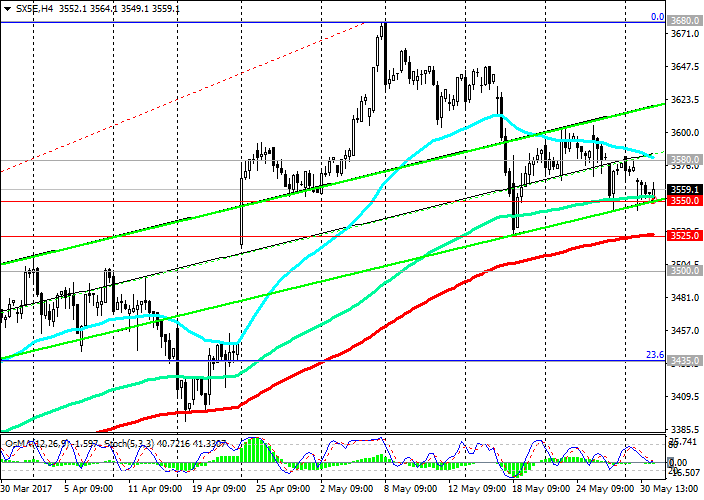

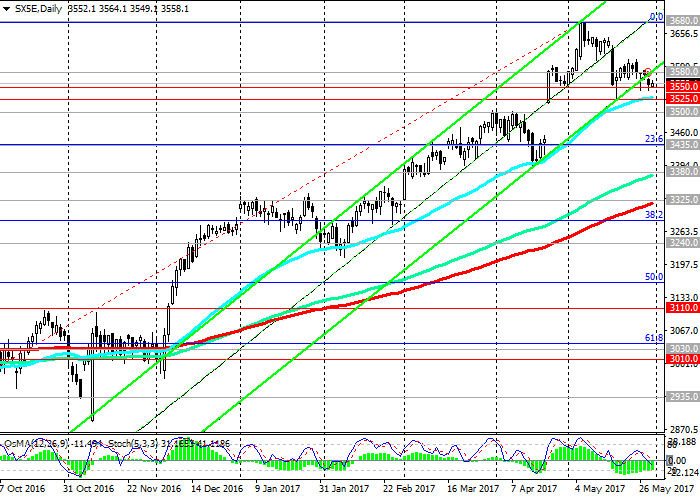

At the beginning of the month against the backdrop of the election of the new French president, the EuroStoxx50 index reached a new annual maximum near the mark of 3680.0. After that, a gradual decline in the index started, and at the moment the EuroStoxx50 index is traded at the short-term support level of 3550.0 (EMA144 and the bottom line of the uplink on the 4-hour chart).

Indicators OsMA and Stochastics on the 4-hour, daily, weekly charts went to the side of sellers.

If the EuroStoxx50 index falls further, the next target will be the support level of 3525.0 (EMA200 on the 4-hour chart, EMA50 on the daily chart).

The level is strong enough. In general, the positive dynamics of the EuroStoxx50 index remains. In case of rebound from the level of 3525.0, the growth of the EuroStoxx50 index may resume. At least, the ECB's propensity to continue the extra soft monetary policy contributes to this.

Medium-term short positions will become relevant only after the EuroStoxx50 index falls below the level of 3500.0 (March and April highs on the eve of the first round of presidential elections in France). The reduction targets will be support levels 3435.0 (Fibonacci level 23.6% correction to the wave of growth since June 2016), 3380.0 (EMA144), 3325.0 (EMA200 on the daily chart).

Support levels: 3525.0, 3500.0, 3435.0, 3380.0, 3325.0

Resistance levels: 3580.0, 3680.0, 3700.0

Trading Scenarios

Sell Stop 3520.0 Stop-Loss 3590.0. Take-Profit 3500.0, 3435.0, 3380.0, 3325.0

Buy Stop 3590.0. Stop-Loss 3520.0. Take-Profit 3600.0, 3680.0, 3700.0

*) Actual and detailed analytics can be found on the Tifia website at tifia.com/analytics