As the Minister of Oil of Saudi Arabia, OPEC and countries outside the cartel stated in Vienna today, they will probably leave the amount of reduction unchanged under the 9-month extension of the deal. According to the minister, if necessary, OPEC may increase the volume of production reduction, but so far it is not necessary. After the Saudi oil minister's speech, oil prices fell sharply.

Meanwhile, the increase in oil production in the US and other major oil-producing countries, largely offset the efforts of OPE to limit oil production. After the entry into force of the OPEC agreement, other countries as a whole reduced production by about 1.8 million barrels a day. During the same time, the US increased production by 750,000 barrels per day to 9.3 million barrels a day, the maximum since the summer of 2015. In fact, by the efforts of the US alone, more than a third of the reduced production was offset. And this, apart other countries, such as Brazil, Libya, Canada.

In the US there is an active increase in oil production. So, according to the data provided by American oil service company Baker Hughes on Friday, the number of active oil drilling rigs in the United States again rose to 720 units in the previous week.

The number of drilling in the US has been steadily increasing since the summer of last year. American investment companies continue to invest in shale companies. At the same time, American drilling companies have developed a number of financial protection tools that insure against losses in the event of a fall in prices. Innovations in the oil industry of the US economy make it possible to achieve all the best results in oil production. The increase in efficiency makes it possible to reduce the cost of production to less than $ 40 per barrel against $ 63 in 2014. There are all prerequisites to the fact that the volume of supply of oil in the US will increasingly increase, further reducing the effect of the agreement within OPEC.

If, at the OPEC meeting, it is announced that it is possible to expand the volume of cuts and further extend after the expiration of the next 9-month period, the price of oil will be a powerful stimulus for growth.

In general, the extension of the deal to reduce production in the same volumes was expected by market participants, and it is mostly already taken into account in prices. It is possible that after a small increase in oil prices will return to a downward trend.

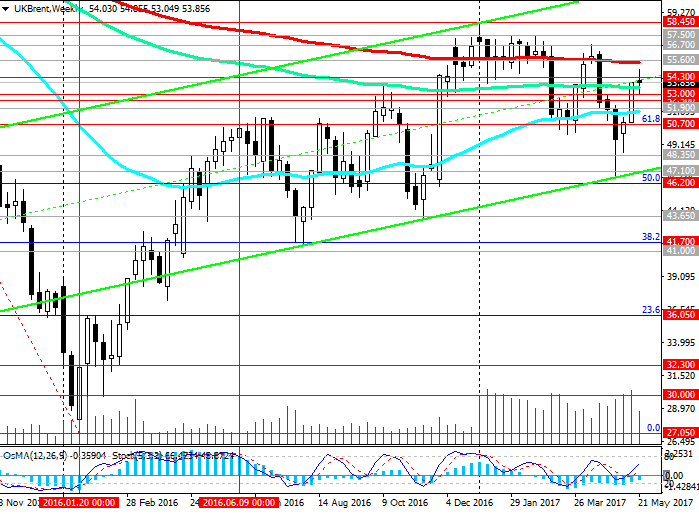

Support and resistance levels

The price of Brent crude oil could not gain a foothold above the level of resistance at 54.30 (the upper limit of the descending channel on the daily chart) and in the course of today's European session is declining.

Indicators OsMA and Stochastics on the 1-hour and 4-hour charts went to the side of sellers. On the daily chart, indicators also unfold to short positions.

After the speech of Saudi Arabia's oil minister, the price dropped sharply, reaching a short-term support level of 53.00 (EMA200 on the 1-hour chart). If the price roll is repeated downward, and support levels of 53.00, 52.50 (EMA200 on the 4-hour chart, EMA144 on the daily chart) will be broken, it is likely that the price will decline further to support level 51.90 (EMA200 on the daily chart).

In the event of a breakthrough in the support level of 50.70 (the Fibonacci level of 61.8% of the correction to the decline from the level of 65.30 from June 2015 to the absolute minimums of 2016 near the 27.00 mark) the price will go deeper into the descending channel on the daily chart and to levels 48.35, 47.10, 46.20. In case of consolidation below level 46.20 (the Fibonacci level of 50% and the lower border of the descending channel on the daily chart), the upward trend in the price of Brent crude oil will be canceled.

The scenario for strengthening the price is connected with the breakdown of the local resistance level at 54.30 and further growth in the uplink channel on the weekly chart, the upper limit of which passes near the level of 62.00.

Support levels: 53.00, 52.35, 52.05, 51.70, 51.40, 50.70, 48.35, 47.00, 46.20

Resistance levels: 54.00, 55.60, 56.70, 57.50

Trading Scenarios

Sell Stop 53.80. Stop-Loss 54.30. Take-Profit 53.00, 52.35, 52.05, 51.70, 51.40, 50.70

Buy Stop 54.30. Stop-Loss 53.80. Take-Profit 55.00, 55.60, 56.70, 57.00, 57.50

*) Actual and detailed analytics can be found on the Tifia website at tifia.com/analytics