According to the data published on Friday from the American oil service company Baker Hughes, the number of oil drilling rigs in the US increased by 9 units to 697 units last week. Thus, almost continuously increasing, the number of active drilling oil rigs in the United States has now reached a level almost two times higher than the minimum marked more than a year ago. The observed sustained recovery of shale oil production in the US substantially negates the effect of OPEC efforts to reduce production and create an artificial deficit in the oil market. At the same time, US oil companies have significant reserve capacity. Despite the increase in drilling activity this year, while only about 70% of existing drilling rigs work. The risks of additional increase in oil production in the US are very significant. According to the forecast of the International Energy Agency (IEA), oil production in the US by the end of this year will grow by 680,000 barrels per day compared with the end of 2016.

At the same time, production in non-OPEC countries is increasing. So, on Monday in the Libyan oil company National Oil Corp. Said that production had peaked since 2014, rising to a level of 760,000 barrels per day.

As a result of yesterday, futures for Brent crude on ICE Futures fell in price by 1.02% to 51.52 dollars per barrel.

Oil production outside OPEC, according to the IEA, this year may increase by 485,000 barrels per day. Reserves of oil in world storage facilities are still significantly higher than average 5-year levels.

All this raises doubts among investors that OPEC will prolong the period of production reduction at the next meeting of the cartel, which will be held on May 25. If the agreement is extended, it will support oil prices in the second half of the year.

If not, the oil market could collapse and again quickly return to the lows of 2016, when a barrel of Brent crude oil was worth about 27.00 dollars.

Today at 20:30 (GMT), the American Petroleum Institute (API) publishes a weekly report with data on oil reserves and four major petroleum products: gasoline, kerosene, distillates and fuel oil in US storage. Another increase in stocks is expected, which will negatively affect oil prices. Previous value: +0.897 million barrels.

Support and resistance levels

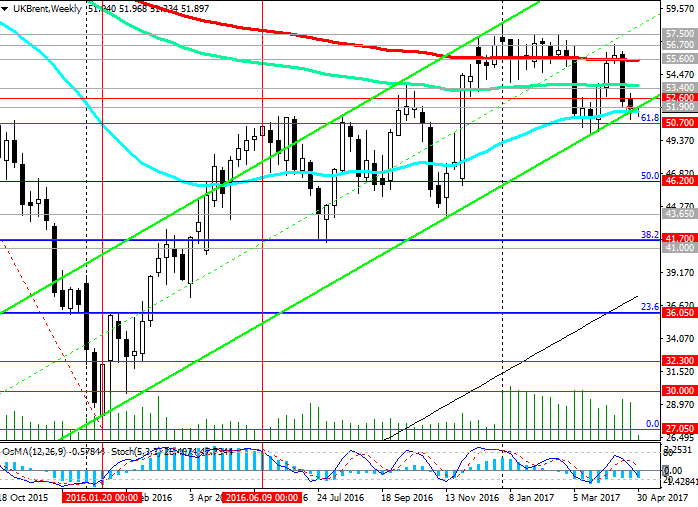

During the last seven trading sessions, the price for Brent crude oil broke through the most important short- and medium-term support levels of 52.60 (EMA200 on 1-hour, EMA144 on the daily chart), 51.90 (EMA200 on the daily chart).

At the beginning of today's European session, the spot price for Brent crude oil is close to $ 51.50 per barrel, through which the bottom line of the rising channel and EMA50 pass on the weekly chart. Breakdown of this level of support will significantly increase the growing negative trend.

Indicators OsMA and Stochastics on the weekly, daily, 4-hour charts went to the side of sellers.

In the case of a confirmed breakdown of the support level of 50.70 (the Fibonacci retracement level of 61.8% of the correction to decrease from the level of 65.30 from June 2015 to the absolute minimums of 2016 near the 27.00 mark) and fixing below the level of 50.00, the upward trend in the price of Brent crude oil will be canceled.

An alternative scenario for growth is associated with a return of the price above the level of 52.60 and further growth in the uplink on the daily chart. The upper boundary of this channel passes near the level of 57.50 (the highs of the year).

So far, negative dynamics prevails.

Support levels: 51.00, 50.70, 50.00

Levels of resistance: 51.90, 52.60, 53.40, 55.60, 56.70, 57.00, 57.50

Trading Scenarios

Sell Stop 51.30. Stop-Loss 52.10. Take-Profit 51.00, 50.70, 50.00, 49.50

Buy Stop 52.10. Stop-Loss 51.30. Take-Profit 52.60, 53.40, 55.60, 56.70, 57.00, 57.50